VT Form HS-122 2015 free printable template

Show details

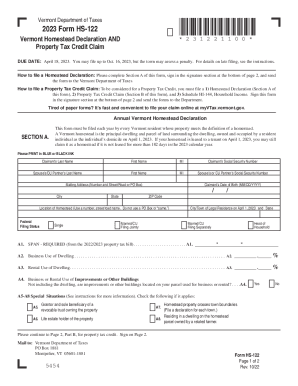

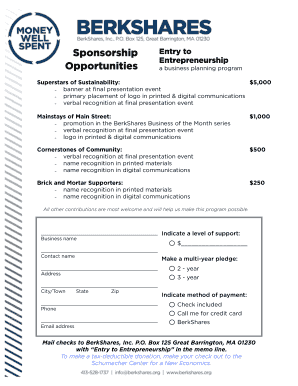

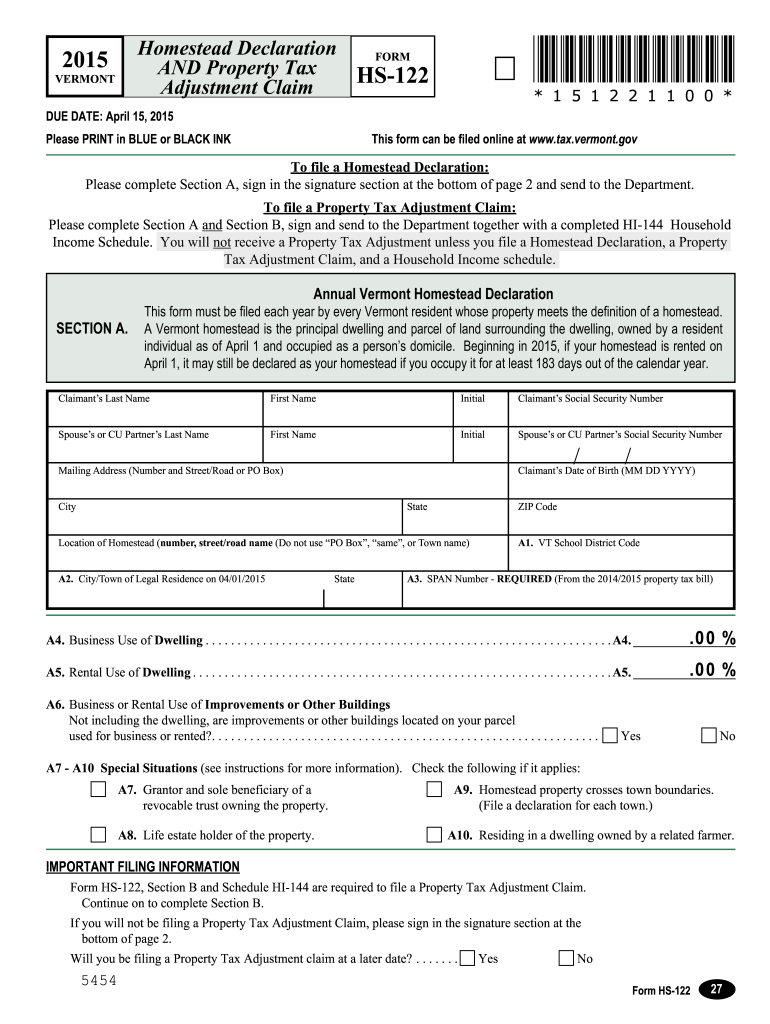

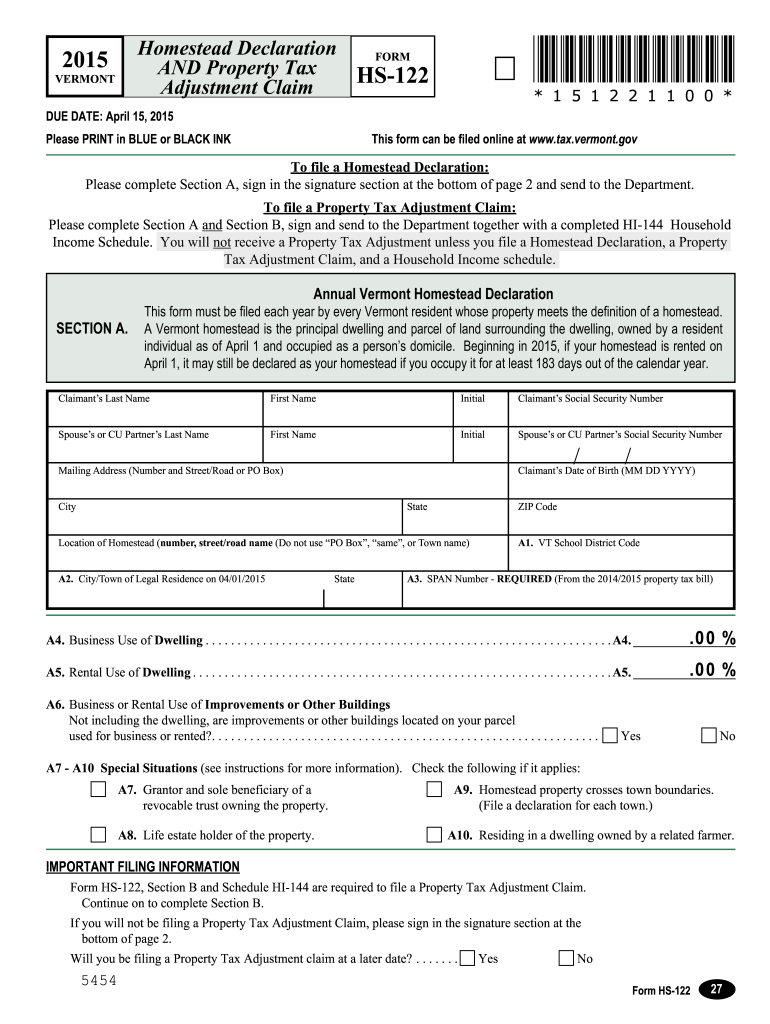

VERMONT Homestead Declaration FORM AND Property Tax HS-122 Adjustment Claim 151221100 DUE DATE April 15 2015 Please PRINT in BLUE or BLACK INK This form can be filed online at www. Will you be filing a Property Tax Adjustment claim at a later date. c Yes Form HS-122 Social Security Number PROPERTY TAX ADJUSTMENT CLAIM For Household Income up to approx. Preparer s Use Only Preparer s signature SSN or PTIN Firm s name or yours if self-employed and address EIN Preparer s Telephone Number Form...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form hs 122 2015-2019

Edit your form hs 122 2015-2019 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form hs 122 2015-2019 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form hs 122 2015-2019 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form hs 122 2015-2019. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VT Form HS-122 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form hs 122 2015-2019

How to fill out VT Form HS-122

01

Obtain VT Form HS-122 from the Vermont Department of Taxes website or your local tax office.

02

Begin by filling out your personal information at the top of the form, including your name, address, and social security number.

03

Specify the tax year for which you are filing the form.

04

Detail your income sources in the designated sections, providing accurate figures as per the instructions provided on the form.

05

Complete any additional sections that are applicable to your financial situation, such as deductions or credits.

06

Review all entries for accuracy before signing and dating the form at the bottom.

07

Submit the completed form to the Vermont Department of Taxes by mail or electronically, as per the filing guidelines.

Who needs VT Form HS-122?

01

Individuals residing in Vermont who need to report their income and claim eligible tax deductions.

02

Residents who are applying for a property tax adjustment or need to seek tax relief through the state.

Fill

form

: Try Risk Free

People Also Ask about

What is the first time homebuyer tax credit in Vermont?

In Vermont, first-time homebuyers, qualifying veterans and those purchasing in specific target areas are eligible for a mortgage credit certificate (MCC), a tax credit on their mortgage interest equal to up to $2,000 per year.

Do seniors get property tax break in Vermont?

Vermont Property Tax Breaks for Retirees For 2022, senior homeowners with 2021 household income of $136,900 or less may qualify for a property tax credit of up to $8,000.

Who is eligible for the Vermont property tax credit?

In order to file a Vermont Property Tax Credit Claim, you must meet ALL of the following eligibility requirements: Your property qualifies as a homestead, and you have filed a Homestead Declaration for the 2022 grand list. You were domiciled* in Vermont for the entire 2021 calendar year.

What is Vermont Form HS 122?

HOMEOWNERS Form HS-122, Homestead Declaration AND Property Tax Credit Claim, must be filed each year . Homeowners with Household Income up to $134,800 on Line z should complete Form HS-122, Section B . You may be eligible for a property tax credit . This schedule must be filed with Form HS-122 .

Do I have to file a Vermont tax return?

You must file an income tax return in Vermont: if you are a resident, part-year resident of Vermont, or a nonresident but earned Vermont income, and. if you are required to file a federal income tax return, and. you earned or received more than $100 in Vermont income, or.

What is the difference between homestead and non homestead taxes Vermont?

For this purpose, property is categorized as either nonhomestead or homestead. A homestead is the principal dwelling and parcel of land surrounding the dwelling, owned and occupied by the resident as the person's domicile. All property is considered nonhomestead, unless it is declared as a homestead.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute form hs 122 2015-2019 online?

pdfFiller has made filling out and eSigning form hs 122 2015-2019 easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I make edits in form hs 122 2015-2019 without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit form hs 122 2015-2019 and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I edit form hs 122 2015-2019 on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share form hs 122 2015-2019 on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is VT Form HS-122?

VT Form HS-122 is a tax form used in the state of Vermont for individuals and entities to report their homestead property and claim property tax adjustments.

Who is required to file VT Form HS-122?

Homeowners who occupy their property as their primary residence and seek to qualify for property tax benefits in Vermont are required to file VT Form HS-122.

How to fill out VT Form HS-122?

To fill out VT Form HS-122, provide personal information, details of the property, certify your residency, and report any applicable income information, following the instructions provided on the form.

What is the purpose of VT Form HS-122?

The purpose of VT Form HS-122 is to allow Vermont residents to report their homestead property status to qualify for the Homestead Declaration and obtain associated property tax adjustments.

What information must be reported on VT Form HS-122?

VT Form HS-122 requires reporting personal identification information, property details, residency status, and income information relevant to the property tax adjustment eligibility.

Fill out your form hs 122 2015-2019 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Hs 122 2015-2019 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.