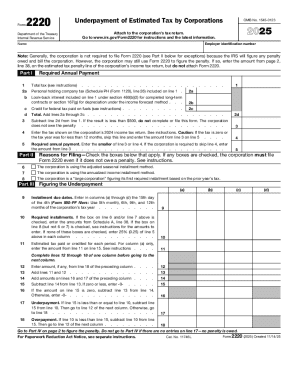

IRS 2220 2020 free printable template

Instructions and Help about IRS 2220

How to edit IRS 2220

How to fill out IRS 2220

About IRS 2 previous version

What is IRS 2220?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 2220

How can I correct mistakes made on my IRS 2220 form?

If you realize you've made an error on your IRS 2220 after submission, you can amend it by filing a corrected version. Be sure to clearly indicate it as an amended return and provide any pertinent documentation that supports the changes. This process ensures the IRS has the most accurate information regarding your tax obligations.

How can I verify the status of my IRS 2220 filing?

To check the status of your filed IRS 2220, you can use the IRS online tools available for tracking submissions. Make sure to have your reference number handy, as this will help you navigate the system effectively. If you encounter issues, be aware of common rejection codes and their solutions.

What should I do if I receive a notice regarding my IRS 2220?

Receiving a notice related to your IRS 2220 submission can be concerning. First, read the notice carefully to understand what the IRS is asking. Gather any documentation required to address their inquiries and respond timely to avoid further complications.

Can I e-file my IRS 2220, and what should I know about it?

E-filing the IRS 2220 is an efficient option, but ensure your software is compatible with IRS requirements. Be aware of service fees that might apply and know what to do if your submission is rejected to avoid delays in processing.

Are there specific considerations for foreign payees when filing IRS 2220?

When filing an IRS 2220 that involves nonresidents or foreign payees, consult IRS guidelines regarding taxation and documentation requirements. It’s critical to ensure compliance with international tax obligations, and seeking guidance from a tax professional can be beneficial.