MY Section 50 9 free printable template

Show details

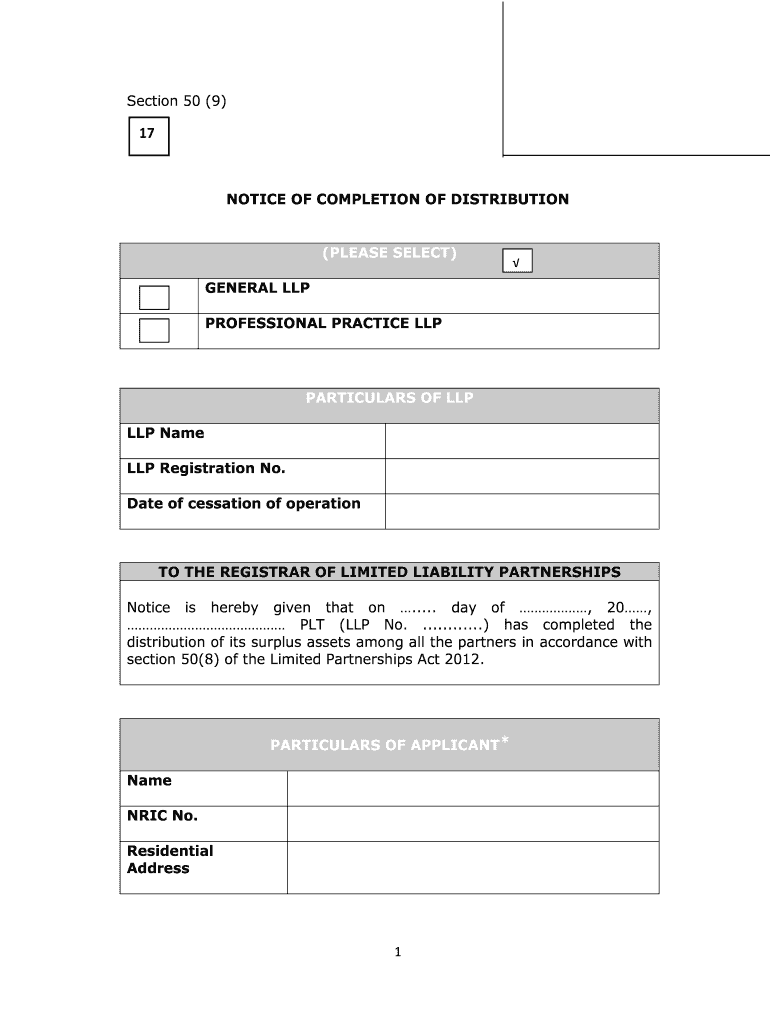

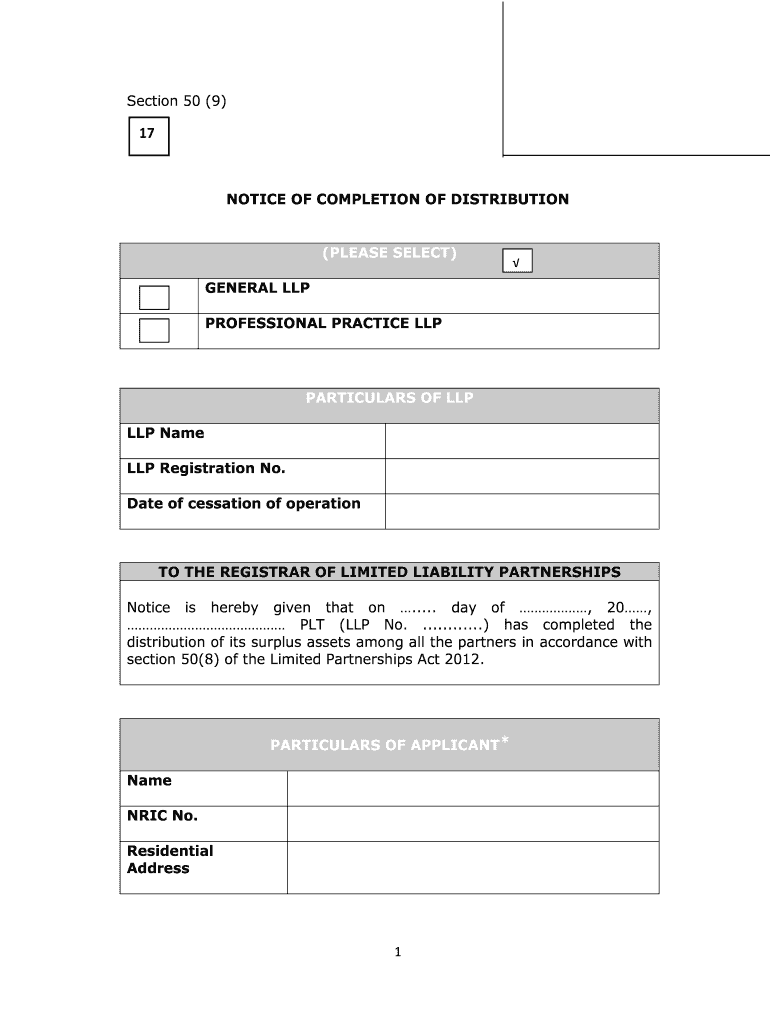

Section 50 (9) 17 NOTICE OF COMPLETION OF DISTRIBUTION (PLEASE SELECT) GENERAL LLP ? ? PROFESSIONAL PRACTICE LLP PARTICULARS OF LLP Name LLP Registration No. Date of cessation of operation TO THE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ssm form 9

Edit your 53842341 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 9 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 9 ssm online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ssm borang 9 form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ssm form9

How to fill out MY Section 50 (9)

01

Gather all necessary personal and financial information required for MY Section 50 (9).

02

Begin filling out the form by entering your name and contact details at the top section.

03

Provide accurate information regarding your current financial situation, including income, expenses, and any outstanding debts.

04

Include details about any assets you own, such as property or investments.

05

Review the eligibility criteria to ensure that you qualify for the benefits associated with MY Section 50 (9).

06

Double-check all entries for accuracy and completeness before submission.

07

Sign and date the form where indicated.

Who needs MY Section 50 (9)?

01

Individuals or entities that are seeking to apply for benefits under MY Section 50 (9).

02

Those who have specific financial circumstances that are addressed in the provisions of MY Section 50 (9).

03

Applicants who need to provide formal documentation of their financial status for review.

Fill

borang 9

: Try Risk Free

People Also Ask about form 9 certificate of incorporation

How hard is it to get a W9?

Filling out a W-9 form isn't difficult since it only requires a few pieces of basic information. You will usually submit a W-9 form when you receive payments for services you provide as an independent contractor, pay interest on your mortgage or even contribute money to your IRA account.

How do I ask for a W-9 form?

Most of the time, a company or financial institution will send you a blank W-9 form to complete before you begin business with them. If you need to issue the form, you can download a W-9 from the IRS website.

Can I get a W9 form online?

Where can I get a current W9 form? The W-9 can be downloaded from the IRS website, and the business must then provide a completed W-9 to every employer it works for to verify its EIN for reporting purposes.

Can anyone request a W9?

Who Asks for a Completed W-9? The person or business paying you is responsible for requesting the W-9 Form from you. However, the requester has no obligation to file the W-9 with the IRS.

How can I request a W 9 form?

Tips for getting W-9s from vendors Send a copy of Form W-9 to the vendor. Make it easy to fill out and return the Form W-9 by sending your vendor a copy to their email or physical inbox. Explain why you're asking for a W-9. Refuse to sign contracts without a W-9.

Where can I download a free W 9 form?

Commonly, the business or financial institutions will give you a blank W-9, and you can complete it directly. Or if you or your business is asked to provide a fillable w 9 form to independent contractors, you can download the w 9 form directly from the IRS website.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit ssm form 9 sample in Chrome?

Install the pdfFiller Google Chrome Extension to edit company form 9 and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I complete contoh borang 9 ssm on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your form 9 ssm change to section from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

Can I edit sdn bhd form 9 on an Android device?

With the pdfFiller Android app, you can edit, sign, and share ssm express filing form pdf on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is MY Section 50 (9)?

MY Section 50 (9) is a specific section in the tax regulations that outlines reporting requirements for certain transactions and information.

Who is required to file MY Section 50 (9)?

Entities and individuals involved in specific types of financial transactions or engagements that fall under the guidelines of MY Section 50 (9) are required to file.

How to fill out MY Section 50 (9)?

To fill out MY Section 50 (9), one must provide accurate information as required by the form, ensuring to include details regarding transactions and relevant data as specified in the instructions.

What is the purpose of MY Section 50 (9)?

The purpose of MY Section 50 (9) is to ensure transparency and compliance in reporting specific financial transactions to the tax authorities.

What information must be reported on MY Section 50 (9)?

Information that must be reported includes details about the transaction type, parties involved, amounts, dates, and any other relevant financial information as mandated.

Fill out your MY Section 50 9 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Malaysia Form 9 is not the form you're looking for?Search for another form here.

Keywords relevant to borang 9 ssm sample

Related to form 8 and form 9

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.