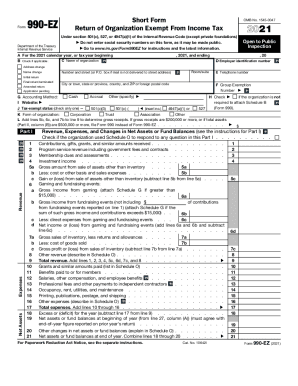

IRS 990-EZ 2020 free printable template

Show details

Click on the question mark icons to display help windows.

The information provided will enable you to file a more complete return and reduce the chances the IRS will need to contact you. Form990EZShort

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 990-EZ

How to edit IRS 990-EZ

How to fill out IRS 990-EZ

Instructions and Help about IRS 990-EZ

How to edit IRS 990-EZ

To edit IRS 990-EZ, first ensure you have a copy of the form. You can fill it out electronically using platforms like pdfFiller that allow for straightforward editing. Once opened, make the necessary changes directly on the form before saving or submitting it. Be cautious to maintain the accuracy of your data when making edits.

How to fill out IRS 990-EZ

Filling out IRS 990-EZ requires detailed attention to the sections provided. Start by gathering all necessary financial documents and information pertinent to your organization. Follow these steps:

01

Review each section of the form to understand what information is required.

02

Fill in your organization’s identifying information, including its name, address, and Employer Identification Number (EIN).

03

Report the organization’s financial activities accurately in the income and expense sections.

04

Complete the statements or schedules that apply to your organization. Ensure all entries are coherent and consistent.

After completing the form, double-check all entries for accuracy to avoid penalties. It's advisable to have someone else review the form before submission.

About IRS 990-EZ 2020 previous version

What is IRS 990-EZ?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 990-EZ 2020 previous version

What is IRS 990-EZ?

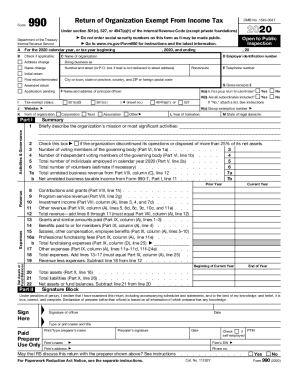

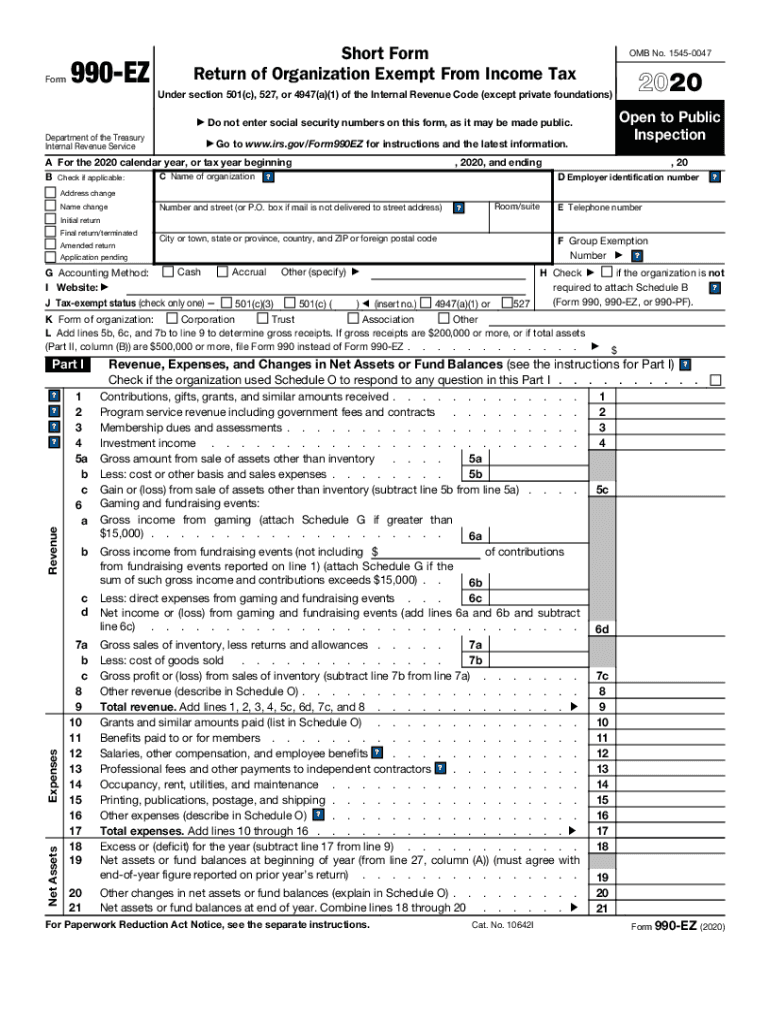

IRS 990-EZ is a tax form utilized by small to mid-sized tax-exempt organizations in the United States. It is a simplified version of Form 990, designed to provide the IRS with financial information about the organization's activities, governance, and programs.

What is the purpose of this form?

The purpose of IRS 990-EZ is to report the financial status of exempt organizations while ensuring compliance with federal tax laws. This form aids the IRS in verifying that tax-exempt organizations operate in accordance with the regulations and do not engage in profit-driven activities.

Who needs the form?

Tax-exempt organizations with gross receipts of less than $200,000 and total assets under $500,000 are generally required to file IRS 990-EZ. This includes charities, nonprofit organizations, and certain educational institutions that meet the specified criteria.

When am I exempt from filling out this form?

Organizations may be exempt from filing IRS 990-EZ if they fall under specific categories, such as churches, certain federally recognized tribes, or organizations with very minimal financial activity. It is important to confirm eligibility based on the current IRS guidelines.

Components of the form

IRS 990-EZ consists of various components, including basic identifying information, financial summaries of revenue and expenses, and specific schedules that collect information regarding the organization's activities. Each component must be completed accurately to ensure compliance.

Due date

The due date for filing IRS 990-EZ is the 15th day of the 5th month after the end of the organization’s accounting period. If an extension is necessary, Form 8868 can be filed to request additional time to submit your forms.

What payments and purchases are reported?

IRS 990-EZ requires reporting on specific financial activities, including total revenue, contributions, grants, and any other receipts. Additionally, it includes information on expenses related to program services, management, and fundraising.

How many copies of the form should I complete?

Generally, organizations should complete one copy of IRS 990-EZ for submission to the IRS. However, it is advisable to keep a copy for your records. If the organization has state reporting obligations, it may also need to send copies to state tax authorities.

What are the penalties for not issuing the form?

Failing to file IRS 990-EZ can result in significant penalties, including monetary fines and the potential loss of tax-exempt status. Organizations are advised to be diligent in complying with filing requirements to avoid these consequences.

What information do you need when you file the form?

When filing IRS 990-EZ, you need the organization’s name, address, EIN, a breakdown of revenue and expenses, and additional schedules that may apply to the organization’s specific activities. Having this information organized before starting the filing process can expedite completion.

Is the form accompanied by other forms?

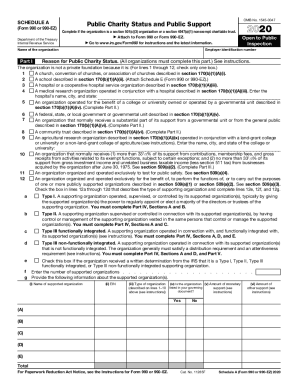

IRS 990-EZ may need to be accompanied by additional forms or schedules, such as Schedule A for public charity status or Schedule B for reporting contributors. Always verify which additional schedules may be required based on your organization’s activities.

Where do I send the form?

IRS 990-EZ should be mailed to the appropriate IRS address based on the organization’s location and the method of submission. Refer to the IRS Form 990-EZ instructions for the correct mailing address.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Easy to use and the confirmation of reciept when sending a document via email is perfect for sending important documents

allowed me to come back to edit easily, but did not see a e-file or address yet. Thank you

See what our users say