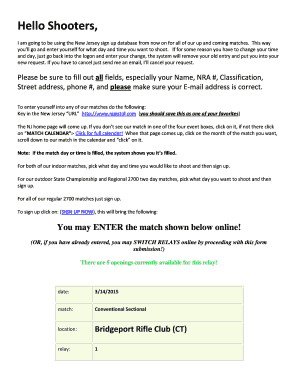

MO MO-99 MISC 2014 free printable template

Get, Create, Make and Sign mo misc 2014 form

How to edit mo misc 2014 form online

Uncompromising security for your PDF editing and eSignature needs

MO MO-99 MISC Form Versions

How to fill out mo misc 2014 form

How to fill out MO MO-99 MISC

Who needs MO MO-99 MISC?

Instructions and Help about mo misc 2014 form

Ok today we're going to show you how to properly convert a r22 air conditioner to mo 99 first you're going to want to recover all the refrigerant making sure that you get every bit of it into your recovery tank then you're going to want to install a filter dryer which will cut to that in a second next is to install the filter dryer brazing a new filter dryer in this case we have a heat pump, so we're using a bi-directional filter dryer next we will be removing the valve core stems the shredder valves and replacing them with new ones so all those removed is a liqueur now we'll install the new ones next is pull a deep vacuum I recommend about 400 microns and verify that it will hold for honor'd microns for at least 5 minutes if not search for any leaks and make any repairs once you've obtained a deep vacuum that is stable then determine the method of charging in this particular case we are going to be using subcooling because this is an exp driven system with mo 99 there is no need to replace the t --xv the r22 t --xv will work perfectly with the mo 9 mo 99 refrigerant with only minor variances finally there are several methods but for today's purposes we'll be dealing with subcooling because the now we will find the factory charge which in this case is 4 pounds 0.63, so we will convert that into our mo 99 there's a plenty of apps out there on Google play and at the app store that will easily convert then you will want to weigh in your charge and while the unit's off then you will want to slowly add refrigerant the mo 99 into the system because you are adding it as a liquid you have to the box must be upside down because it's a blend of several refrigerants and what once you've got your charge weighed in — you're going to be very close and so it won't take very long to get the proper subcooling in this particular case, so now we are adding in this case the app showed that we want 4 pounds 2 ounces, and so we will add while the unit is off until it either will not take anymore or we have reached the four pounds two ounces, and then we will turn the system on and begin fine-tuning okay we've added the four pounds two ounces, and now we are fine-tuning make sure that you're using gauges that are set up for 438 a which is the refrigerant number and make sure you've got your temperature probes on both your suction and liquid so that you can determine in this case we want subcooling and the manufacture is designed subcooling is 12 degrees currently we have only a 3.8, so we're going to continue to add and add slowly most people manufacturer planets get a diffuser for the end of your refrigerant line so that way you can add it in as a gas instead of a liquid but as long as you get it pretty close then adding small amounts at a time is recommended if you don't have a diffuser and then just wait make sure it's your patient because your refrigerant has to travel all the way through the system before you see the actual results and once we've achieved the 12...

People Also Ask about

How do I claim miscellaneous income?

Is Missouri a no return required military?

Where can I get a tax instruction book?

How do I get a tax booklet?

Where can I pick up a federal tax booklet?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit mo misc 2014 form from Google Drive?

How do I fill out the mo misc 2014 form form on my smartphone?

How do I edit mo misc 2014 form on an Android device?

What is MO MO-99 MISC?

Who is required to file MO MO-99 MISC?

How to fill out MO MO-99 MISC?

What is the purpose of MO MO-99 MISC?

What information must be reported on MO MO-99 MISC?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.