MO MO-99 MISC 2017 free printable template

Show details

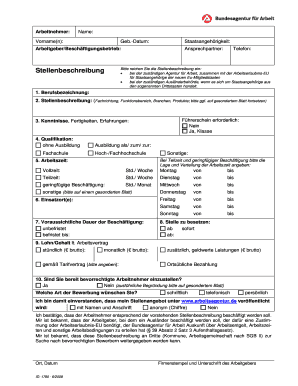

Mo. gov Visit http //www. dor. mo. gov/personal/individual/ for additional information. Form MO-99 Misc Revised 03-2017. Reset Form Print Form Missouri Department of Revenue Form MO-99 MISC Information Return For Receipts of Miscellaneous Income Paid To 20 Name Tax Identification Number Address State City ZIP Code Income Paid By If account is for multiple payees with different surname or it includes the name of a fiduciary trust or estate place an asterisk by the name of the individual or...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MO MO-99 MISC

Edit your MO MO-99 MISC form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MO MO-99 MISC form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MO MO-99 MISC online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit MO MO-99 MISC. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO MO-99 MISC Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MO MO-99 MISC

How to fill out MO MO-99 MISC

01

Obtain the MO MO-99 MISC form from the official website or local office.

02

Fill out your name, address, and contact information at the top of the form.

03

Indicate the tax year for which you are filing.

04

Provide details about your income, including any applicable deductions or credits.

05

Double-check your entries for accuracy and completeness.

06

Sign and date the form at the designated area.

07

Submit the completed form by mailing it to the appropriate tax agency or local office.

Who needs MO MO-99 MISC?

01

Individuals or businesses who have miscellaneous income that needs to be reported for state tax purposes.

02

Taxpayers who have received certain types of payments, such as royalties or non-employee compensation.

Fill

form

: Try Risk Free

People Also Ask about

How do I claim miscellaneous income?

If you're not an employee of the payer, and you're not in a self-employed trade or business, you should report the income on line 8j of Schedule 1 (Form 1040), Additional Income and Adjustments to IncomePDF and any allowable expenses on Schedule A (Form 1040), Itemized Deductions.

Is Missouri a no return required military?

The military pay of nonresident military personnel stationed in Missouri due to military orders is not taxable to Missouri. If you are a servicemember and earned only military income while stationed in Missouri, complete a No Return Required-Military online form at the following link: Military No Return Required.

Where can I get a tax instruction book?

Call 1-800-TAX-FORM (800-829-3676) Monday through Friday, 7:00 a.m. to 7:00 p.m. local time to order current or prior year forms and instructions or IRS publications.

How do I get a tax booklet?

Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

Where can I pick up a federal tax booklet?

Get federal tax forms Get the current filing year's forms, instructions, and publications for free from the IRS. You can also find printed versions of many forms, instructions, and publications in your community for free at: Libraries. IRS Taxpayer Assistance Centers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send MO MO-99 MISC to be eSigned by others?

Once your MO MO-99 MISC is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How can I edit MO MO-99 MISC on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing MO MO-99 MISC right away.

How do I edit MO MO-99 MISC on an iOS device?

Use the pdfFiller mobile app to create, edit, and share MO MO-99 MISC from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is MO MO-99 MISC?

MO MO-99 MISC is a tax form used in the state of Missouri to report miscellaneous income.

Who is required to file MO MO-99 MISC?

Individuals or entities that have paid $600 or more in miscellaneous income to a Missouri resident or entity are required to file MO MO-99 MISC.

How to fill out MO MO-99 MISC?

To fill out MO MO-99 MISC, you should provide the payer's information, the recipient's information, the amount paid, and any applicable withholding information.

What is the purpose of MO MO-99 MISC?

The purpose of MO MO-99 MISC is to report payments made to individuals or entities that are not classified as wages or salaries for tax purposes.

What information must be reported on MO MO-99 MISC?

The information that must be reported includes the payer's name and address, recipient's name and address, taxpayer identification number, the amount paid, and any withholding tax deducted.

Fill out your MO MO-99 MISC online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MO MO-99 MISC is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.