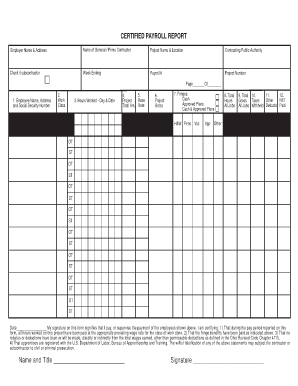

Federal Certified Payroll Form

What is federal certified payroll form?

The federal certified payroll form is a document that employers are required to submit to the government to report detailed information about the wages paid to employees working on federally funded construction projects. It helps to ensure that contractors are paying their workers the appropriate prevailing wages and benefits as mandated by federal regulations.

What are the types of federal certified payroll form?

There are three main types of federal certified payroll forms: 1. WH-347: This form is used for projects under the Davis-Bacon Act and Related Acts, which cover federal construction contracts. 2. SF-1444: This form is used for projects subject to the Service Contract Act (SCA) and is required for all covered service contracts over $2,500. 3. WH-3080: This form is used for projects subject to the Contract Work Hours and Safety Standards Act (CWHSSA) and is required for all covered contracts over $2,500.

How to complete federal certified payroll form

To complete the federal certified payroll form, follow these steps: 1. Gather the necessary information, including the contractor and subcontractor details, project information, and employee data such as names, addresses, and job classifications. 2. Fill in the hours worked by each employee, including the regular and overtime hours. 3. Calculate and input the wages and benefits paid to each employee. 4. Complete any additional sections or provide supporting documentation as required by the specific form. 5. Review the form for accuracy and completeness, making sure all required fields are filled in. 6. Sign and date the form before submitting it to the appropriate government agency.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.