WI I-0103 Schedule SB 2020 free printable template

Show details

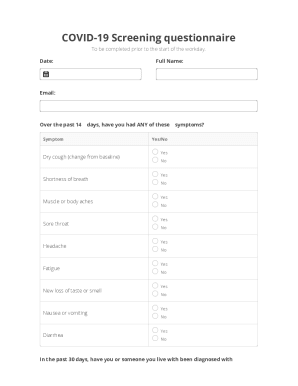

ScheduleSBWisconsin Department of Revenue Waveform 1 Subtractions from Income2020File with Wisconsin Form1Social Security Numbers the instructions for additional information on the subtractions listed

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WI I-0103 Schedule SB

Edit your WI I-0103 Schedule SB form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WI I-0103 Schedule SB form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit WI I-0103 Schedule SB online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit WI I-0103 Schedule SB. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI I-0103 Schedule SB Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WI I-0103 Schedule SB

How to fill out WI I-0103 Schedule SB

01

Obtain a copy of WI I-0103 Schedule SB from the appropriate state website or office.

02

Begin by entering your name and address at the top of the form.

03

List all the sources of income on the schedule, categorizing them as required.

04

Fill in the specific details for each source of income, including amounts and relevant periods.

05

Ensure to provide any necessary documentation or attachments that support your income claims.

06

Review the form for accuracy and completeness before submitting.

07

Sign and date the form at the designated section.

Who needs WI I-0103 Schedule SB?

01

Individuals or businesses that have certain types of income which require reporting on the WI I-0103 Schedule SB.

02

Taxpayers who need to report and calculate their state income tax obligations in Wisconsin.

Fill

form

: Try Risk Free

People Also Ask about

Where is my Wisconsin state tax return?

To check your return status by telephone: 1-608-266-8100 in Madison. 1-414-227-4907 in Milwaukee. Toll free at 1-866-947-7363 in other areas of Wisconsin.

Why are Wisconsin refunds taking so long?

(TNS) — The State of Wisconsin will delay at least 60,000 income tax refunds for up to 12 weeks this spring as part of fraud prevention efforts, a sign of how the rise of identity theft and the state's response to it is impacting state taxpayers.

What is a Wisconsin subtraction?

You may subtract the amount of Per Diem reimbursement that is included as wages on your W-2 if you were a Wisconsin legislator. Contributions to ABLE Accounts - Code 24. For 2022, a subtraction can be claimed up to $16,000 for contributions made to an ABLE account whose beneficiary is a disabled person.

When can I expect my Wisconsin tax refund?

A Wisconsin state tax refund can be expected within three weeks of electronically filing your tax return. If you elected to file via paper return, your refund processing may take longer.

What is the Wisconsin withholding tax rate for 2021?

As a single earner or head of household in Wisconsin, you'll be taxed at a rate of 3.54% if you make up to $12,760 in taxable income per year. Singles and heads of household making $280,950 or more in taxable income are subject to the highest tax rate of 7.65%.

What is Schedule U on Wisconsin tax form?

Purpose of Schedule U Use Schedule U to see if you owe interest for underpaying your estimated tax and, if you do, to figure the amount of interest you owe.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my WI I-0103 Schedule SB in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your WI I-0103 Schedule SB and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I send WI I-0103 Schedule SB to be eSigned by others?

To distribute your WI I-0103 Schedule SB, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I create an electronic signature for the WI I-0103 Schedule SB in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your WI I-0103 Schedule SB and you'll be done in minutes.

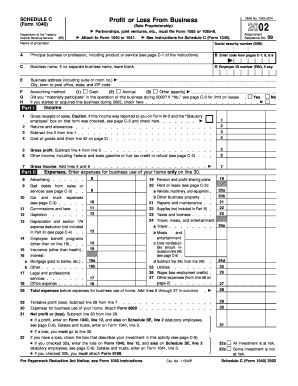

What is WI I-0103 Schedule SB?

WI I-0103 Schedule SB is a form used by tax filers in Wisconsin to report certain tax information related to business income and to calculate the business income tax owed.

Who is required to file WI I-0103 Schedule SB?

Taxpayers who operate a business in Wisconsin and meet specific criteria for business income must file WI I-0103 Schedule SB.

How to fill out WI I-0103 Schedule SB?

To fill out WI I-0103 Schedule SB, taxpayers need to provide information about their business income, deductions, and any credits claimed. Detailed instructions are typically provided on the form itself.

What is the purpose of WI I-0103 Schedule SB?

The purpose of WI I-0103 Schedule SB is to ensure that business income is accurately reported and taxed according to Wisconsin tax laws.

What information must be reported on WI I-0103 Schedule SB?

WI I-0103 Schedule SB requires reporting of total business income, allowable deductions, any business tax credits, and relevant identification details about the taxpayer and the business.

Fill out your WI I-0103 Schedule SB online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WI I-0103 Schedule SB is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.