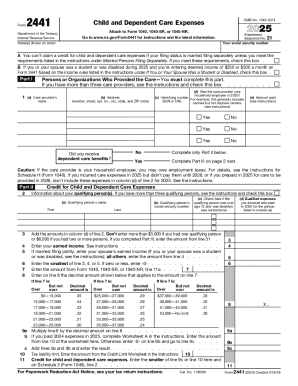

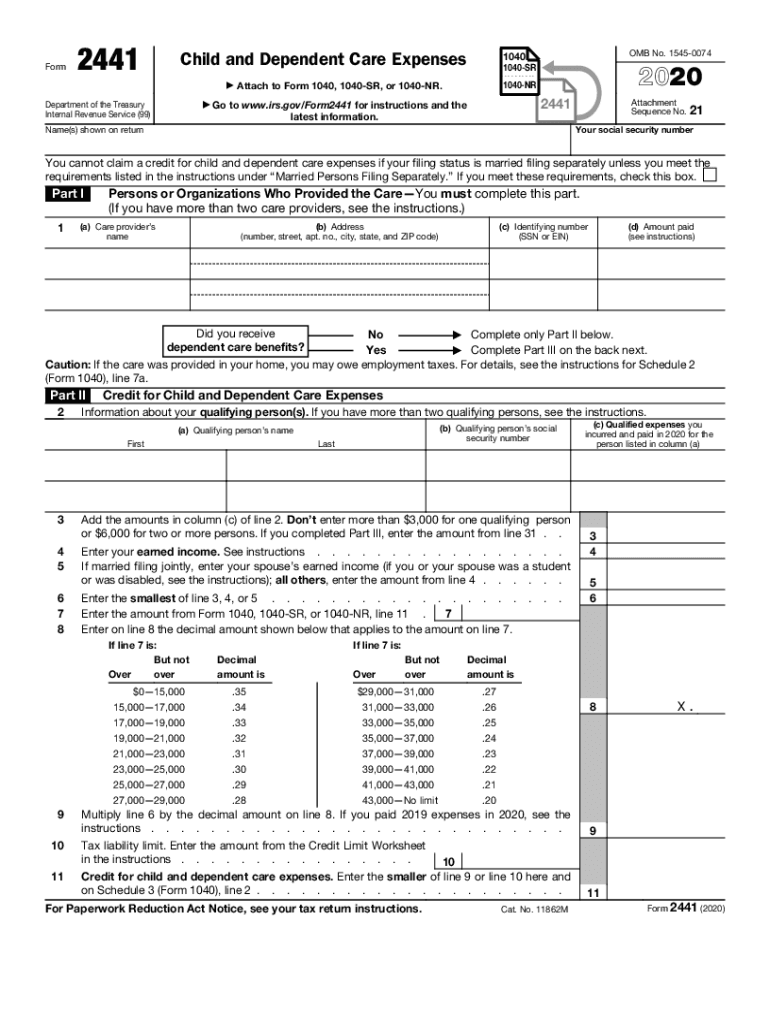

IRS 2441 2020 free printable template

Instructions and Help about IRS 2441

How to edit IRS 2441

How to fill out IRS 2441

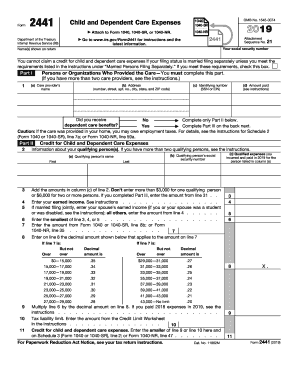

About IRS 2 previous version

What is IRS 2441?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 2441

What should I do if I realize I've made a mistake on my submitted IRS 2441?

If you discover an error after submitting your IRS 2441, you'll need to file an amended return. This can be done by completing a new IRS 2441 and marking it as amended. It's important to follow the IRS guidelines for corrections to ensure your amendments are processed correctly.

How can I track the status of my IRS 2441 submission?

To verify the receipt and processing of your IRS 2441, you can use the IRS 'Where's My Refund?' tool. Additionally, if e-filed, watch for common rejection codes that may indicate issues with your submission. Address any discrepancies promptly to avoid delays in processing.

What are the common errors to avoid when filing the IRS 2441?

When completing your IRS 2441, common errors include incorrect social security numbers, miscalculating credits, and not providing required supporting documentation. Carefully reviewing your information and cross-checking against the IRS instructions can help you avoid these pitfalls.

Can I e-file my IRS 2441 using specific software, and are there any technical requirements?

Yes, many tax software programs support e-filing for IRS 2441. Ensure that your chosen software is compatible with current IRS requirements and supports necessary features like e-signatures. Additionally, make sure your device and internet browser meet the technical specifications outlined by the software provider.

See what our users say