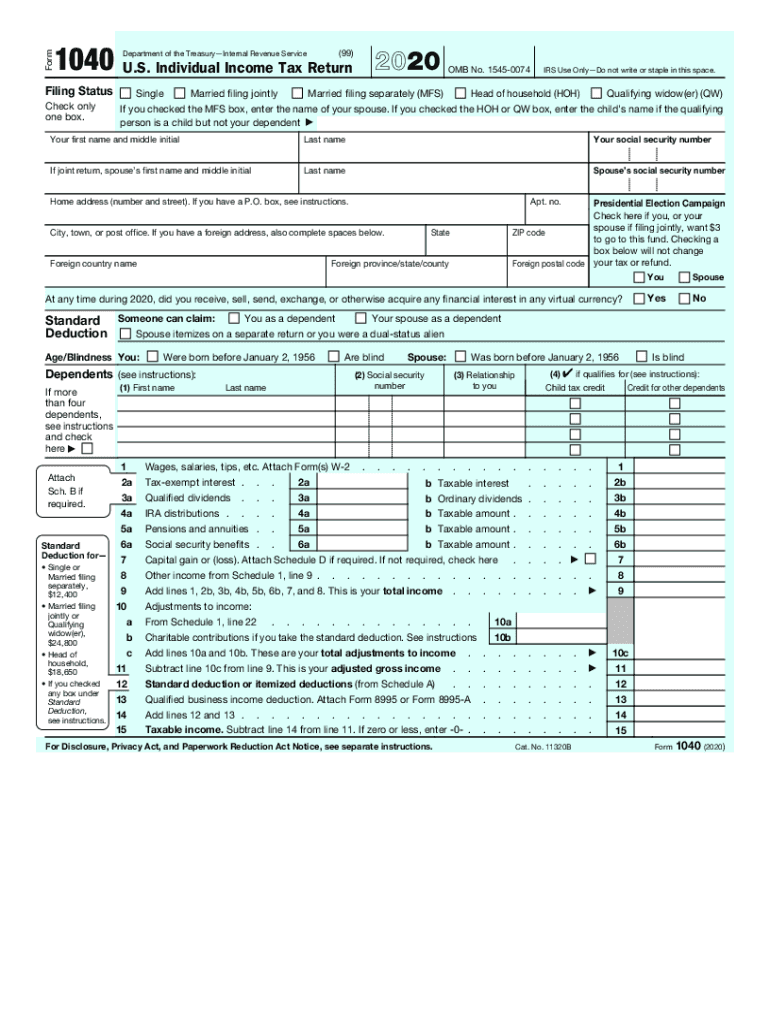

IRS 1040 2020 free printable template

Instructions and Help about IRS 1040

How to edit IRS 1040

How to fill out IRS 1040

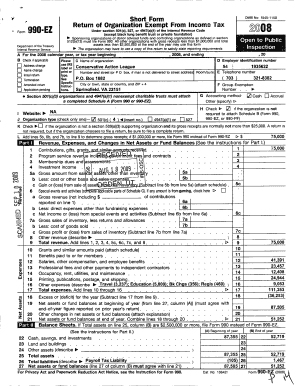

About IRS previous version

What is IRS 1040?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1040

What should I do if I realize I've made a mistake on my IRS 1040 after filing?

If you discover an error on your IRS 1040, the first step is to file an amended return using Form 1040-X. This form allows you to make corrections to your original filing. Ensure that you include any necessary documentation that supports the changes and follow the IRS guidelines for submission.

How can I track the status of my IRS 1040 after submission?

To check the status of your submitted IRS 1040, use the IRS 'Where's My Refund?' tool online. You'll need your Social Security number, filing status, and the exact amount of your refund. This tool will provide updates on whether your return has been received and is being processed.

What are some common errors taxpayers make when filing the IRS 1040?

Common mistakes include incorrect Social Security numbers, math errors, and failing to sign the form. To avoid these issues, double-check your information and calculations before submission, and consider using software that highlights common errors for the IRS 1040.

What are my options if my e-filed IRS 1040 gets rejected?

If your e-filed IRS 1040 is rejected, review the rejection code provided by the IRS. Each code indicates a specific issue that needs resolution. After correcting the error, you can resubmit your return electronically or file a paper version if necessary.

How long should I keep records related to my IRS 1040?

It's recommended to retain records related to your IRS 1040 for at least three years from the date of filing, as this is the typical period the IRS can audit your return. However, if you claim a loss from a worthless security or underreport income, you may need to keep records longer.

See what our users say