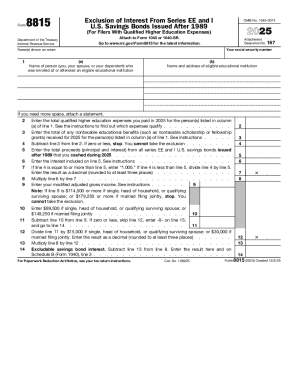

IRS 8815 2021 free printable template

Show details

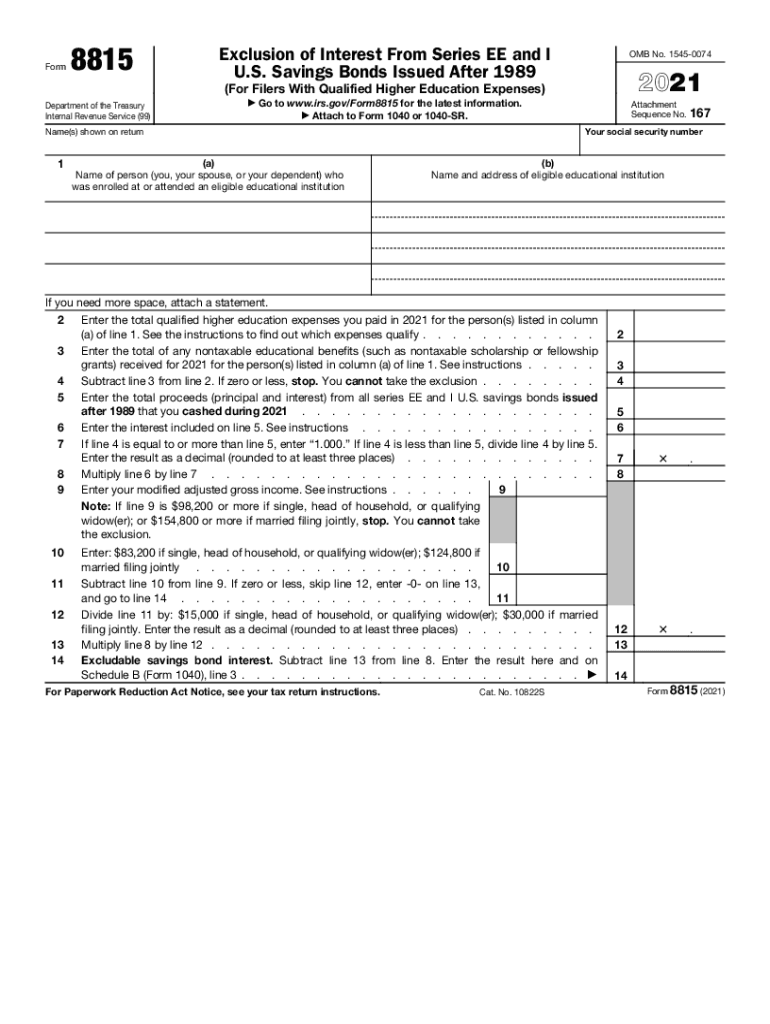

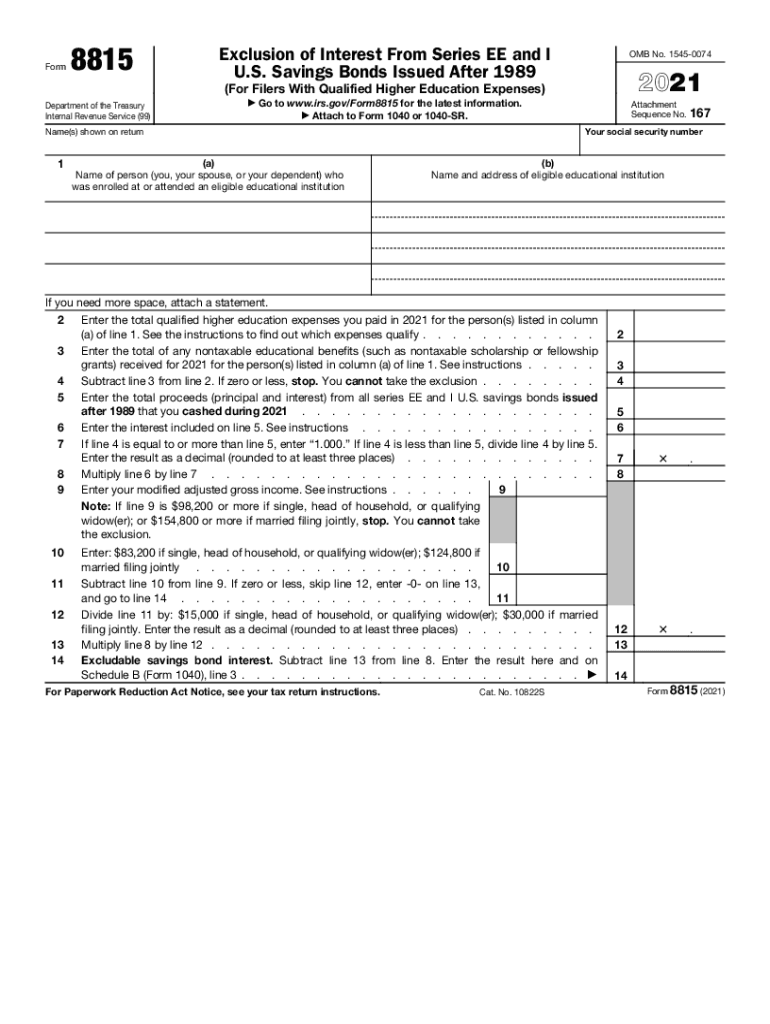

For purposes of figuring the amount to put on Form 8815 line 9 do not reduce your educator expenses if any by the amount on Form 8815 line 14. 5. Add lines 3 and 4. 6. Subtract line 5 from line 1. Enter the result here and on Form 8815 line 6. Cat. No. 10822S Form 8815 2017 Page 2 Intentionally Left Blank Page 3 General Instructions Section references are to the Internal Revenue Code. Line 6 Worksheet keep a copy for your records 1. Enter the amount from Form 8815 line 5. 2. Enter the face...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 8815

Edit your IRS 8815 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 8815 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 8815 online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IRS 8815. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 8815 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 8815

How to fill out IRS 8815

01

Obtain IRS Form 8815 from the IRS website or your tax preparation software.

02

Fill in your personal information at the top of the form, including your name, Social Security number, and filing status.

03

Enter the amount of qualified U.S. savings bonds you are redeeming and the amount of your qualified educational expenses.

04

Complete the calculations to determine the amount of exclusion you are eligible for based on your income.

05

Transfer the final amount to your main tax return as instructed on the form.

Who needs IRS 8815?

01

Taxpayers who have redeemed qualified U.S. savings bonds and are using the proceeds for qualified educational expenses.

02

Individuals who meet the income requirements and are eligible for the interest exclusion on their federal income tax return.

Fill

form

: Try Risk Free

People Also Ask about

How do you avoid taxes on Series EE bonds?

Use the Education Exclusion You can skip paying taxes on interest earned with Series EE and Series I savings bonds if you're using the money to pay for qualified higher education costs. That includes expenses you pay for yourself, your spouse or a qualified dependent.

Is there anything you can do with a mature EE bond without paying taxes?

One way you might avoid owing taxes on the bond interest is to cash your EE or I bonds before maturity and use the proceeds to pay for college. If you meet this set of rules, the interest won't be taxable: You must have acquired the bonds after 1989 when you were at least age 24. The bonds must be in your name only.

How long do EE bonds earn interest after maturity?

Series EE savings bonds are a low-risk way to save money. They earn interest regularly for 30 years (or until you cash them if you do that before 30 years). For EE bonds you buy now, we guarantee that the bond will double in value in 20 years, even if we have to add money at 20 years to make that happen.

Do I pay taxes on I bonds?

You owe tax on the interest the bond earned until it was reissued.

Do I need to report series I bonds on my taxes?

Interest from your bonds goes on your federal income tax return on the same line with other interest income.

Does cashing a bond count as income?

The 1099-INT will only come when someone cashes the bond or the bond matures. The interest will be reported under the name and Social Security Number of the person who cashes the bond or who owns it when it matures. The 1099-INT will include all the interest the bond earned over its lifetime.

Do you have to pay taxes on EE savings bonds?

You owe tax on the interest the bond earned until it was reissued.

Who files Form 8815?

You cashed qualified U.S. savings bonds in 2022 that were issued after 1989. 2. You paid qualified higher education expenses in 2022 for yourself, your spouse, or your dependents.

How can I avoid paying taxes on savings bonds?

You can roll savings bonds into a 529 college savings plan or a Coverdell Education Savings Account (ESA) to avoid taxes. There are some advantages to either approach. With a 529 college savings plan, you can continue saving money on a tax-advantaged basis for higher education.

Do you have to pay taxes on cashed savings bonds?

In general, you must report the interest in income in the taxable year in which you redeemed the bonds to the extent you did not include the interest in income in a prior taxable year.

Are savings bonds reported to IRS?

More about savings bonds The interest earned by purchasing and holding savings bonds is subject to federal tax at the time the bonds are redeemed. However, interest earned on savings bonds is not taxable at the state or local level.

How do I report interest on series EE bonds?

You can report interest income from Series E, EE, and I bonds in one of these ways: Report the interest in the year you earn it. Report the entire amount of interest earned when the bond matures or when you redeem it, whichever comes first.

What to do with EE bonds that have matured?

If your savings bond from a Series other than EE, I, or HH has finished its interest-earning life, you could cash it and use the money for something else – a project, a financial need, or a new investment like an interest-earning savings bond or other Treasury security.

Do you have to report cashing in savings bonds?

In general, you must report the interest in income in the taxable year in which you redeemed the bonds to the extent you did not include the interest in income in a prior taxable year.

How do I avoid paying taxes on Series EE bonds?

Use the Education Exclusion You can skip paying taxes on interest earned with Series EE and Series I savings bonds if you're using the money to pay for qualified higher education costs. That includes expenses you pay for yourself, your spouse or a qualified dependent.

How do I avoid paying taxes on EE bonds?

Use the Education Exclusion You can skip paying taxes on interest earned with Series EE and Series I savings bonds if you're using the money to pay for qualified higher education costs. That includes expenses you pay for yourself, your spouse or a qualified dependent.

Is there a penalty for not cashing in matured EE savings bonds?

There is no penalty if you simply hold onto the bond after five years. There is value in holding onto most bonds. The longer they mature, the more interest bonds earn.

How do I avoid paying taxes on EE savings bonds?

You can skip paying taxes on interest earned with Series EE and Series I savings bonds if you're using the money to pay for qualified higher education costs. That includes expenses you pay for yourself, your spouse or a qualified dependent. Only certain qualified higher education costs are covered, including: Tuition.

What happens to an EE bond after 30 years?

Series EE bonds mature after 20 years. They are sold at half their face value and are worth their full value at maturity. Series I bonds are sold at face value and mature after 30 years. Interest is added monthly to the bond's value.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute IRS 8815 online?

pdfFiller has made filling out and eSigning IRS 8815 easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit IRS 8815 straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit IRS 8815.

How do I fill out the IRS 8815 form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign IRS 8815 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is IRS 8815?

IRS Form 8815 is used by individuals to report the exclusion of certain income earned by children under age 19 or full-time students under age 24 from taxable income.

Who is required to file IRS 8815?

Taxpayers who have children meeting the criteria for filing Form 8815, specifically those claiming the child’s earned income exclusion, are required to file this form if they intend to exclude their child's income.

How to fill out IRS 8815?

To fill out Form 8815, you need to provide information regarding the child's income, your relationship to the child, and other necessary details as specified in the form instructions. Follow the form's step-by-step guide to ensure accurate reporting.

What is the purpose of IRS 8815?

The purpose of IRS Form 8815 is to allow parents to exclude certain unearned income of their children from their own taxable income to potentially reduce their overall tax liability.

What information must be reported on IRS 8815?

On Form 8815, you must report the child's name, Social Security number, the amount of qualifying income, and details about the exclusion being claimed, along with any other pertinent financial information as required.

Fill out your IRS 8815 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 8815 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.