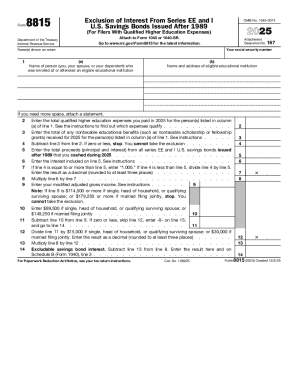

IRS 8815 2023 free printable template

Show details

In previous years. and on Form 8815 line 6. Page 4 Line 9 Follow these steps before you fill in the Line 9 Worksheet below. Cat. No. 10822S. Form 8815 2023 Intentionally Left Blank Page 3 General Instructions Section references are to the Internal Revenue Code. 5. Add lines 3 and 4. 6. Subtract line 5 from line 1. If you did not report any interest in previous years for the savings the result here and on Form 8815 line 6. Enter the amount from line 8 of the worksheet on Form 8815 line 6. If...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 8815

Edit your IRS 8815 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 8815 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 8815 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS 8815. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 8815 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 8815

How to fill out IRS 8815

01

Obtain IRS Form 8815 from the IRS website or a tax preparation software.

02

Fill in your name and Social Security number at the top of the form.

03

Complete Part I by reporting the amount of qualified dividends and capital gain distributions.

04

Proceed to Part II to determine your tax rate based on your taxable income.

05

Calculate the amount of tax using the tax rate for qualified dividends and capital gains.

06

Transfer the calculated tax amount to your main tax return, usually Form 1040.

Who needs IRS 8815?

01

Individuals who have qualified dividends or capital gain distributions and are required to report their tax liability on those earnings.

Fill

form

: Try Risk Free

People Also Ask about

How do you avoid taxes on Series EE bonds?

Use the Education Exclusion You can skip paying taxes on interest earned with Series EE and Series I savings bonds if you're using the money to pay for qualified higher education costs. That includes expenses you pay for yourself, your spouse or a qualified dependent.

Is there anything you can do with a mature EE bond without paying taxes?

One way you might avoid owing taxes on the bond interest is to cash your EE or I bonds before maturity and use the proceeds to pay for college. If you meet this set of rules, the interest won't be taxable: You must have acquired the bonds after 1989 when you were at least age 24. The bonds must be in your name only.

How long do EE bonds earn interest after maturity?

Series EE savings bonds are a low-risk way to save money. They earn interest regularly for 30 years (or until you cash them if you do that before 30 years). For EE bonds you buy now, we guarantee that the bond will double in value in 20 years, even if we have to add money at 20 years to make that happen.

Do I pay taxes on I bonds?

You owe tax on the interest the bond earned until it was reissued.

Do I need to report series I bonds on my taxes?

Interest from your bonds goes on your federal income tax return on the same line with other interest income.

Does cashing a bond count as income?

The 1099-INT will only come when someone cashes the bond or the bond matures. The interest will be reported under the name and Social Security Number of the person who cashes the bond or who owns it when it matures. The 1099-INT will include all the interest the bond earned over its lifetime.

Do you have to pay taxes on EE savings bonds?

You owe tax on the interest the bond earned until it was reissued.

Who files Form 8815?

You cashed qualified U.S. savings bonds in 2022 that were issued after 1989. 2. You paid qualified higher education expenses in 2022 for yourself, your spouse, or your dependents.

How can I avoid paying taxes on savings bonds?

You can roll savings bonds into a 529 college savings plan or a Coverdell Education Savings Account (ESA) to avoid taxes. There are some advantages to either approach. With a 529 college savings plan, you can continue saving money on a tax-advantaged basis for higher education.

Do you have to pay taxes on cashed savings bonds?

In general, you must report the interest in income in the taxable year in which you redeemed the bonds to the extent you did not include the interest in income in a prior taxable year.

Are savings bonds reported to IRS?

More about savings bonds The interest earned by purchasing and holding savings bonds is subject to federal tax at the time the bonds are redeemed. However, interest earned on savings bonds is not taxable at the state or local level.

How do I report interest on series EE bonds?

You can report interest income from Series E, EE, and I bonds in one of these ways: Report the interest in the year you earn it. Report the entire amount of interest earned when the bond matures or when you redeem it, whichever comes first.

What to do with EE bonds that have matured?

If your savings bond from a Series other than EE, I, or HH has finished its interest-earning life, you could cash it and use the money for something else – a project, a financial need, or a new investment like an interest-earning savings bond or other Treasury security.

Do you have to report cashing in savings bonds?

In general, you must report the interest in income in the taxable year in which you redeemed the bonds to the extent you did not include the interest in income in a prior taxable year.

How do I avoid paying taxes on Series EE bonds?

Use the Education Exclusion You can skip paying taxes on interest earned with Series EE and Series I savings bonds if you're using the money to pay for qualified higher education costs. That includes expenses you pay for yourself, your spouse or a qualified dependent.

How do I avoid paying taxes on EE bonds?

Use the Education Exclusion You can skip paying taxes on interest earned with Series EE and Series I savings bonds if you're using the money to pay for qualified higher education costs. That includes expenses you pay for yourself, your spouse or a qualified dependent.

Is there a penalty for not cashing in matured EE savings bonds?

There is no penalty if you simply hold onto the bond after five years. There is value in holding onto most bonds. The longer they mature, the more interest bonds earn.

How do I avoid paying taxes on EE savings bonds?

You can skip paying taxes on interest earned with Series EE and Series I savings bonds if you're using the money to pay for qualified higher education costs. That includes expenses you pay for yourself, your spouse or a qualified dependent. Only certain qualified higher education costs are covered, including: Tuition.

What happens to an EE bond after 30 years?

Series EE bonds mature after 20 years. They are sold at half their face value and are worth their full value at maturity. Series I bonds are sold at face value and mature after 30 years. Interest is added monthly to the bond's value.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify IRS 8815 without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your IRS 8815 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I create an electronic signature for signing my IRS 8815 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your IRS 8815 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I complete IRS 8815 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your IRS 8815 from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is IRS 8815?

IRS Form 8815 is a tax form used by individuals to calculate the amount of their taxable social security benefits.

Who is required to file IRS 8815?

Taxpayers who receive social security benefits and meet certain income thresholds are required to file IRS Form 8815.

How to fill out IRS 8815?

To fill out IRS Form 8815, gather your total social security benefits and other income, then follow the instructions on the form to calculate your taxable benefits based on your filing status.

What is the purpose of IRS 8815?

The purpose of IRS Form 8815 is to determine the amount of social security benefits that are subject to federal income tax.

What information must be reported on IRS 8815?

IRS Form 8815 requires reporting of total social security benefits received, any other income, and calculation of the taxable portion of the social security benefits.

Fill out your IRS 8815 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 8815 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.