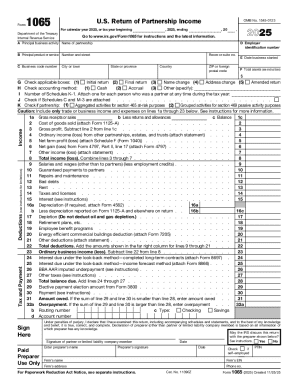

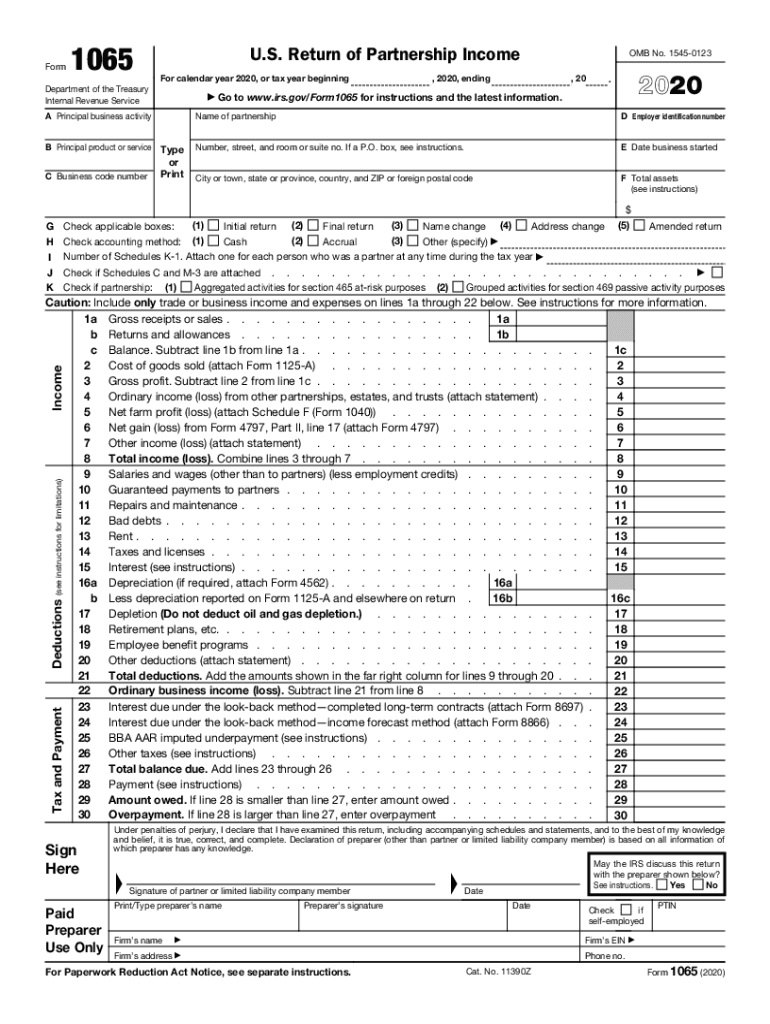

IRS 1065 2020 free printable template

Instructions and Help about IRS 1065

How to edit IRS 1065

How to fill out IRS 1065

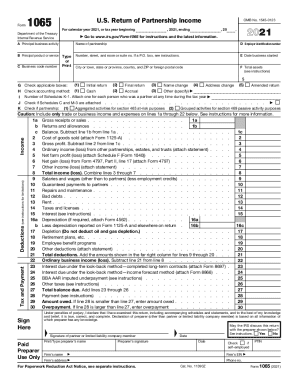

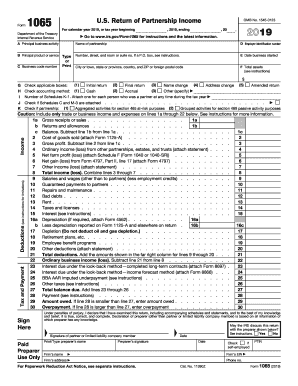

About IRS previous version

What is IRS 1065?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1065

What should I do if I discover a mistake after submitting IRS 1065?

If you find an error on your IRS 1065 form after submission, you can file an amended return using Form 1065X. This allows you to correct the mistakes and ensure your tax records are accurate. It's important to act promptly to minimize any potential penalties or issues.

How can I verify the status of my submitted IRS 1065?

To track the status of your submitted IRS 1065, you can utilize the IRS online services, which provide insights into your filing status. Additionally, retain any acknowledgement receipt if you filed electronically, as it confirms submission and can help address any processing issues.

What are some common errors to avoid when submitting IRS 1065?

Common errors when submitting IRS 1065 include incorrect taxpayer identification numbers and failing to sign the form. Ensuring all financial data is accurate and thoroughly reviewing the form before submission can help prevent these mistakes and avoid processing delays.

What should I do if I receive a notice from the IRS after submitting my IRS 1065?

If you receive a notice from the IRS following your submission of IRS 1065, it is crucial to read the notice carefully and understand the action required. Gather any requested documentation and respond promptly to avoid further complications or penalties.

Are there special considerations for e-filing IRS 1065 on behalf of someone else?

When e-filing IRS 1065 for someone else, ensure you have the proper power of attorney (POA) documentation in place. It is also necessary to file using the accurate taxpayer information and be mindful of privacy and security measures required for handling someone else's financial data.

See what our users say