WI I-0103 Schedule SB 2021 free printable template

Show details

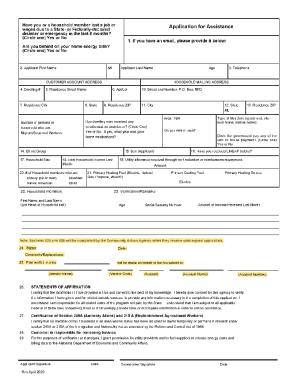

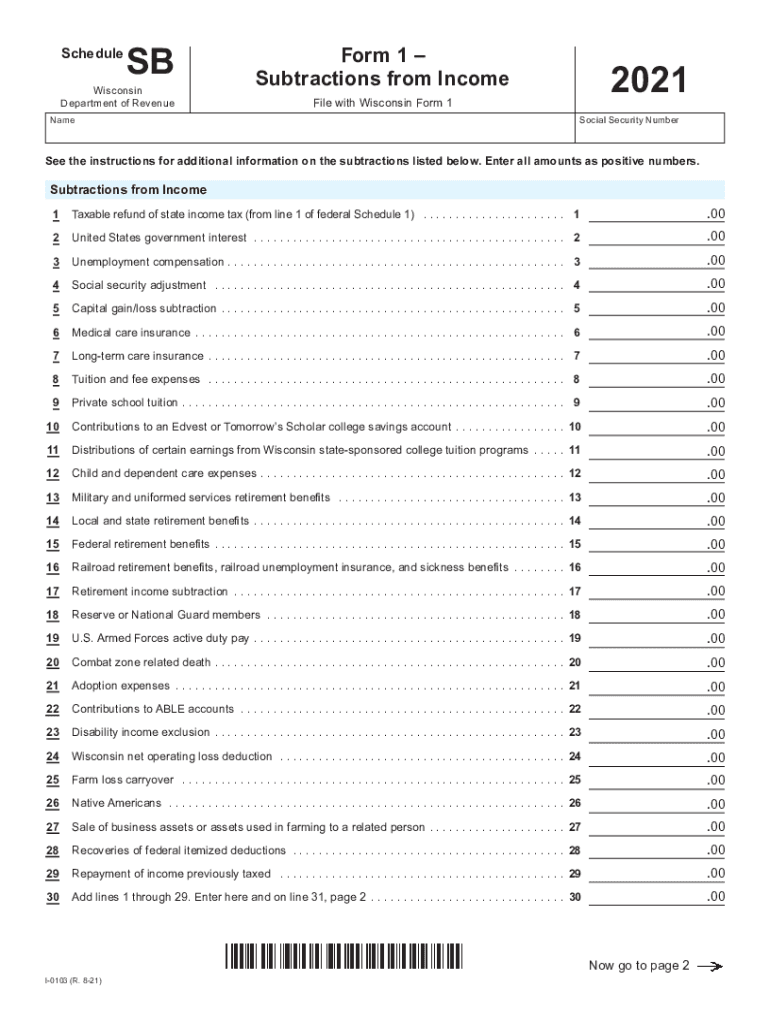

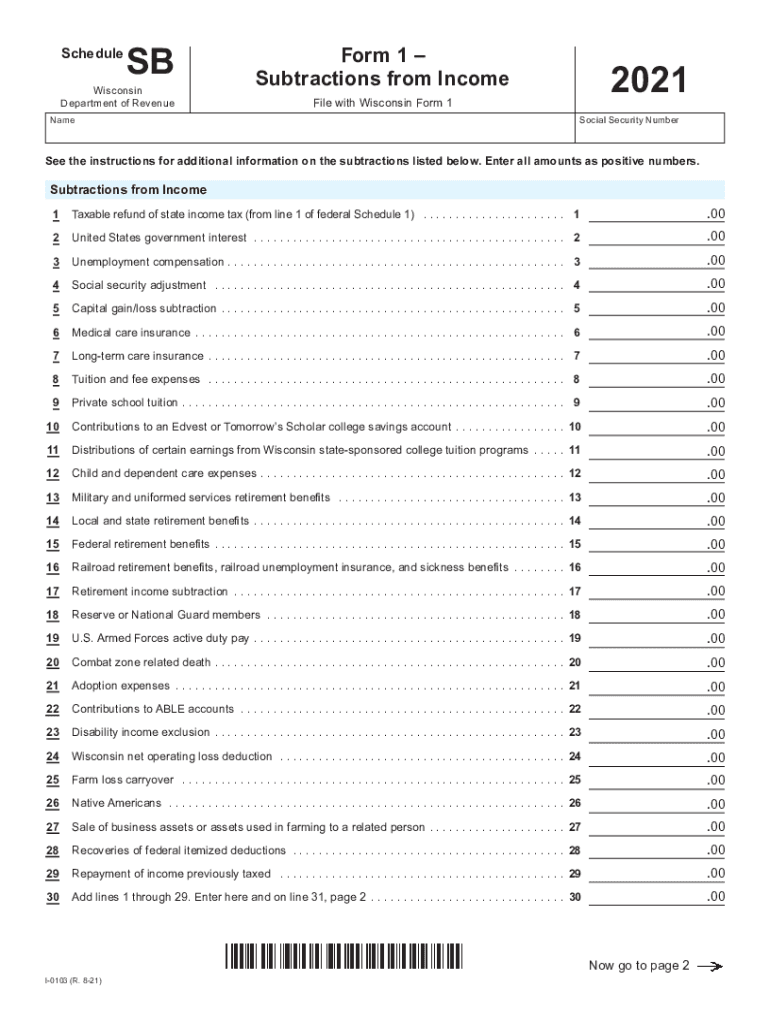

ScheduleSBWisconsin

Department of Revenue

Waveform 1

Subtractions from Income2021File with Wisconsin Form1Social Security Numbers the instructions for additional information on the subtractions listed

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WI I-0103 Schedule SB

Edit your WI I-0103 Schedule SB form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WI I-0103 Schedule SB form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing WI I-0103 Schedule SB online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit WI I-0103 Schedule SB. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI I-0103 Schedule SB Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WI I-0103 Schedule SB

How to fill out WI I-0103 Schedule SB

01

Obtain the WI I-0103 Schedule SB form from the Wisconsin Department of Revenue website.

02

Read the instructions carefully to understand the purpose of the form.

03

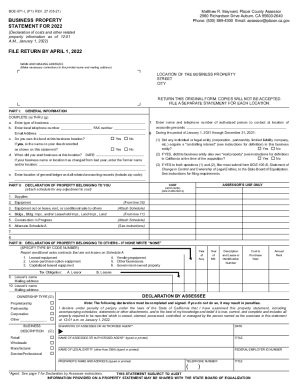

Fill out your personal information at the top of the form, including your name, address, and Social Security number.

04

Provide details regarding your business entity, including the type and structure.

05

Enter the income information required for Schedule SB, including gross receipts and any adjustments.

06

List all business expenses accurately, categorizing them as needed.

07

Calculate the total income and expenses to determine the net income.

08

Complete any additional sections relevant to your business operations as directed in the form.

09

Review the form for accuracy and completeness before submitting.

10

Submit the completed form to the Wisconsin Department of Revenue by the specified deadline.

Who needs WI I-0103 Schedule SB?

01

The WI I-0103 Schedule SB is needed by individuals and businesses in Wisconsin that are filing income tax returns and have specific income or expense details to report.

02

It is particularly relevant for small businesses and self-employed individuals.

Fill

form

: Try Risk Free

People Also Ask about

Where is my Wisconsin state tax return?

To check your return status by telephone: 1-608-266-8100 in Madison. 1-414-227-4907 in Milwaukee. Toll free at 1-866-947-7363 in other areas of Wisconsin.

Why are Wisconsin refunds taking so long?

(TNS) — The State of Wisconsin will delay at least 60,000 income tax refunds for up to 12 weeks this spring as part of fraud prevention efforts, a sign of how the rise of identity theft and the state's response to it is impacting state taxpayers.

What is a Wisconsin subtraction?

You may subtract the amount of Per Diem reimbursement that is included as wages on your W-2 if you were a Wisconsin legislator. Contributions to ABLE Accounts - Code 24. For 2022, a subtraction can be claimed up to $16,000 for contributions made to an ABLE account whose beneficiary is a disabled person.

When can I expect my Wisconsin tax refund?

A Wisconsin state tax refund can be expected within three weeks of electronically filing your tax return. If you elected to file via paper return, your refund processing may take longer.

What is the Wisconsin withholding tax rate for 2021?

As a single earner or head of household in Wisconsin, you'll be taxed at a rate of 3.54% if you make up to $12,760 in taxable income per year. Singles and heads of household making $280,950 or more in taxable income are subject to the highest tax rate of 7.65%.

What is Schedule U on Wisconsin tax form?

Purpose of Schedule U Use Schedule U to see if you owe interest for underpaying your estimated tax and, if you do, to figure the amount of interest you owe.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send WI I-0103 Schedule SB for eSignature?

WI I-0103 Schedule SB is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I complete WI I-0103 Schedule SB online?

pdfFiller makes it easy to finish and sign WI I-0103 Schedule SB online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I create an eSignature for the WI I-0103 Schedule SB in Gmail?

Create your eSignature using pdfFiller and then eSign your WI I-0103 Schedule SB immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is WI I-0103 Schedule SB?

WI I-0103 Schedule SB is a supplemental schedule used for reporting specific tax information for certain Wisconsin taxpayers, particularly those with business income.

Who is required to file WI I-0103 Schedule SB?

Taxpayers who operate a business and meet certain income thresholds or specific criteria are required to file WI I-0103 Schedule SB.

How to fill out WI I-0103 Schedule SB?

To fill out WI I-0103 Schedule SB, you must provide accurate income details from your business operations, along with applicable deductions and credits, following the provided instructions.

What is the purpose of WI I-0103 Schedule SB?

The purpose of WI I-0103 Schedule SB is to gather detailed financial information from businesses to ensure accurate tax assessment and compliance with state tax regulations.

What information must be reported on WI I-0103 Schedule SB?

The information that must be reported on WI I-0103 Schedule SB includes business income, expenses, deductions, and any claimed credits related to the business operations.

Fill out your WI I-0103 Schedule SB online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WI I-0103 Schedule SB is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.