CA Business Tax Application - City of Riverside 2022-2025 free printable template

Show details

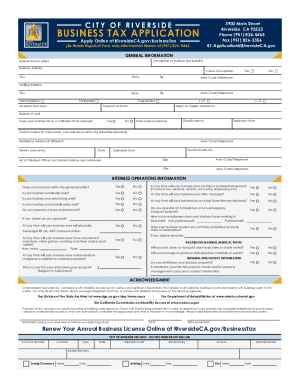

Print Form Email to Bus Tax City of Riverside 3900 MAIN STREET RIVERSIDE CA 92522 PHONE 951 826-5465 FAX 951 826-2356 BT-Application riversideca.gov BUSINESS TAX APPLICATION GENERAL INFORMATION Business Name DBA Description of Business Be specific Business Address Home Occupation City State Zip Area Code/Telephone Mailing Address Sole Proprietor Riverside Start Date Partnership Corporation L.L.P.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing online

To use our professional PDF editor, follow these steps:

1

Log into your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit . Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA Business Tax Application - City of Riverside Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out

How to fill out CA Business Tax Application - City of Riverside

01

Obtain the CA Business Tax Application form from the City of Riverside's website or the finance department.

02

Fill in your business name and address accurately.

03

Provide your federal employer identification number (FEIN) or Social Security number if you are a sole proprietor.

04

Specify the type of business you are operating (e.g., retail, service, etc.).

05

Indicate the date the business commenced operations.

06

List the ownership structure (e.g., sole proprietorship, partnership, corporation, etc.).

07

Complete the section about estimated annual gross receipts.

08

Attach any required documentation or supplemental information that may be needed.

09

Review your application for accuracy and completeness before submission.

10

Submit the application along with any required fees to the City of Riverside finance department.

Who needs CA Business Tax Application - City of Riverside?

01

All businesses operating within the City of Riverside must complete the CA Business Tax Application.

02

New businesses starting operations in Riverside.

03

Businesses that have changed their ownership structure.

04

Businesses that need to renew their business tax registration.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a permit to sell food on the street in California?

How do you get a seller's permit in California? This permit is administered by the state, so restaurants can register for their seller's permit online through the California Department of Tax and Fee Administration .

How do I contact the Riverside County business license?

Contact the County Clerk to file a fictitious business name, at (951) 486-7000 or find the nearest office location.

Does Riverside CA require a business license?

Conducting Business In Riverside. If you are planning to conduct business in the City of Riverside you must obtain a City of Riverside business license, also referred to as a business tax. All persons or companies conducting business in the City of Riverside are required to pay a business tax.

Do you need a permit to sell food on the street in Riverside County?

Riverside County Ordinance 853 requires sidewalk vendors to have a valid Sidewalk Vending Permit with the County of Riverside Transportation Department.

How to start a food business in Riverside County?

Obtain a Food Safety Manager Certification for the MHKO owner, and a Riverside County Food Handler Certification for all other people involved in the MHKO. Submit an Application/Registration to Operate a Food Facility. Schedule an inspection of your home kitchen operation.

Is Riverside a county?

Riverside County is a county located in the southern portion of the U.S. state of California. As of the 2020 census, the population was 2,418,185, making it the fourth-most populous county in California and the 10th-most populous in the United States.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit online?

With pdfFiller, the editing process is straightforward. Open your in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I complete on an Android device?

On Android, use the pdfFiller mobile app to finish your . Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is CA Business Tax Application - City of Riverside?

The CA Business Tax Application for the City of Riverside is a form that businesses must complete to register and obtain a business tax certificate, which allows them to operate legally within the city's jurisdiction.

Who is required to file CA Business Tax Application - City of Riverside?

Any individual or entity conducting business activities within the City of Riverside is required to file the CA Business Tax Application, including sole proprietors, partnerships, corporations, and LLCs.

How to fill out CA Business Tax Application - City of Riverside?

To fill out the CA Business Tax Application, you must provide information such as business name, business address, owner's name, type of business, and estimated gross receipts. The form can be completed online or submitted in person at the appropriate city office.

What is the purpose of CA Business Tax Application - City of Riverside?

The purpose of the CA Business Tax Application is to ensure that businesses operating in Riverside are properly registered and to collect necessary business taxes that support local services and infrastructure.

What information must be reported on CA Business Tax Application - City of Riverside?

The information that must be reported includes business name, business address, contact information, type of business activities, owner information, and estimated gross receipts for the year.

Fill out your online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.