KS DoR Schedule S 2020 free printable template

Show details

SCHEDULE S

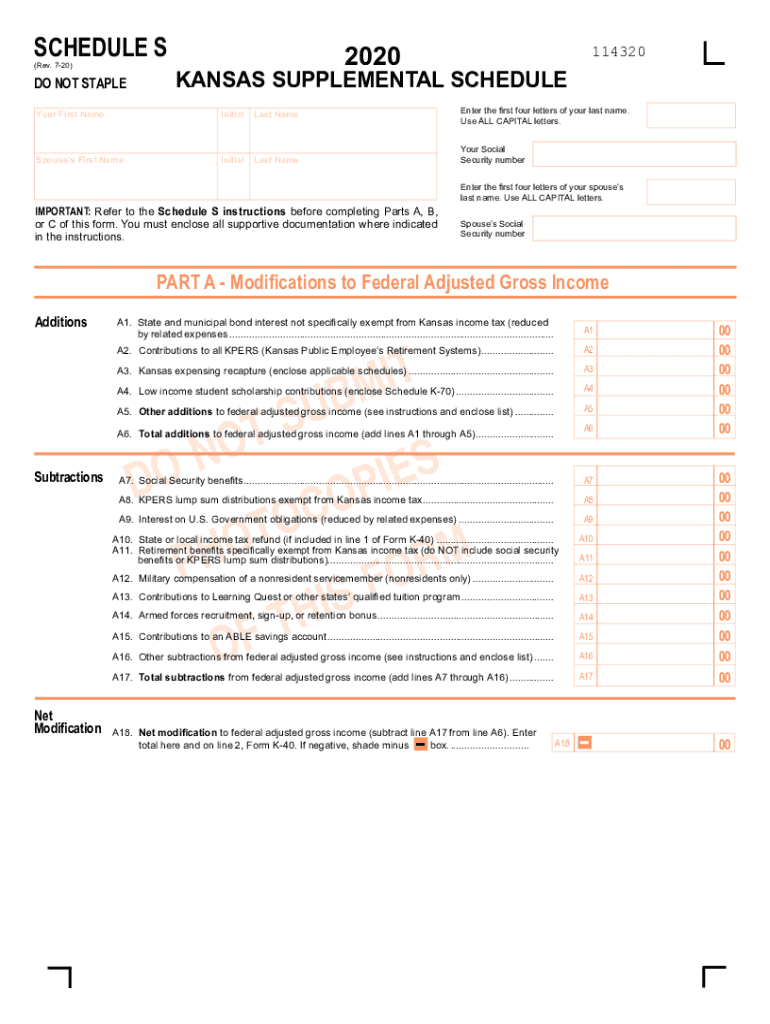

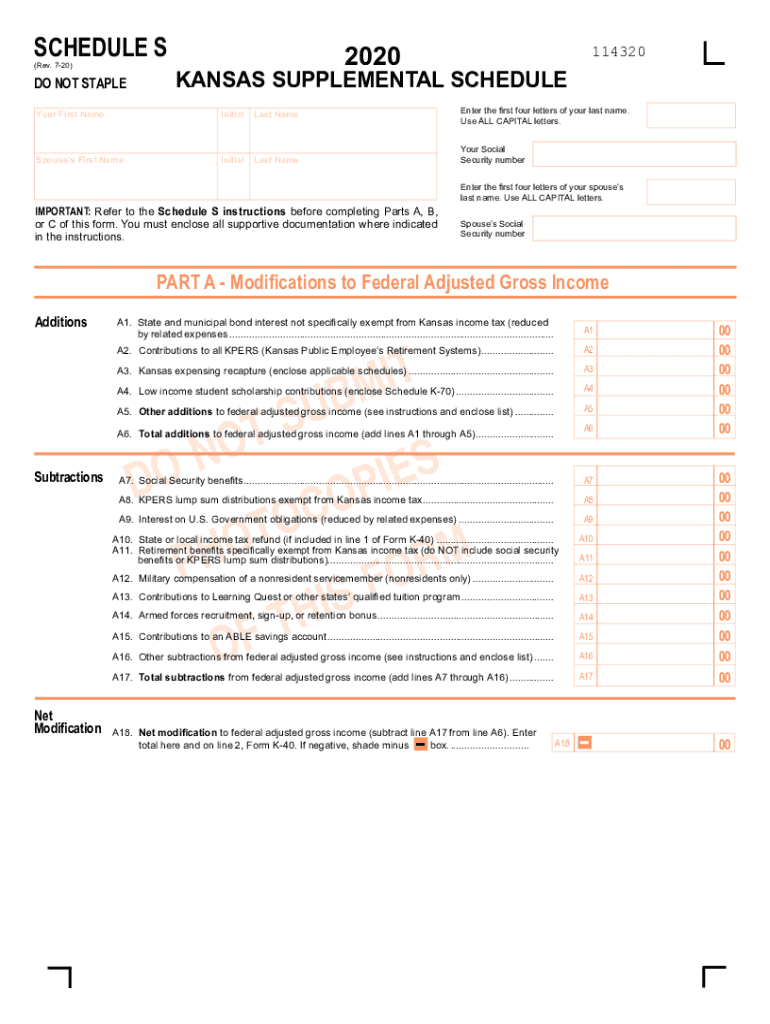

(Rev. 720)DO NOT STAPLE2020KANSAS SUPPLEMENTAL Scheduler First NameInitialLast Espouses First NameInitialLast NameIMPORTANT: Refer to the Schedule S instructions before completing Parts

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KS DoR Schedule S

Edit your KS DoR Schedule S form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KS DoR Schedule S form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit KS DoR Schedule S online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit KS DoR Schedule S. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KS DoR Schedule S Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KS DoR Schedule S

How to fill out KS DoR Schedule S

01

Obtain the KS DoR Schedule S form from the Kansas Department of Revenue website or your tax advisor.

02

Fill out your personal information at the top of the form, including your name, address, and Social Security number.

03

Enter your income details in the designated sections, accurately listing all relevant income sources.

04

Deduct any applicable expenses as specified in the instructions related to each income source.

05

Review the form to ensure all information is complete and accurate.

06

Sign and date the form at the bottom.

07

Submit the completed Schedule S along with your Kansas income tax return.

Who needs KS DoR Schedule S?

01

Individuals filing a Kansas state tax return who have certain sources of income that must be reported separately.

02

Taxpayers who have business income, rental income, or income from trusts and estates.

Fill

form

: Try Risk Free

People Also Ask about

What is the Schedule S for Kansas tax return?

Kansas Income Tax Schedule S Schedule S is a two-page form that includes various modifications and additions for filing with your KS-40, including places for reporting income from sources including social security and various interest-bearing investments.

What is a Schedule S for?

Schedule S (Form 1120-F) is used by foreign corporations to claim an exclusion from gross income under section 883 and to provide reporting information required by the section 883 regulations.

Why do I need Schedule S in Kansas?

I assume that you refer to Schedule S - Supplemental Schedule to a Kansas state return. This schedule is used to report items of income that are not taxed or included on your Federal return but are taxable to Kansas.

What tax forms do I need to file for an S Corp?

In order to become an S corporation, the corporation must submit Form 2553, Election by a Small Business Corporation signed by all the shareholders. See the Instructions for Form 2553PDF for all required information and to determine where to file the form.

What retirement benefits are specifically exempt from Kansas income tax?

Retirement plans administered by the U.S. Railroad Retirement Board are not taxable. This includes U.S. Railroad Retirement Benefits, tier one, tier two, dual vested benefits, and supplemental annuities.

What schedule is an S Corp?

Corporations that elect to be S corporations use Schedule D (Form 1120-S) to report: Capital gains and losses.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my KS DoR Schedule S directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your KS DoR Schedule S along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I send KS DoR Schedule S to be eSigned by others?

Once your KS DoR Schedule S is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I make changes in KS DoR Schedule S?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your KS DoR Schedule S to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

What is KS DoR Schedule S?

KS DoR Schedule S is a form used by the Kansas Department of Revenue to report information related to the sale of securities and certain financial transactions.

Who is required to file KS DoR Schedule S?

Individuals and entities in Kansas who have capital gains or losses from the sale of securities are required to file KS DoR Schedule S.

How to fill out KS DoR Schedule S?

To fill out KS DoR Schedule S, taxpayers need to provide details about the securities sold, including the date of sale, sale price, cost basis, and any gains or losses incurred.

What is the purpose of KS DoR Schedule S?

The purpose of KS DoR Schedule S is to facilitate the reporting of capital gains and losses from the sale of securities, ensuring proper tax calculation and compliance.

What information must be reported on KS DoR Schedule S?

The information that must be reported on KS DoR Schedule S includes details such as the name and type of each security, purchase and sale dates, sale prices, cost basis, and resulting gains or losses.

Fill out your KS DoR Schedule S online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KS DoR Schedule S is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.