IRS W-9 2007 free printable template

Show details

The documentation contained within our Supplier Application is designed to help us to ... The Supplier Agreement must be dated and the Supplier×39’s address filled in. ... 12, Completed W-9 (Click

pdfFiller is not affiliated with IRS

Instructions and Help about IRS W-9

How to edit IRS W-9

How to fill out IRS W-9

Instructions and Help about IRS W-9

How to edit IRS W-9

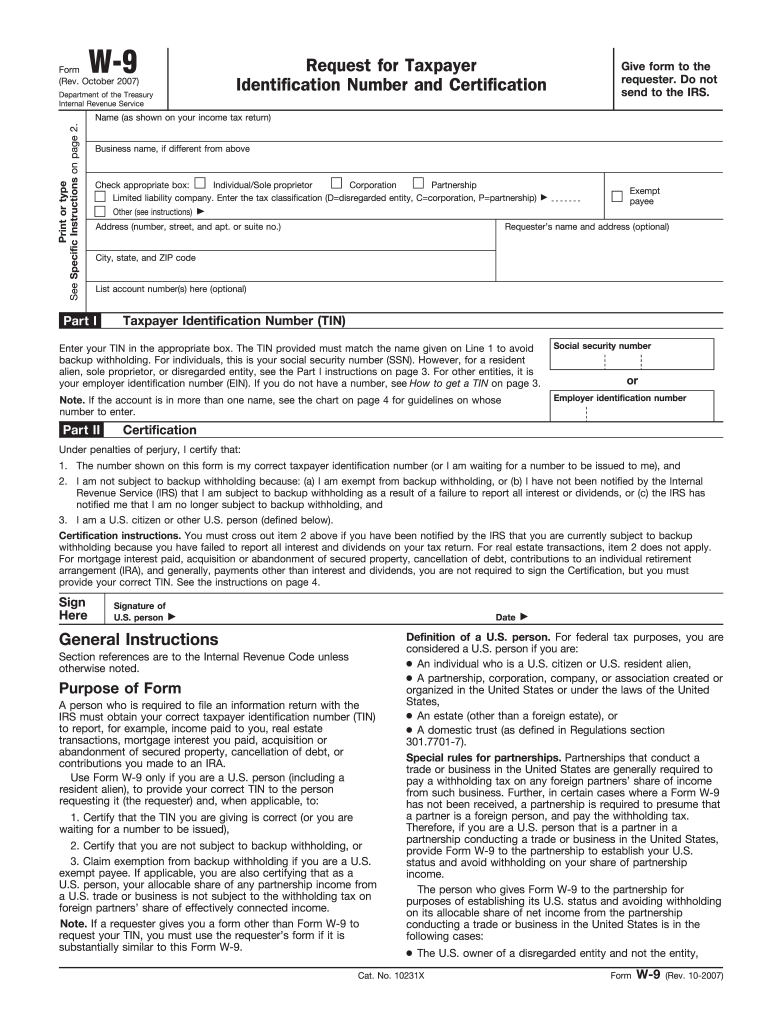

Edit the IRS W-9 form by accessing a PDF editing tool, such as pdfFiller, which allows you to insert or modify the required information online. Start by uploading the form into the tool, where you can directly type or use fillable fields to complete your entries. Once you have made the necessary changes, you can save or print the updated form directly. Ensure all information is accurate before finalizing.

Common editing features include adding text, signing the document, and storing it securely for later use. This can simplify the process of filing the form and ensure compliance with IRS regulations.

How to fill out IRS W-9

Fill out the IRS W-9 form by following these steps:

01

Download the form from an official IRS source or an authorized PDF editing tool.

02

Provide your name as it appears on your tax return in Part I.

03

Enter your business name if applicable.

04

Select your tax classification, such as individual, corporation, or partnership.

05

Fill out your address, city, state, and ZIP code.

06

Supply your taxpayer identification number (TIN), either your Social Security number (SSN) or Employer Identification Number (EIN).

07

Sign and date the form at the bottom of Part II.

Ensure clarity and accuracy, as errors may delay processing or result in tax penalties. After filling out the form, it should be submitted to the requester, not the IRS.

About IRS W-9 2007 previous version

What is IRS W-9?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS W-9 2007 previous version

What is IRS W-9?

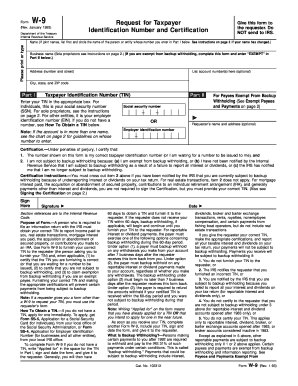

The IRS W-9 form is a Request for Taxpayer Identification Number and Certification. It is primarily used by individuals and businesses to provide their correct TIN to entities that are required to file information returns with the IRS. This includes income paid to independent contractors and freelancers.

What is the purpose of this form?

The purpose of the IRS W-9 form is to certify a taxpayer's TIN and to provide other relevant information to companies or organizations that need this data to correctly report payments made to the individual or entity on a Form 1099. Correct completion helps to ensure compliance with tax laws and facilitates accurate tax reporting.

Who needs the form?

Individuals, sole proprietors, and entities receiving certain types of income need to fill out the W-9 form. This includes independent contractors, freelancers, and businesses that perform services for others and need to declare their earnings for tax purposes. If you receive payments that require a Form 1099, you will generally be asked to complete this form.

When am I exempt from filling out this form?

You may be exempt from filling out the IRS W-9 if you are a corporation or an exempt payee as defined by IRS guidelines. Exempt payees may include certain government entities, educational institutions, or non-profit organizations under specific conditions. Always check the IRS guidelines to determine eligibility for exemption.

Components of the form

The IRS W-9 form consists of several key components: the taxpayer's name, business name (if applicable), address, TIN, and a certification section. It also includes instructions for filling out the form correctly, explaining each part’s significance and verifying your TIN's accuracy to prevent penalties.

What are the penalties for not issuing the form?

Failing to issue the W-9 form when required can result in penalties imposed by the IRS. Payors may be subject to backup withholding at a rate determined by the IRS, currently set at 24%. This withholding is applied to payments made to individuals or entities that do not provide a valid TIN when requested.

Not submitting the form or providing false information may also lead to further legal ramifications, including fines or additional tax liabilities.

What information do you need when you file the form?

When filing the IRS W-9 form, you need to provide your name, business name (if applicable), address, TIN (which can be your SSN or EIN), and certification that the information provided is correct. Ensuring accurate information submission is critical to avoid delays or issues with tax reporting.

Is the form accompanied by other forms?

The IRS W-9 form is typically not submitted to the IRS but is provided to entities that request it. It is essential, however, for those who receive compensation that requires a Form 1099, as the W-9 serves as the base documentation for tax reporting. In some cases, the W-9 may accompany additional IRS forms (like Form 1099) during tax filing by the payor.

Where do I send the form?

Send the completed IRS W-9 form to the requester, usually an employer or a business that has hired you as a contractor. They will retain the W-9 for their records and use the information to complete their reporting requirements, such as filing Form 1099 with the IRS.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

It's simple to use and I can easily find my saved docs.

My experience with PDFfiller has been excellent.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.