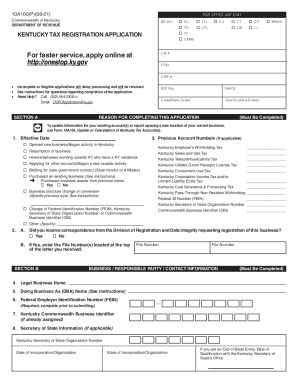

VT Form HS-122 2022 free printable template

Show details

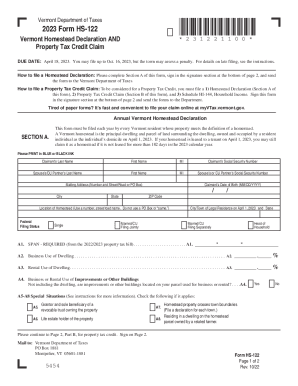

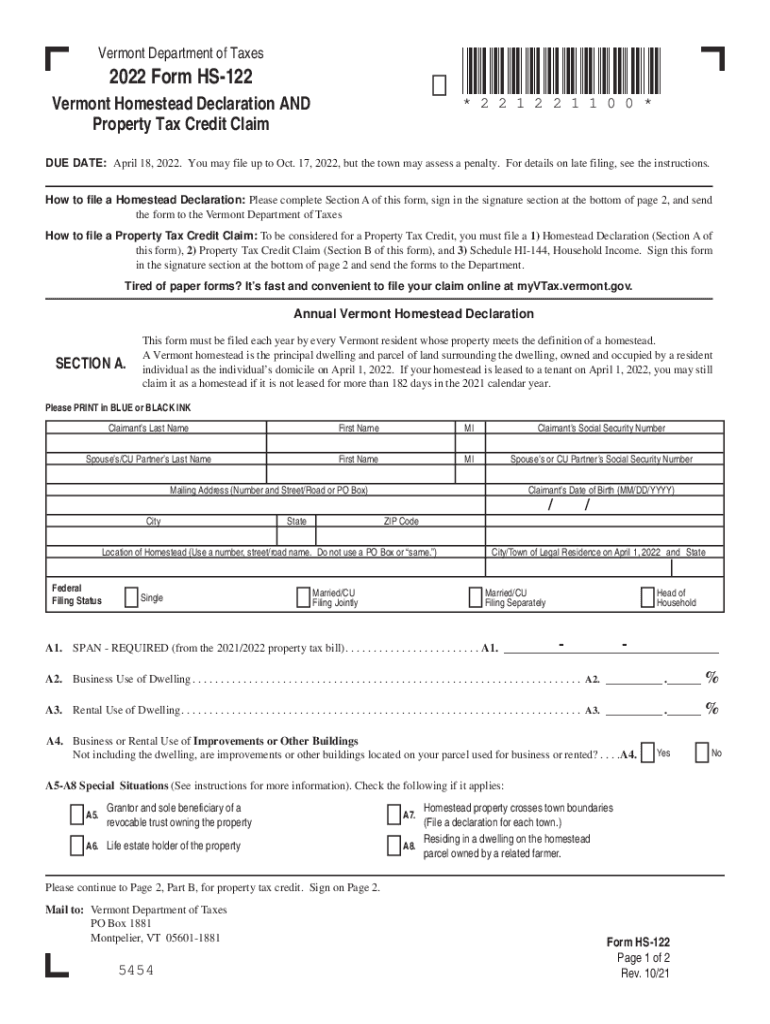

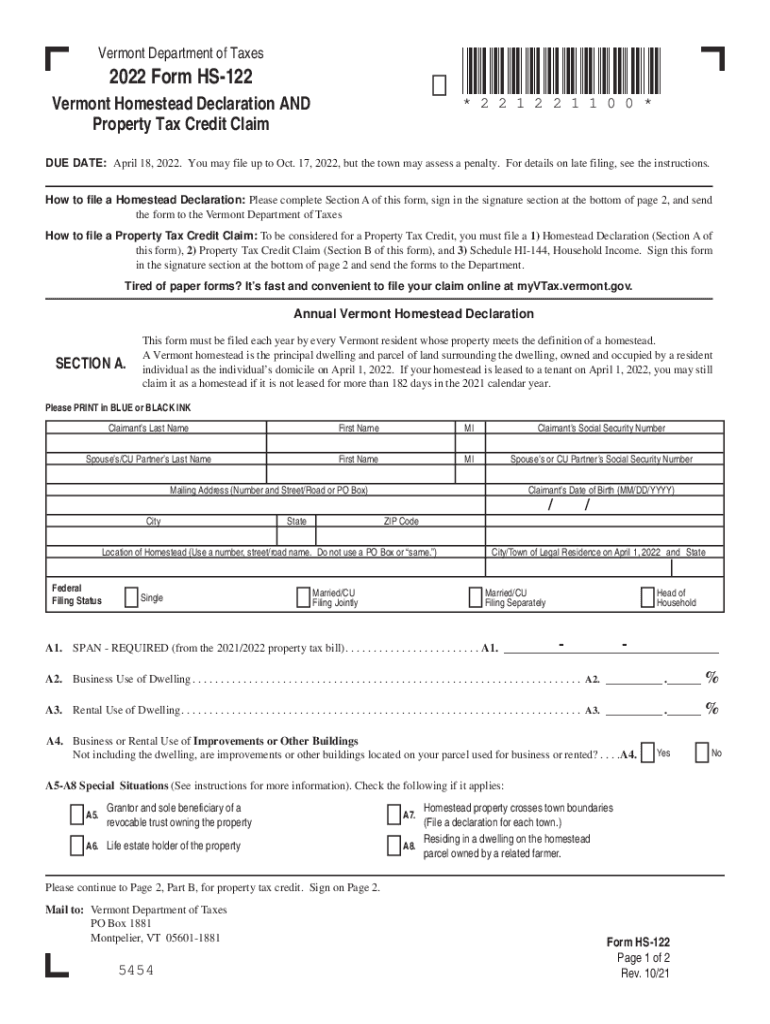

Vermont Department of Taxes×221221100×2022 Form HS122Vermont Homestead Declaration AND

Property Tax Credit Claim* 2 2 1 2 2 1 1 0 0 *DUE DATE:April 18, 2022. You may file up to Oct. 17, 2022, but

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign hs 122 vermont 2022

Edit your hs 122 vermont 2022 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hs 122 vermont 2022 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing hs 122 vermont 2022 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit hs 122 vermont 2022. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VT Form HS-122 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out hs 122 vermont 2022

How to fill out VT Form HS-122

01

Obtain VT Form HS-122 from the Vermont Department of Taxes website or local office.

02

Fill in your personal information at the top of the form, including your name and address.

03

Indicate your filing status by checking the appropriate box.

04

Provide details regarding your income sources as required on the form.

05

Complete any necessary calculations for your income and deductions.

06

Review the provided instructions to ensure all sections are completed accurately.

07

Sign and date the form once you have filled everything out.

08

Submit the form by the specified deadline to the appropriate tax authority.

Who needs VT Form HS-122?

01

Individuals or entities who have income that must be reported and taxed in Vermont.

02

Residents of Vermont filing their state tax return.

03

Non-residents who earned income sourced from Vermont.

Instructions and Help about hs 122 vermont 2022

Fill

form

: Try Risk Free

People Also Ask about

How do I file for homestead exemption in Vermont?

How to File. Online - Taxpayers may file returns using myVTax, our free, secure, online filing site. Paper Returns - If you cannot file and pay through myVTax, you may still use the paper forms. The Homestead Declaration is filed using Form HS-122, the Homestead Declaration and Property Tax Credit Claim.

What is the income limit for property tax adjustment in Vermont?

You occupy the property as your homestead as of April 1, 2022. You meet the “household income” criteria (up to $136,900 for calendar year 2021).

What is the due date for Vermont Form HS-122?

This schedule must be filed with Form HS-122 . Form HS-122 The due date to file is April 18, 2023 . Homeowners filing a property tax credit, Form HS-122 and Schedule HI-144, between April 19 and Oct . 16, 2023, may still qualify for a Property Tax Credit .

What is the first time home buyer tax credit in Vermont?

In Vermont, first-time homebuyers, qualifying veterans and those purchasing in specific target areas are eligible for a mortgage credit certificate (MCC), a tax credit on their mortgage interest equal to up to $2,000 per year.

What is the Vermont property tax rebate for 2022?

The maximum credit for the 2022 and 2023 property tax bill is $5,600 for the education property tax portion and $2,400 for the municipal property tax portion.

What is the standard deduction for Vermont 2022?

The Vermont Standard Deduction increases an average of $267. For tax year 2022, it is $13,050 for Married/CU Filing Jointly or Qualifying Widow(er), $6,500 for Single or Married/CU Filing Separately, $9,800 for Head of Household, and an additional $1,050 for individuals 65 and older and/or blind.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit hs 122 vermont 2022 on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing hs 122 vermont 2022 right away.

How do I edit hs 122 vermont 2022 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share hs 122 vermont 2022 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Can I edit hs 122 vermont 2022 on an Android device?

The pdfFiller app for Android allows you to edit PDF files like hs 122 vermont 2022. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is VT Form HS-122?

VT Form HS-122 is a form used for reporting health insurance information in the state of Vermont.

Who is required to file VT Form HS-122?

Entities that provide health insurance coverage or require reporting for insurance purposes in Vermont are required to file VT Form HS-122.

How to fill out VT Form HS-122?

To fill out VT Form HS-122, you need to provide relevant insurance coverage details, enrollments, and any applicable summary data as instructed in the form guidelines.

What is the purpose of VT Form HS-122?

The purpose of VT Form HS-122 is to collect data on health insurance coverage in Vermont to aid in the state's healthcare planning and ensure compliance with regulations.

What information must be reported on VT Form HS-122?

Information that must be reported includes the number of individuals covered, type of coverage provided, enrollment periods, and other relevant health insurance data.

Fill out your hs 122 vermont 2022 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hs 122 Vermont 2022 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.