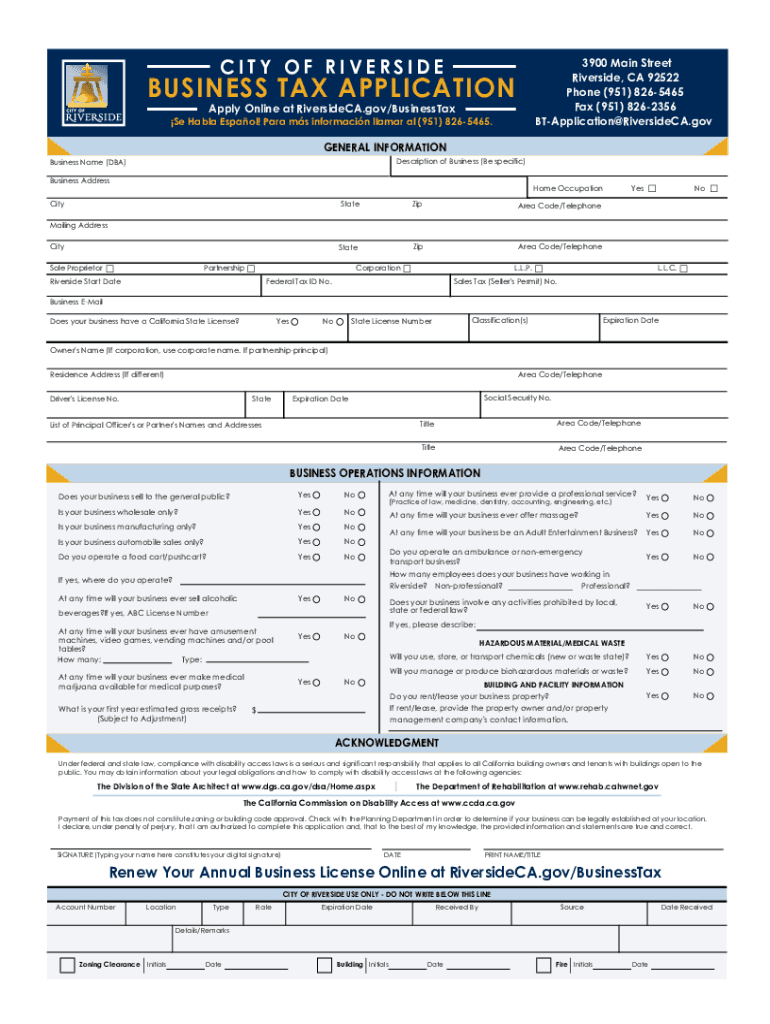

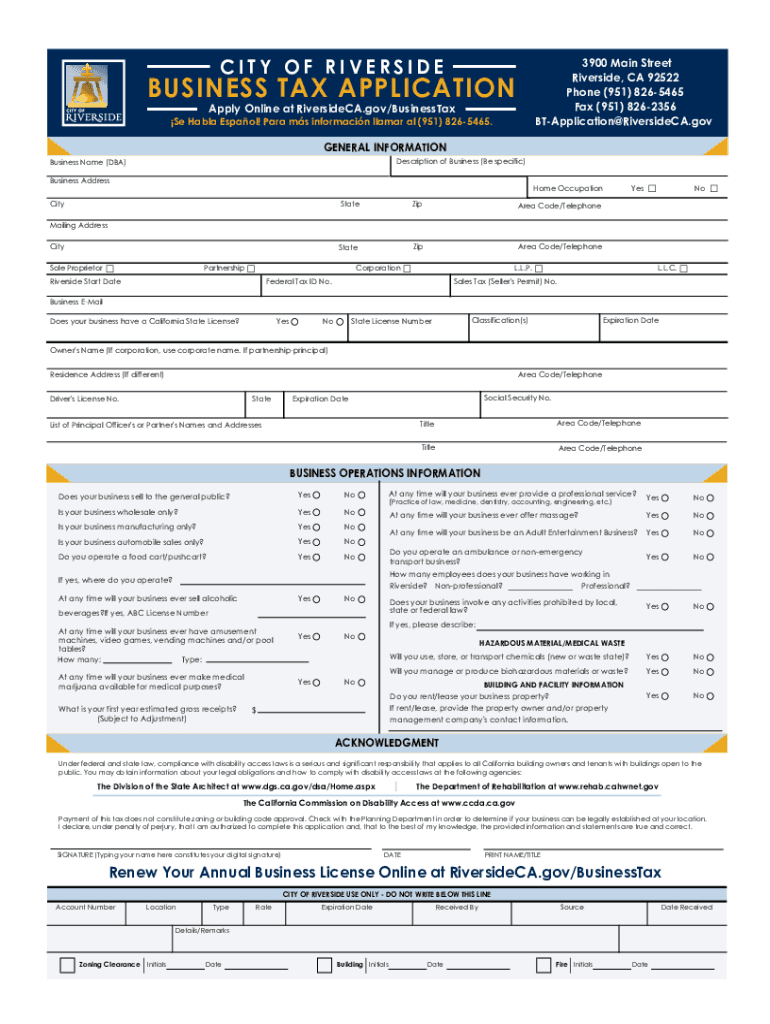

CA Business Tax Application - City of Riverside 2017 free printable template

Show details

CITY OF RIVERSIDE3900 Main Street

Riverside, CA 92522

Phone (951) 8265465

Fax (951) 8262356

BTApplication@RiversideCA.govBUSINESS TAX APPLICATION

Apply Online at RiversideCA.gov/BusinessTaxSe Tabla

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA Business Tax Application - City

Edit your CA Business Tax Application - City form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA Business Tax Application - City form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA Business Tax Application - City online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit CA Business Tax Application - City. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA Business Tax Application - City of Riverside Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA Business Tax Application - City

How to fill out CA Business Tax Application - City of Riverside

01

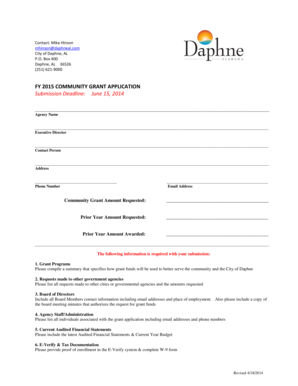

Obtain the CA Business Tax Application form from the City of Riverside's official website or local government office.

02

Fill in your business information, including the business name, address, and contact details.

03

Provide ownership details, including the name of the owner(s) and their contact information.

04

Specify the type of business activities your business will engage in.

05

Include the Federal Employer Identification Number (FEIN) if applicable.

06

Indicate the estimated gross receipts or sales for the first year of operation.

07

Review the application for accuracy and completeness.

08

Submit the application either online or in person at the designated city office, along with any required fees.

Who needs CA Business Tax Application - City of Riverside?

01

Any individual or entity planning to operate a business within the City of Riverside is required to fill out the CA Business Tax Application.

02

This includes sole proprietors, partnerships, corporations, and limited liability companies (LLCs).

03

Businesses that are applying for a business license or need to comply with local tax regulations.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a permit to sell food on the street in California?

How do you get a seller's permit in California? This permit is administered by the state, so restaurants can register for their seller's permit online through the California Department of Tax and Fee Administration .

How do I contact the Riverside County business license?

Contact the County Clerk to file a fictitious business name, at (951) 486-7000 or find the nearest office location.

Does Riverside CA require a business license?

Conducting Business In Riverside. If you are planning to conduct business in the City of Riverside you must obtain a City of Riverside business license, also referred to as a business tax. All persons or companies conducting business in the City of Riverside are required to pay a business tax.

Do you need a permit to sell food on the street in Riverside County?

Riverside County Ordinance 853 requires sidewalk vendors to have a valid Sidewalk Vending Permit with the County of Riverside Transportation Department.

How to start a food business in Riverside County?

Obtain a Food Safety Manager Certification for the MHKO owner, and a Riverside County Food Handler Certification for all other people involved in the MHKO. Submit an Application/Registration to Operate a Food Facility. Schedule an inspection of your home kitchen operation.

Is Riverside a county?

Riverside County is a county located in the southern portion of the U.S. state of California. As of the 2020 census, the population was 2,418,185, making it the fourth-most populous county in California and the 10th-most populous in the United States.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit CA Business Tax Application - City in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing CA Business Tax Application - City and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I edit CA Business Tax Application - City on an iOS device?

You certainly can. You can quickly edit, distribute, and sign CA Business Tax Application - City on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I complete CA Business Tax Application - City on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your CA Business Tax Application - City, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is CA Business Tax Application - City of Riverside?

The CA Business Tax Application - City of Riverside is a form that businesses must submit to the City of Riverside to apply for a business license and pay the associated business taxes.

Who is required to file CA Business Tax Application - City of Riverside?

All businesses operating within the City of Riverside, including sole proprietorships, partnerships, corporations, and other entities, are required to file the CA Business Tax Application.

How to fill out CA Business Tax Application - City of Riverside?

To fill out the CA Business Tax Application, businesses need to provide their business name, address, type of ownership, nature of business, and estimated gross receipts. Detailed instructions are available on the application form or the City’s website.

What is the purpose of CA Business Tax Application - City of Riverside?

The purpose of the CA Business Tax Application is to ensure that businesses operating in Riverside are properly licensed and paying their required taxes, contributing to the local economy and municipal services.

What information must be reported on CA Business Tax Application - City of Riverside?

Information that must be reported includes the business name, business address, owner’s name, contact information, type of business, number of employees, and estimated gross receipts for the year.

Fill out your CA Business Tax Application - City online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA Business Tax Application - City is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.