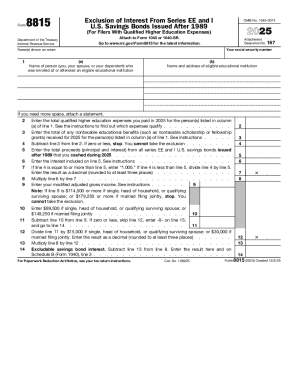

IRS 8815 2020 free printable template

Show details

For purposes of figuring the amount to put on Form 8815 line 9 do not reduce your educator expenses if any by the amount on Form 8815 line 14. 5. Add lines 3 and 4. 6. Subtract line 5 from line 1. Enter the result here and on Form 8815 line 6. Cat. No. 10822S Form 8815 2017 Page 2 Intentionally Left Blank Page 3 General Instructions Section references are to the Internal Revenue Code. Line 6 Worksheet keep a copy for your records 1. Enter the amount from Form 8815 line 5. 2. Enter the face...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 8815

Edit your IRS 8815 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 8815 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 8815 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS 8815. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 8815 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 8815

How to fill out IRS 8815

01

Obtain IRS Form 8815 from the IRS website or your tax professional.

02

Fill out your personal information at the top of the form.

03

Report the amount of your qualified education expenses on line 1.

04

Calculate the qualified expenses for your dependent if applicable.

05

Complete Part II to determine the refundable portion of the credit.

06

Transfer the calculated credit to your Form 1040 or 1040-SR.

Who needs IRS 8815?

01

Individuals who pay for qualified education expenses for themselves, their spouse, or their dependents.

02

Taxpayers seeking to claim the refundable portion of the American Opportunity Credit.

Fill

form

: Try Risk Free

People Also Ask about

How do you avoid taxes on Series EE bonds?

Use the Education Exclusion You can skip paying taxes on interest earned with Series EE and Series I savings bonds if you're using the money to pay for qualified higher education costs. That includes expenses you pay for yourself, your spouse or a qualified dependent.

Is there anything you can do with a mature EE bond without paying taxes?

One way you might avoid owing taxes on the bond interest is to cash your EE or I bonds before maturity and use the proceeds to pay for college. If you meet this set of rules, the interest won't be taxable: You must have acquired the bonds after 1989 when you were at least age 24. The bonds must be in your name only.

How long do EE bonds earn interest after maturity?

Series EE savings bonds are a low-risk way to save money. They earn interest regularly for 30 years (or until you cash them if you do that before 30 years). For EE bonds you buy now, we guarantee that the bond will double in value in 20 years, even if we have to add money at 20 years to make that happen.

Do I pay taxes on I bonds?

You owe tax on the interest the bond earned until it was reissued.

Do I need to report series I bonds on my taxes?

Interest from your bonds goes on your federal income tax return on the same line with other interest income.

Does cashing a bond count as income?

The 1099-INT will only come when someone cashes the bond or the bond matures. The interest will be reported under the name and Social Security Number of the person who cashes the bond or who owns it when it matures. The 1099-INT will include all the interest the bond earned over its lifetime.

Do you have to pay taxes on EE savings bonds?

You owe tax on the interest the bond earned until it was reissued.

Who files Form 8815?

You cashed qualified U.S. savings bonds in 2022 that were issued after 1989. 2. You paid qualified higher education expenses in 2022 for yourself, your spouse, or your dependents.

How can I avoid paying taxes on savings bonds?

You can roll savings bonds into a 529 college savings plan or a Coverdell Education Savings Account (ESA) to avoid taxes. There are some advantages to either approach. With a 529 college savings plan, you can continue saving money on a tax-advantaged basis for higher education.

Do you have to pay taxes on cashed savings bonds?

In general, you must report the interest in income in the taxable year in which you redeemed the bonds to the extent you did not include the interest in income in a prior taxable year.

Are savings bonds reported to IRS?

More about savings bonds The interest earned by purchasing and holding savings bonds is subject to federal tax at the time the bonds are redeemed. However, interest earned on savings bonds is not taxable at the state or local level.

How do I report interest on series EE bonds?

You can report interest income from Series E, EE, and I bonds in one of these ways: Report the interest in the year you earn it. Report the entire amount of interest earned when the bond matures or when you redeem it, whichever comes first.

What to do with EE bonds that have matured?

If your savings bond from a Series other than EE, I, or HH has finished its interest-earning life, you could cash it and use the money for something else – a project, a financial need, or a new investment like an interest-earning savings bond or other Treasury security.

Do you have to report cashing in savings bonds?

In general, you must report the interest in income in the taxable year in which you redeemed the bonds to the extent you did not include the interest in income in a prior taxable year.

How do I avoid paying taxes on Series EE bonds?

Use the Education Exclusion You can skip paying taxes on interest earned with Series EE and Series I savings bonds if you're using the money to pay for qualified higher education costs. That includes expenses you pay for yourself, your spouse or a qualified dependent.

How do I avoid paying taxes on EE bonds?

Use the Education Exclusion You can skip paying taxes on interest earned with Series EE and Series I savings bonds if you're using the money to pay for qualified higher education costs. That includes expenses you pay for yourself, your spouse or a qualified dependent.

Is there a penalty for not cashing in matured EE savings bonds?

There is no penalty if you simply hold onto the bond after five years. There is value in holding onto most bonds. The longer they mature, the more interest bonds earn.

How do I avoid paying taxes on EE savings bonds?

You can skip paying taxes on interest earned with Series EE and Series I savings bonds if you're using the money to pay for qualified higher education costs. That includes expenses you pay for yourself, your spouse or a qualified dependent. Only certain qualified higher education costs are covered, including: Tuition.

What happens to an EE bond after 30 years?

Series EE bonds mature after 20 years. They are sold at half their face value and are worth their full value at maturity. Series I bonds are sold at face value and mature after 30 years. Interest is added monthly to the bond's value.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete IRS 8815 online?

pdfFiller makes it easy to finish and sign IRS 8815 online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I make edits in IRS 8815 without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing IRS 8815 and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I sign the IRS 8815 electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

What is IRS 8815?

IRS Form 8815 is used to claim the interest exclusion for qualified U.S. savings bonds that were issued after 1989 and are being redeemed for education expenses.

Who is required to file IRS 8815?

Individuals who have U.S. savings bond interest that they want to exclude from their taxable income and who use that interest to pay for qualified educational expenses are required to file IRS 8815.

How to fill out IRS 8815?

To fill out IRS 8815, gather information on the U.S. savings bonds, report the interest earned, and provide details regarding the qualified education expenses. Follow the instructions provided on the form for accurate completion.

What is the purpose of IRS 8815?

The purpose of IRS 8815 is to allow taxpayers to exclude from their gross income the interest earned on qualified U.S. savings bonds when used for eligible education expenses.

What information must be reported on IRS 8815?

Taxpayers must report information such as the total amount of interest earned on the qualified U.S. savings bonds, the qualified education expenses paid, and the taxpayer's filing status.

Fill out your IRS 8815 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 8815 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.