Get the free 3800

Show details

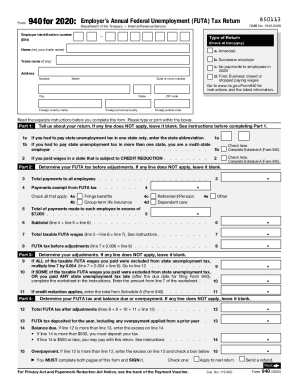

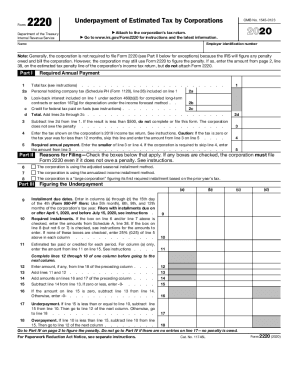

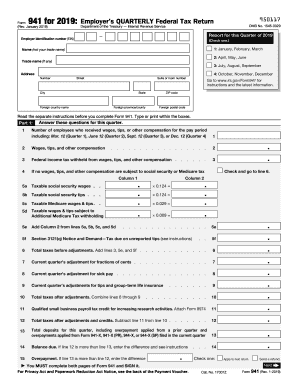

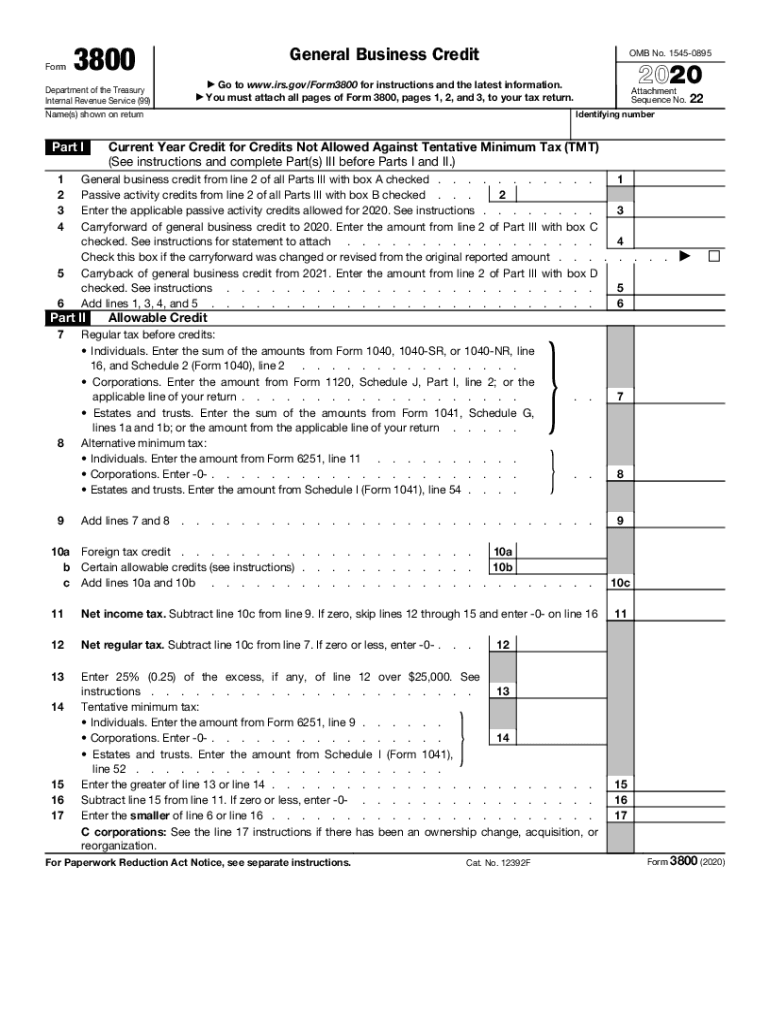

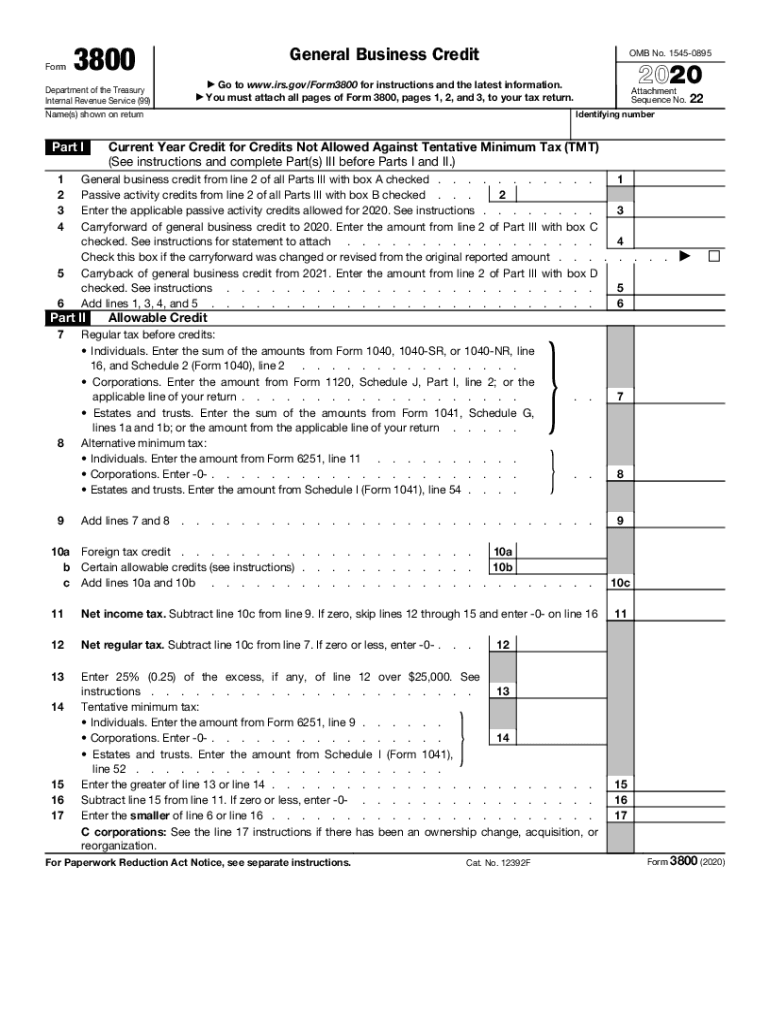

Form3800General Business CreditDepartment of the Treasury

Internal Revenue Service (99)OMB No. 154508951

2

3

45

6

789Current Year Credit for Credits Not Allowed Against Tentative Minimum Tax (TMT)

(See

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 3800

Edit your 3800 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 3800 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 3800 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 3800. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 3800

How to fill out IRS 3800

01

Obtain Form 3800 from the IRS website or your tax preparation software.

02

Read the instructions carefully to understand the eligibility requirements for claiming credits.

03

Determine which credits you qualify for, such as the general business credit.

04

Fill out Part I to enter the total amount of credits you are claiming.

05

Complete Part II for listing individual credits, providing the necessary details for each.

06

If applicable, fill out Part III for any carryback or carryforward credits.

07

Ensure you have all required supporting documentation for the credits claimed.

08

Review the completed form for accuracy before submitting it with your tax return.

Who needs IRS 3800?

01

Individuals or businesses that wish to claim certain tax credits, such as the general business credit, on their tax returns.

Fill

form

: Try Risk Free

People Also Ask about

How is general business credit limit calculated?

Add your net income tax and your alternative minimum tax. From that sum, subtract the greater of 1) your tentative minimum tax for the tax year or 2) 25% of the amount of your regular tax liability that exceeds $25,000 ($12,500 for married taxpayers filing separately, but only if both of them qualify for the credit)6.

What happens to unused business credits?

Unused R&D tax credits may still be available to eligible businesses if they file amended tax returns for the years in which they failed to claim the credit. Businesses can then carry forward the unused credits for up to 20 years after first carrying them back for one year.

Should I file form 3800?

If you claim more than one business credit, you must report the total on form Form 3800, General Business Credit, when filing your income tax return.

Do general business tax credits expire?

In the absence of an income tax liability, the business credits will build up and carry over until the corporation either generates taxable income or the credits expire.

What is 3800 general business credit?

The General Business Credit (Form 3800) is used to accumulate all of the business tax credits you are applying for in a specific tax year, to come up with a total tax credit amount for your business tax return.

What is the general business credit limitation?

These credit amounts are then combined and subjected to a limitation on the aggregate credit. The general business credit (computed without regard to certain credits) may not exceed net income tax minus the greater of: 25% of net regular tax liability above $25,000, or. 75% of the tentative minimum tax.

Do unused tax credits carry forward?

What happens to unused R&D credits? Unused R&D tax credits may still be available to eligible businesses if they file amended tax returns for the years in which they failed to claim the credit. Businesses can then carry forward the unused credits for up to 20 years after first carrying them back for one year.

Who must file form 3800?

The general business credit is the total value of all tax credits a business claims for a tax year. If you claim more than one business credit, you must report the total on form Form 3800, General Business Credit, when filing your income tax return.

What qualifies as a general business credit?

Your general business credit for the year consists of your carryforward of business credits from prior years plus the total of your current year business credits. In addition, your general business credit for the current year may be increased later by the carryback of business credits from later years.

Why do I have to fill out Form 3800?

More In Forms and Instructions File Form 3800 to claim any of the general business credits. Note: To claim credits carried over from a prior year, taxpayers must provide details.

Do general business credits have to be carried back?

Most unused general business credits may be carried back one year and carried forward forward 20 years until exhausted. However, for tax years beginning after 2022, the carryover rules apply separately to applicable credit that are eligible for the IRC §6417 tax payment election.

What is an eligible small business credit?

Some small businesses can use the tax credit to offset their alternative minimum tax. To qualify, the business must be a non-publicly traded corporation, partnership or sole proprietorship with an average of $50 million or less in gross receipts over the last three years.

How long can you carry forward tax credits?

Carryback and Carryover of Unused Credit You can carry back for one year and then carry forward for 10 years the unused foreign tax.

What is the purpose of IRS form 3800?

You must file Form 3800 to claim any of the general business credits. The carryforward may have to be reduced in the event of any recapture event (change in ownership, change in use of property, etc.). If a section 1603 grant is received, the carryforward must be reduced to zero.

What is a form 3800?

More In Forms and Instructions File Form 3800 to claim any of the general business credits. Note: To claim credits carried over from a prior year, taxpayers must provide details.

Who can file Form 3800?

General Instructions Partnerships and S corporations must always complete the source credit form. All other filers whose only source for a credit listed on Form 3800, Part III, is from a partnership, S corporation, estate, trust, or cooperative can report the credit directly on Form 3800.

What is the general business credit limited to?

The general business credit (computed without regard to certain credits) may not exceed net income tax minus the greater of: 25% of net regular tax liability above $25,000, or. 75% of the tentative minimum tax.

Do unused tax credits carry over?

Unused R&D tax credits may still be available to eligible businesses if they file amended tax returns for the years in which they failed to claim the credit. Businesses can then carry forward the unused credits for up to 20 years after first carrying them back for one year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 3800?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific 3800 and other forms. Find the template you need and change it using powerful tools.

Can I create an electronic signature for the 3800 in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your 3800 in seconds.

How do I fill out 3800 using my mobile device?

Use the pdfFiller mobile app to fill out and sign 3800 on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is IRS 3800?

IRS Form 3800 is the General Business Credit form used to report and claim various business credits for tax purposes.

Who is required to file IRS 3800?

Taxpayers who have eligible business credits that they want to claim, including corporations, partnerships, and certain individuals, are required to file IRS Form 3800.

How to fill out IRS 3800?

To fill out IRS Form 3800, taxpayers must provide information about the credits they are claiming, complete the relevant sections for each credit, and calculate any carryforwards or carrybacks as needed.

What is the purpose of IRS 3800?

The purpose of IRS Form 3800 is to help taxpayers consolidate their claims for various business credits into one form, making it easier to report and calculate their total business credit.

What information must be reported on IRS 3800?

Information that must be reported on IRS Form 3800 includes the type and amount of credits being claimed, any necessary calculations, taxpayer identification details, and any carryforward or carryback amounts.

Fill out your 3800 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

3800 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.