CA Business Tax Application - City of Riverside 2013 free printable template

Show details

Print Form Email to Bus Tax City of Riverside 3900 MAIN STREET RIVERSIDE CA 92522 PHONE 951 826-5465 FAX 951 826-2356 BT-Application riversideca.gov BUSINESS TAX APPLICATION GENERAL INFORMATION Business Name DBA Description of Business Be specific Business Address Home Occupation City State Zip Area Code/Telephone Mailing Address Sole Proprietor Riverside Start Date Partnership Corporation L.L.P.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA Business Tax Application - City

Edit your CA Business Tax Application - City form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA Business Tax Application - City form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA Business Tax Application - City online

To use our professional PDF editor, follow these steps:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit CA Business Tax Application - City. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA Business Tax Application - City of Riverside Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA Business Tax Application - City

How to fill out CA Business Tax Application - City of Riverside

01

Download the CA Business Tax Application from the City of Riverside's official website.

02

Fill in your business information, including the business name, address, and contact details.

03

Provide details on the type of business activities conducted.

04

Indicate the number of employees you have.

05

Specify your anticipated gross receipts for the upcoming year.

06

Complete any applicable sections for your specific business type (e.g., sole proprietorship, partnership, corporation).

07

Review all information for accuracy.

08

Sign and date the application.

09

Submit the application online or mail it to the City of Riverside's Business Tax Division.

Who needs CA Business Tax Application - City of Riverside?

01

Any individual or entity planning to conduct business activities within the City of Riverside requires the CA Business Tax Application.

02

Businesses that are engaged in selling goods, providing services, or operating within city limits must complete this application.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a permit to sell food on the street in California?

How do you get a seller's permit in California? This permit is administered by the state, so restaurants can register for their seller's permit online through the California Department of Tax and Fee Administration .

How do I contact the Riverside County business license?

Contact the County Clerk to file a fictitious business name, at (951) 486-7000 or find the nearest office location.

Does Riverside CA require a business license?

Conducting Business In Riverside. If you are planning to conduct business in the City of Riverside you must obtain a City of Riverside business license, also referred to as a business tax. All persons or companies conducting business in the City of Riverside are required to pay a business tax.

Do you need a permit to sell food on the street in Riverside County?

Riverside County Ordinance 853 requires sidewalk vendors to have a valid Sidewalk Vending Permit with the County of Riverside Transportation Department.

How to start a food business in Riverside County?

Obtain a Food Safety Manager Certification for the MHKO owner, and a Riverside County Food Handler Certification for all other people involved in the MHKO. Submit an Application/Registration to Operate a Food Facility. Schedule an inspection of your home kitchen operation.

Is Riverside a county?

Riverside County is a county located in the southern portion of the U.S. state of California. As of the 2020 census, the population was 2,418,185, making it the fourth-most populous county in California and the 10th-most populous in the United States.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my CA Business Tax Application - City in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your CA Business Tax Application - City and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I edit CA Business Tax Application - City on an Android device?

You can make any changes to PDF files, such as CA Business Tax Application - City, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

How do I complete CA Business Tax Application - City on an Android device?

Use the pdfFiller mobile app to complete your CA Business Tax Application - City on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

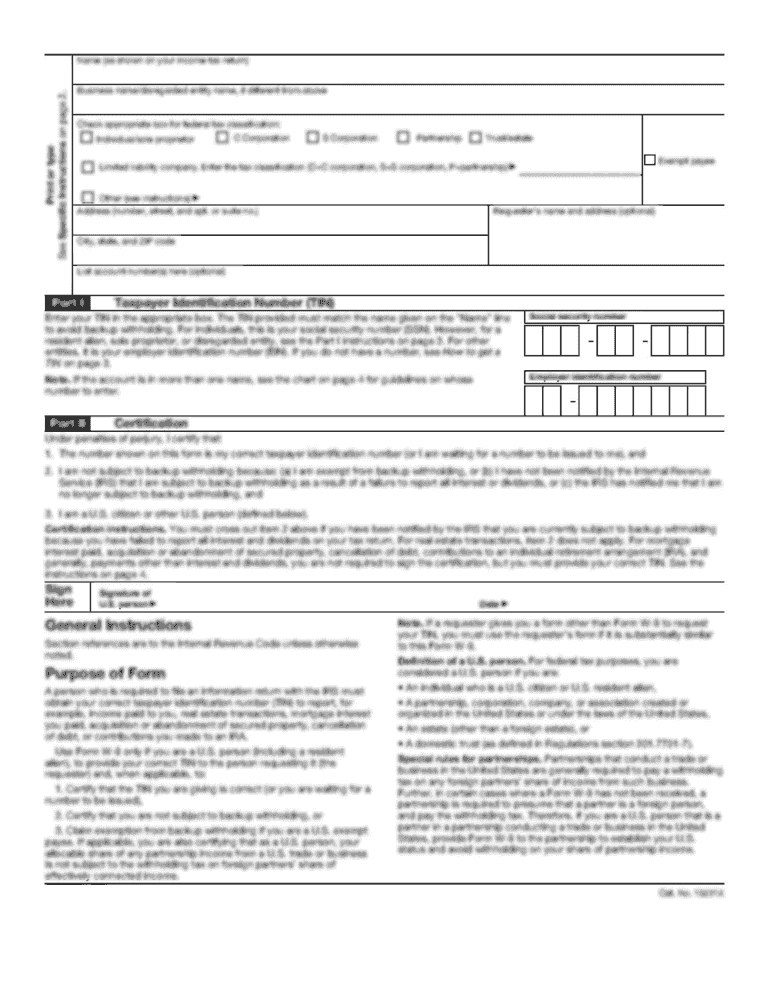

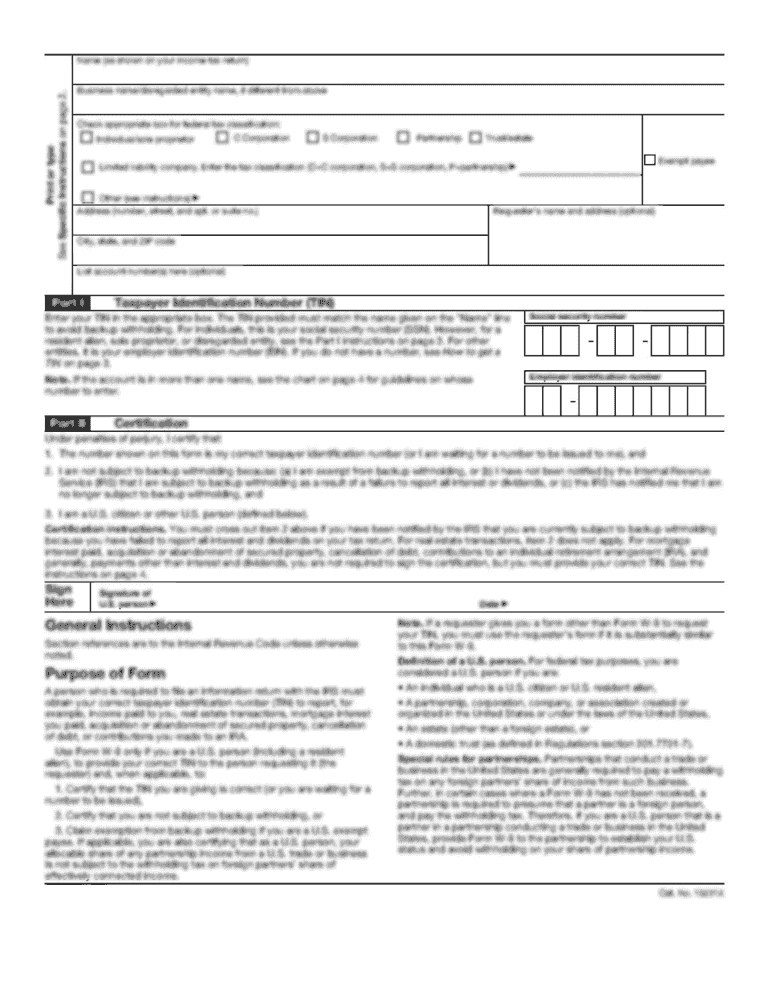

What is CA Business Tax Application - City of Riverside?

The CA Business Tax Application for the City of Riverside is a form that businesses must complete to apply for a business tax certificate, which is required for operating a business within the city limits.

Who is required to file CA Business Tax Application - City of Riverside?

All businesses operating within the City of Riverside, including sole proprietors, partnerships, corporations, and other entities, are required to file the CA Business Tax Application.

How to fill out CA Business Tax Application - City of Riverside?

To fill out the CA Business Tax Application, complete all required sections of the form, providing accurate information about the business, including ownership details, business location, and nature of the business activities. Ensure to attach any necessary documentation and submit the form to the city’s finance department.

What is the purpose of CA Business Tax Application - City of Riverside?

The purpose of the CA Business Tax Application is to register businesses in the City of Riverside and to assess the appropriate business tax based on the nature and size of the business activities conducted within the city.

What information must be reported on CA Business Tax Application - City of Riverside?

The information that must be reported includes the business name, business address, owner details, type of business entity, description of business activities, and estimated gross receipts or revenue for the upcoming year.

Fill out your CA Business Tax Application - City online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA Business Tax Application - City is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.