Certified Payroll California

What is certified payroll california?

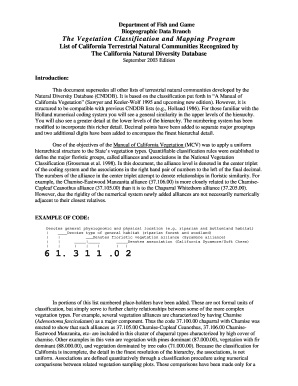

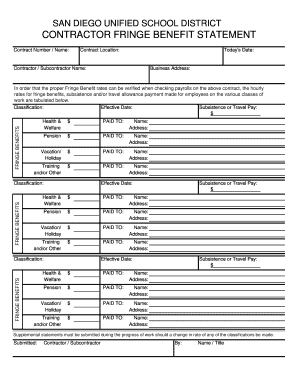

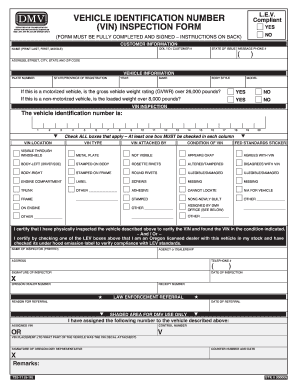

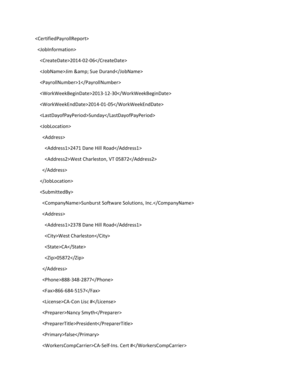

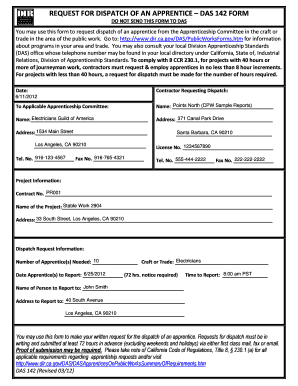

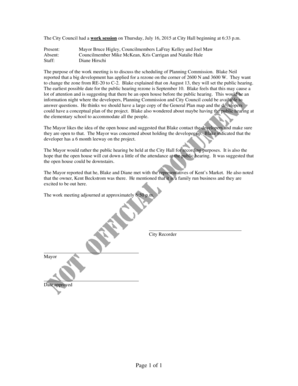

Certified payroll California refers to a system that ensures compliance with prevailing wage laws and regulations in the state of California. It is a process in which employers are required to submit certified payroll reports detailing the wages paid to construction workers on public works projects. These reports help enforce fair wages, benefits, and working conditions for construction workers.

What are the types of certified payroll california?

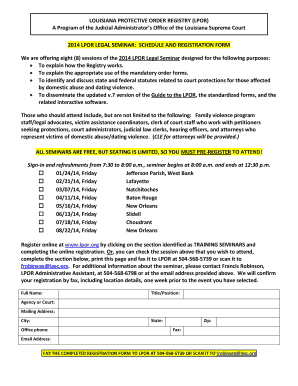

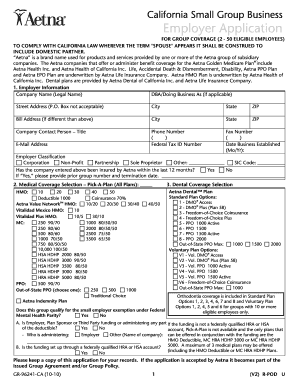

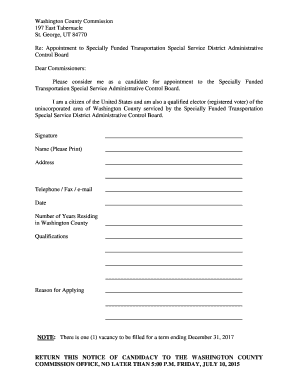

There are several types of certified payroll reports in California that employers may be required to submit. These include:

How to complete certified payroll california

Completing certified payroll reports in California involves the following steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.