Get the free tennessee sales tax

Show details

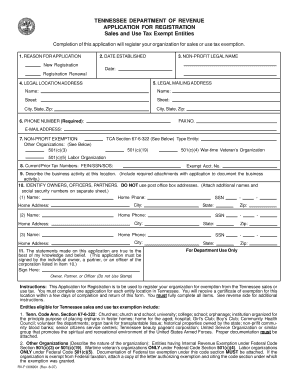

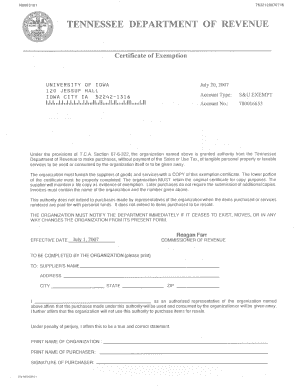

TENNESSEE DEPARTMENT OF REVENUE Claim for Credit or Refund of Sales or Use Tax MAIL THIS FORM AND DOCUMENTATION TO: STATE OF TENNESSEE DEPARTMENT OF REVENUE ANDREW JACKSON STATE OFFICE BUILDING 4TH

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tennessee sales tax

Edit your tennessee sales tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tennessee sales tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tennessee sales tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tennessee sales tax. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tennessee sales tax

How to fill out Tennessee sales tax?

01

Begin by gathering all necessary information, including your business information, sales records, and tax identification number.

02

Access the Tennessee Department of Revenue's website and navigate to the Sales and Use Tax section.

03

Register your business by completing the necessary forms and providing accurate information.

04

Familiarize yourself with the sales tax rates applicable to your products or services, as well as any exemptions or special rules that may apply.

05

Keep detailed records of your sales transactions, including the date, customer information, and sales amount.

06

Calculate the amount of sales tax owed based on the applicable rate and the total sales amount.

07

File your sales tax return on time, either online or by mail, including the calculated amount of sales tax due.

08

Pay the sales tax owed by the designated deadline, making sure to follow the proper payment method specified by the Tennessee Department of Revenue.

Who needs Tennessee sales tax?

01

Any individual or business engaged in selling tangible personal property or taxable services in Tennessee is generally required to collect and remit sales tax.

02

This includes both in-state businesses and out-of-state sellers who meet certain economic nexus thresholds.

03

Additionally, certain transactions may be exempt from sales tax, such as sales to qualified exempt organizations or sales of certain medical equipment or prescription drugs. It is crucial to understand the specific exemptions that apply to your business.

Fill

form

: Try Risk Free

People Also Ask about

How much is the sales tax in Tennessee?

The general sale tax rate for most tangible personal property and taxable services is 7%. A few products and services have special tax rates. All local jurisdictions in Tennessee have a local sales and use tax rate.

What is tax free in TN 2023?

Tennessee's traditional sales tax holiday on clothing, school supplies and computers is the last full weekend in July. For 2023, it begins at 12:01 a.m. on Friday, July 28, 2023, and ends at 11:59 p.m. on Sunday, July 30, 2023.

What tax does Tennessee not have?

Income tax is generally levied at a state-level on the income you earn within a tax year. Yet, Tennessee is one of several states that doesn't levy a state-level income tax on personal income. Business income and real property taxes as well as sales taxes are levied in Tennessee.

What is the sales tax on clothing in TN?

The Tennessee (TN) state sales tax rate is 7.0%.

What is the sales tax in Tennessee 2023?

From August through October 2023, Tennesseans will not pay tax on most food and food ingredients sold in grocery stores. The tax-relief does not include alcoholic beverages, tobacco, candy, dietary supplements, or prepared food.

How do you calculate Tennessee sales tax?

State Sales Tax is 7% of purchase price less total value of trade in.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get tennessee sales tax?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the tennessee sales tax. Open it immediately and start altering it with sophisticated capabilities.

Can I sign the tennessee sales tax electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your tennessee sales tax in minutes.

How can I fill out tennessee sales tax on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your tennessee sales tax. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is tennessee sales tax?

Tennessee sales tax is a consumption tax imposed on the sale of goods and services within the state of Tennessee. The state sales tax rate is currently set at 7%, with additional local taxes that may apply.

Who is required to file tennessee sales tax?

Any business or individual making retail sales of tangible personal property and certain services in Tennessee is required to collect and remit sales tax to the state. This includes both brick-and-mortar retailers and online sellers.

How to fill out tennessee sales tax?

To fill out Tennessee sales tax forms, you need to gather sales records, calculate total sales, determine tax collected, and complete the appropriate sales tax return form provided by the Tennessee Department of Revenue. Ensure all figures are accurate before submitting.

What is the purpose of tennessee sales tax?

The purpose of Tennessee sales tax is to generate revenue for state and local governments to fund public services such as education, infrastructure, and public safety. It is a significant source of funding for these essential services.

What information must be reported on tennessee sales tax?

When filing Tennessee sales tax, businesses must report total sales, total taxable sales, sales tax collected, exemptions claimed, and any other relevant details as specified on the sales tax return form.

Fill out your tennessee sales tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tennessee Sales Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.