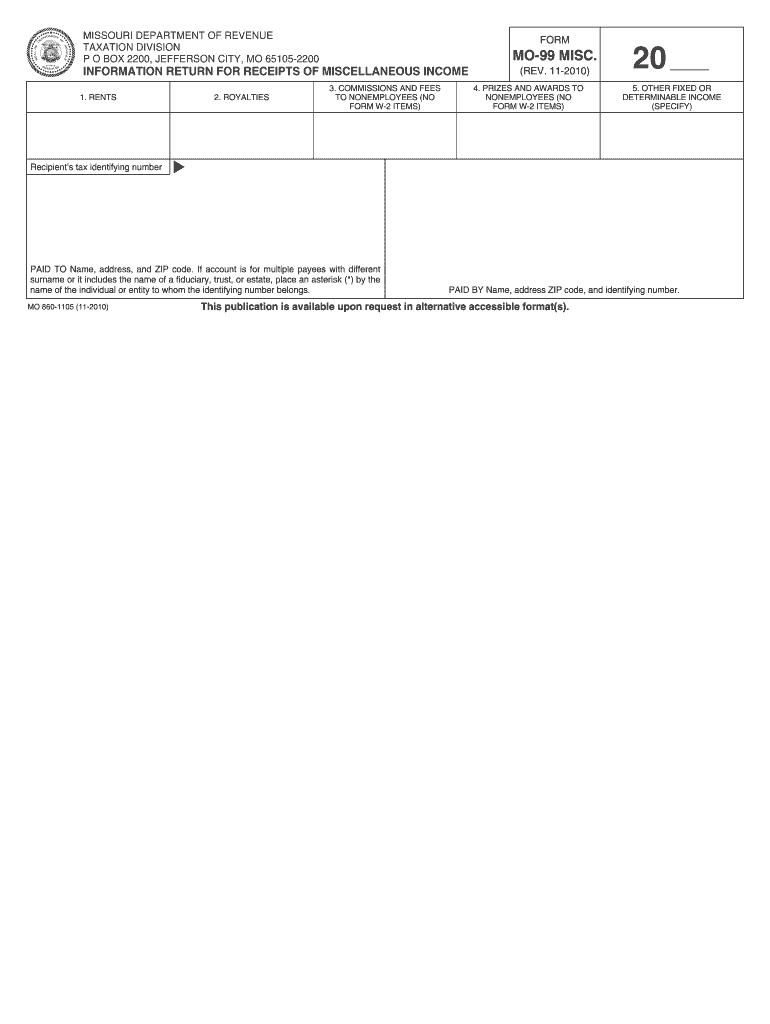

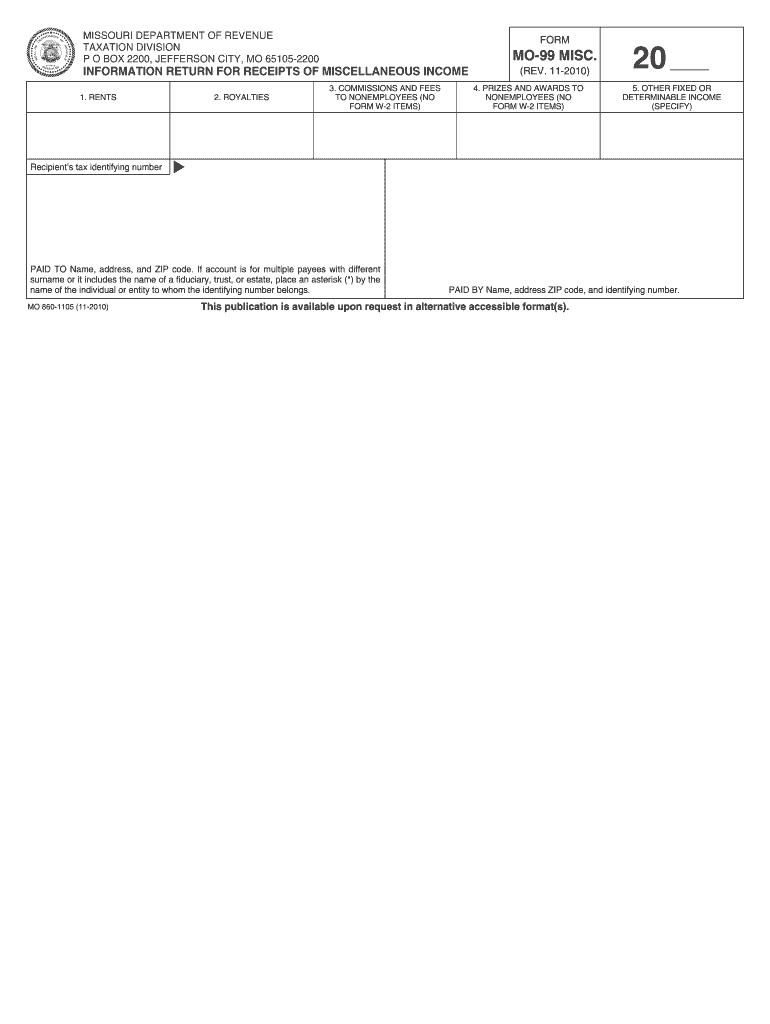

MO MO-99 MISC 2010 free printable template

Show details

Mo. gov Visit http //www. dor. mo. gov/personal/individual/ for additional information. Form MO-99 Misc Revised 07-2014. Reset Form Print Form Missouri Department of Revenue Form MO-99 MISC Information Return For Receipts of Miscellaneous Income 20 Paid To Name Tax Identification Number Address State City Zip Code Income Paid By If account is for multiple payees with different surname or it includes the name of a fiduciary trust or estate place a...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form mo 99misc instructions

Edit your form mo 99misc instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form mo 99misc instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form mo 99misc instructions online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form mo 99misc instructions. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO MO-99 MISC Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form mo 99misc instructions

How to fill out MO MO-99 MISC

01

Begin by downloading the MO MO-99 MISC form from the official website.

02

Fill in your personal information including your name, address, and Social Security number.

03

Indicate the tax year for which you are filing the form.

04

Complete the section detailing your income sources, including wages, investments, and any other relevant earnings.

05

Provide any applicable deductions or credits that you qualify for.

06

Review the form for accuracy and ensure all necessary documentation is attached.

07

Sign and date the form before submission.

Who needs MO MO-99 MISC?

01

Individuals who have received miscellaneous income and are required to report it for tax purposes.

02

Taxpayers who need to reconcile their earnings with reported income on their tax return.

03

Freelancers and independent contractors who receive payments outside of traditional employment.

Fill

form

: Try Risk Free

People Also Ask about

How do I claim miscellaneous income?

If you're not an employee of the payer, and you're not in a self-employed trade or business, you should report the income on line 8j of Schedule 1 (Form 1040), Additional Income and Adjustments to IncomePDF and any allowable expenses on Schedule A (Form 1040), Itemized Deductions.

Is Missouri a no return required military?

The military pay of nonresident military personnel stationed in Missouri due to military orders is not taxable to Missouri. If you are a servicemember and earned only military income while stationed in Missouri, complete a No Return Required-Military online form at the following link: Military No Return Required.

Where can I get a tax instruction book?

Call 1-800-TAX-FORM (800-829-3676) Monday through Friday, 7:00 a.m. to 7:00 p.m. local time to order current or prior year forms and instructions or IRS publications.

How do I get a tax booklet?

Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

Where can I pick up a federal tax booklet?

Get federal tax forms Get the current filing year's forms, instructions, and publications for free from the IRS. You can also find printed versions of many forms, instructions, and publications in your community for free at: Libraries. IRS Taxpayer Assistance Centers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form mo 99misc instructions to be eSigned by others?

When you're ready to share your form mo 99misc instructions, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I edit form mo 99misc instructions on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign form mo 99misc instructions right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I complete form mo 99misc instructions on an Android device?

Use the pdfFiller app for Android to finish your form mo 99misc instructions. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is MO MO-99 MISC?

MO MO-99 MISC is a specific form used for reporting miscellaneous income in the state of Missouri.

Who is required to file MO MO-99 MISC?

Any individual or business entity that has made payments for certain types of miscellaneous income to Missouri residents or businesses is required to file MO MO-99 MISC.

How to fill out MO MO-99 MISC?

To fill out MO MO-99 MISC, you need to provide details such as the recipient's information, the amount paid, and the nature of the income. Follow the instructions provided with the form carefully.

What is the purpose of MO MO-99 MISC?

The purpose of MO MO-99 MISC is to report miscellaneous income payments made to individuals or entities, ensuring that such income is properly reported for tax purposes.

What information must be reported on MO MO-99 MISC?

The information that must be reported includes the payee's name, address, social security number or tax identification number, the amount paid, and the type of income.

Fill out your form mo 99misc instructions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Mo 99misc Instructions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

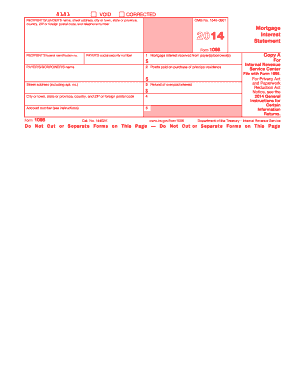

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.