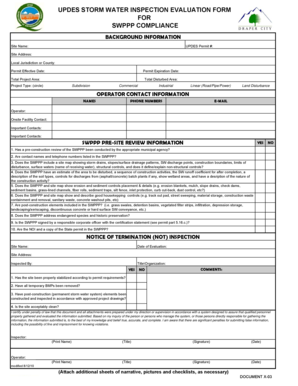

Certified Payroll Reporting Requirements

What is certified payroll reporting requirements?

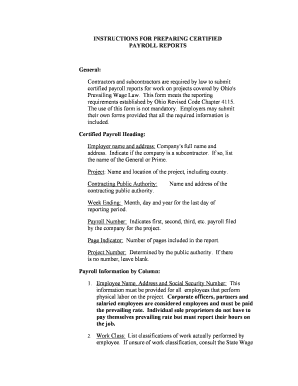

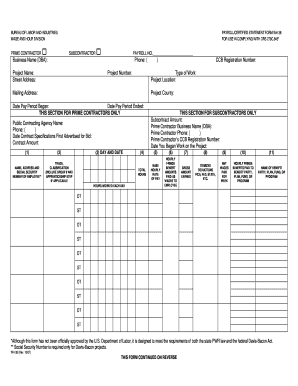

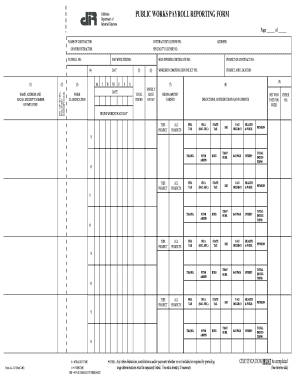

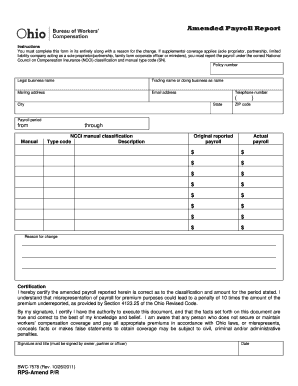

Certified payroll reporting requirements refer to the rules and regulations that employers must follow when submitting payroll reports for their employees. These requirements are designed to ensure that workers are being paid properly and receiving all the benefits they are entitled to.

What are the types of certified payroll reporting requirements?

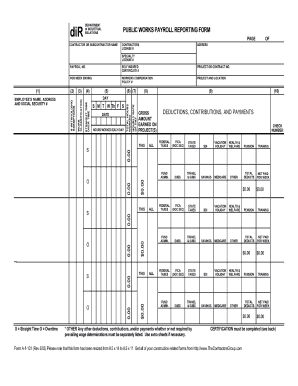

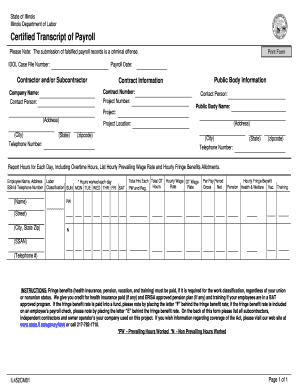

There are several types of certified payroll reporting requirements that employers may need to comply with, depending on their specific circumstances. Some common types include:

How to complete certified payroll reporting requirements

Completing certified payroll reporting requirements can feel overwhelming, but with the right tools and knowledge, it can be a straightforward process. Here are some steps to help you complete these requirements:

By following these steps and using the right tools, you can easily meet the certified payroll reporting requirements and ensure compliance with the regulations. Remember that pdfFiller provides a user-friendly platform that empowers you to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the ideal PDF editor to help you get all your documents done efficiently.