VT Form HS-122 2020 free printable template

Show details

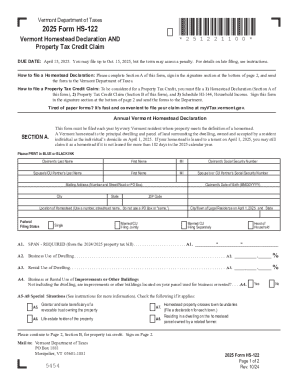

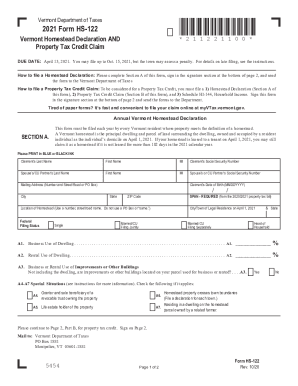

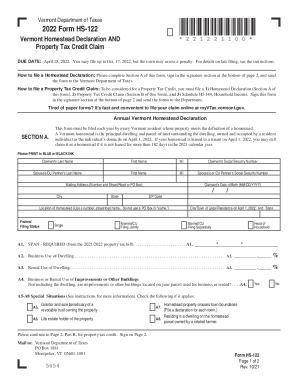

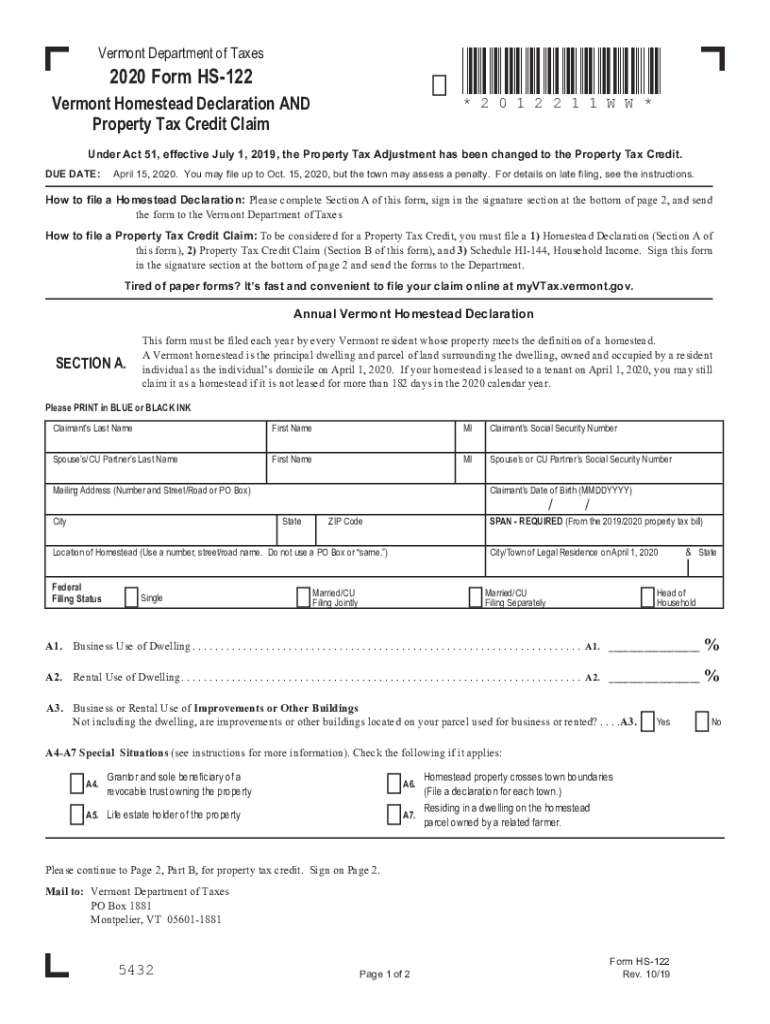

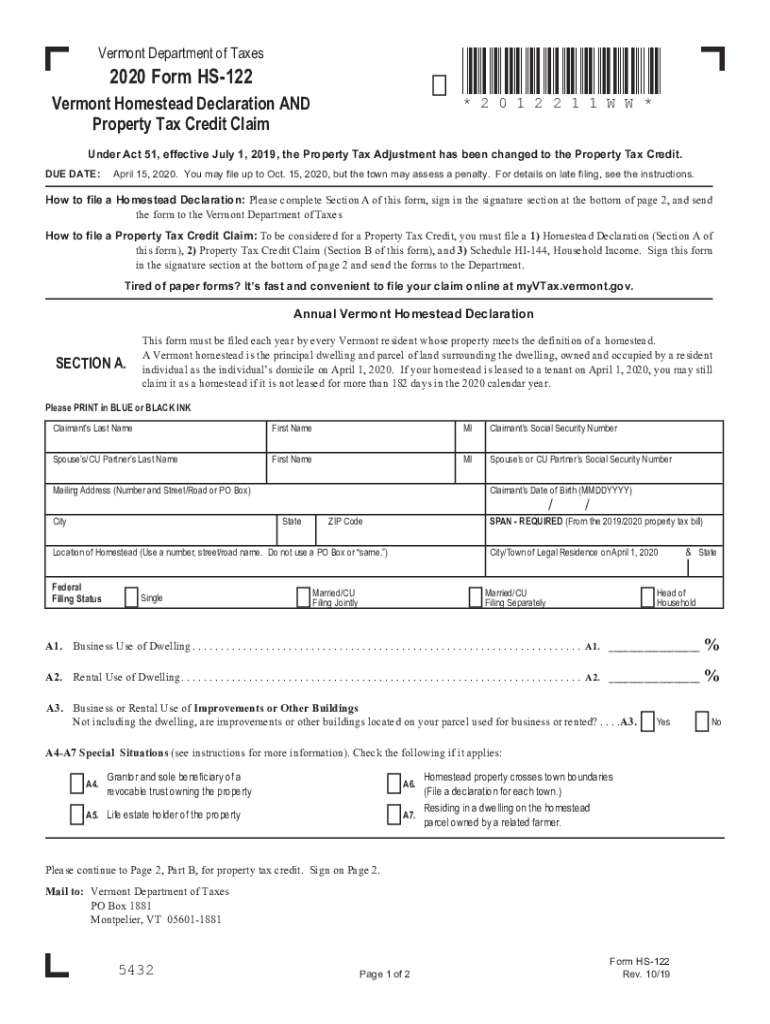

Vermont Homestead Declaration AND Property Tax Adjustment Claim 2019 Form HS-122 DUE DATE April 15 2019. You may file up to Oct. 15 2019 but the town may assess a penalty. For details on late filing see the instructions. How to file a Homestead Declaration Please complete Section A of this form sign in the signature section at the bottom of page 2 and send the form to the Vermont Department of Taxes How to file a Property Tax Adjustment Claim To be considered for a Property Tax Adjustment you...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign VT Form HS-122

Edit your VT Form HS-122 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your VT Form HS-122 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit VT Form HS-122 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit VT Form HS-122. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VT Form HS-122 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out VT Form HS-122

How to fill out VT Form HS-122

01

Obtain a copy of VT Form HS-122 from the Vermont Department of Health website or your local health department.

02

Begin filling out the form by providing your personal information, including your name, address, and contact information.

03

Indicate the reason for completing the form in the appropriate section.

04

Fill in detailed information regarding your health history and any medical conditions relevant to the form.

05

If applicable, provide information about any medications you are currently taking.

06

Review the form for accuracy and completeness to ensure all sections are filled out correctly.

07

Sign and date the form at the designated area.

08

Submit the completed form to the appropriate health authority as instructed.

Who needs VT Form HS-122?

01

Anyone residing in Vermont who requires accommodation or assistance due to a health condition.

02

Individuals seeking to register for health-related services or programs offered by the Vermont Department of Health.

03

Patients needing to document their health history for medical reasons or public health programs.

Fill

form

: Try Risk Free

People Also Ask about

What is the non homestead tax in Vermont?

The statewide nonhomestead (formerly called “nonresidential”) tax rate is $1.466 per $100 of property value. The homestead property yield is $13,314 which goes with a base rate of $1.00 per $100 of property value.

What towns in Vermont have the lowest property taxes?

If you're looking for low property taxes in Vermont, Franklin County is one of your best bets. The county's average effective property tax rate is 1.71%, good for second-lowest in the state. In St. Albans, the largest city in the county, the total municipal rate is about 2.6265%.

What is the income limit for property tax adjustment in Vermont?

You occupy the property as your homestead as of April 1, 2022. You meet the “household income” criteria (up to $136,900 for calendar year 2021).

What is Vermont Form HS 122?

HOMEOWNERS Form HS-122, Homestead Declaration AND Property Tax Credit Claim, must be filed each year . Homeowners with Household Income up to $134,800 on Line z should complete Form HS-122, Section B . You may be eligible for a property tax credit . This schedule must be filed with Form HS-122 .

What is the difference between homestead and non homestead taxes Vermont?

For this purpose, property is categorized as either nonhomestead or homestead. A homestead is the principal dwelling and parcel of land surrounding the dwelling, owned and occupied by the resident as the person's domicile. All property is considered nonhomestead, unless it is declared as a homestead.

What area has the cheapest property taxes?

All of the data below comes from the Census Bureau's 2021 1-year American Community Survey (ACS) Estimates. Hawaii has the lowest property tax rate in the U.S. at 0.27%. The Aloha state has a home median value of $722,500.

Does Vermont have a property tax discount for seniors?

Vermont Property Tax Breaks for Retirees For 2022, senior homeowners with 2021 household income of $136,900 or less may qualify for a property tax credit of up to $8,000.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the VT Form HS-122 form on my smartphone?

Use the pdfFiller mobile app to complete and sign VT Form HS-122 on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Can I edit VT Form HS-122 on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share VT Form HS-122 from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I edit VT Form HS-122 on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as VT Form HS-122. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is VT Form HS-122?

VT Form HS-122 is a tax form used in Vermont for reporting and calculating the Homestead Declaration for residential properties.

Who is required to file VT Form HS-122?

Homeowners in Vermont who wish to claim a homestead property tax benefit must file VT Form HS-122.

How to fill out VT Form HS-122?

To fill out VT Form HS-122, public members need to provide details including property information, owner information, and any relevant deductions or exemptions.

What is the purpose of VT Form HS-122?

The purpose of VT Form HS-122 is to determine eligibility for the Vermont Homestead Property Tax Credit and to report the declaration of homestead status.

What information must be reported on VT Form HS-122?

VT Form HS-122 requires reporting personal information such as the name and address of the property owner, property details, and information regarding any co-owners or partners.

Fill out your VT Form HS-122 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

VT Form HS-122 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.