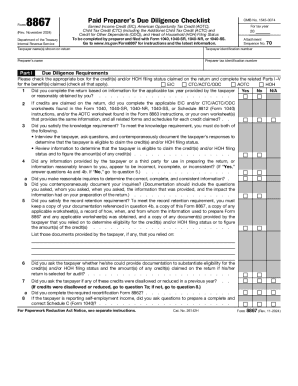

IRS 8867 2020 free printable template

Instructions and Help about IRS 8867

How to edit IRS 8867

How to fill out IRS 8867

About IRS 8 previous version

What is IRS 8867?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 8867

What should I do if I discover an error in my submitted form 8867?

If you find a mistake in your submitted form 8867, you should file an amended return. Ensure you indicate that the form is corrected and provide the necessary documentation to support the changes. Always keep a copy of the original and amended form for your records.

How can I check the status of my submitted form 8867?

To verify the receipt or processing status of your form 8867, you can use the IRS's online tracking tools or contact their customer service. It's essential to have your details handy, such as your name, Social Security number, and the tax year of the form to facilitate the inquiry.

Are there special considerations for filing form 8867 on behalf of someone else?

When filing form 8867 on behalf of another individual, you must have a valid power of attorney (POA) in place. Ensure that all necessary signatures are included, and be aware of any specific requirements related to nonresidents or foreign payees.

What common errors should I avoid when submitting form 8867?

Common errors when submitting form 8867 include incorrect amounts, missing signatures, and failure to provide necessary supporting documents. Double-check each section before submission to prevent delays in processing or potential rejections.

Can I e-file my form 8867, and what are the requirements?

Yes, you can e-file your form 8867 provided you meet certain technical requirements, such as using compatible software and browsers. Ensure your e-filing software supports form 8867 and follow the guidelines for electronic submission to avoid common pitfalls.

See what our users say