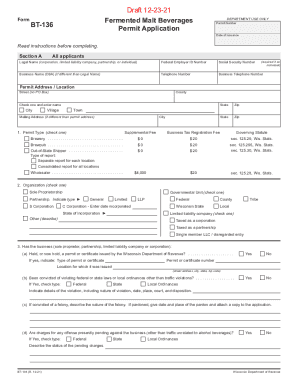

WI DoR BT-136 2012 free printable template

Show details

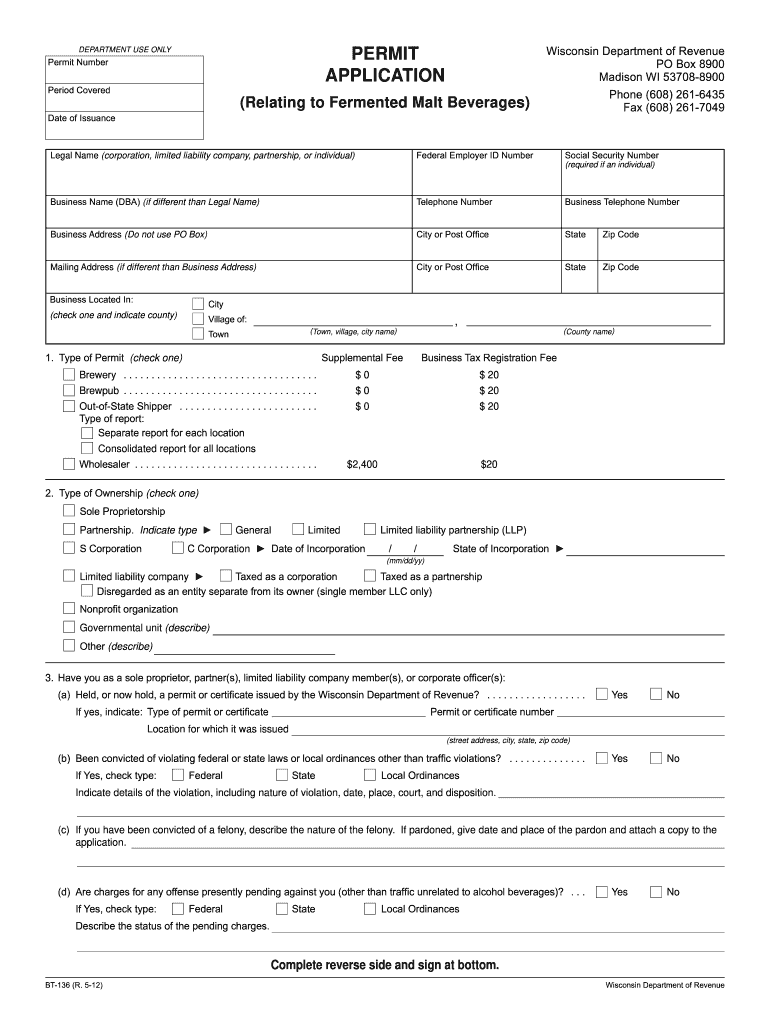

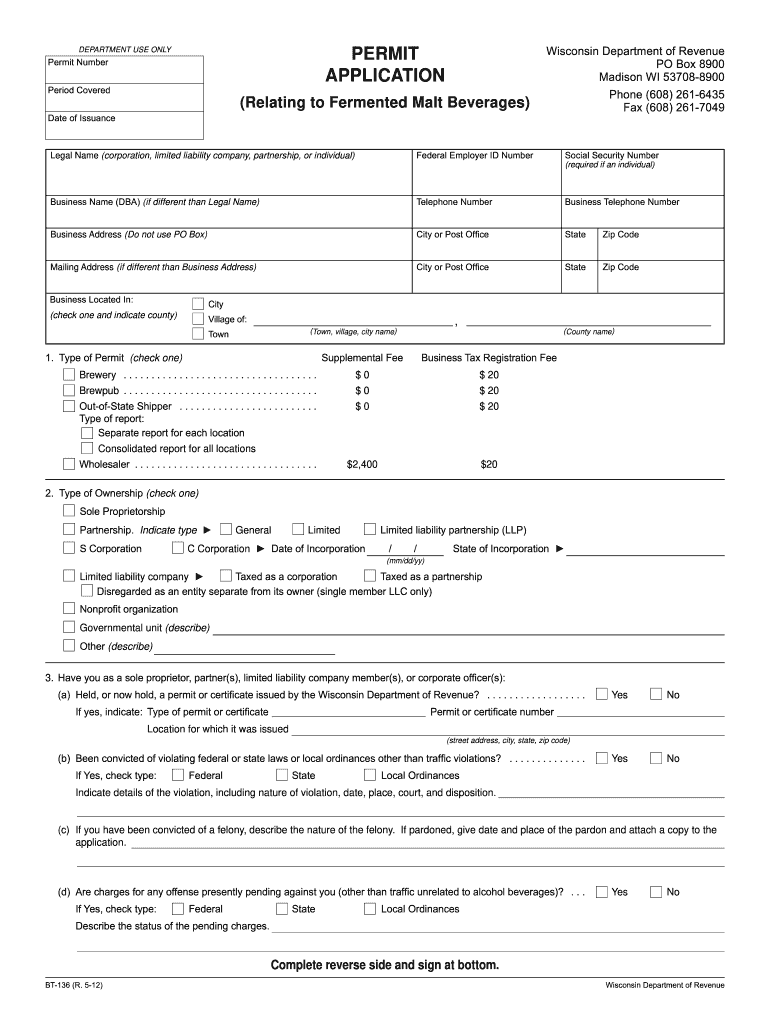

Instructions DEPARTMENT USE ONLY Tab to navigate within form. Use mouse, press space bar or press Enter, to check applicable boxes. Save Print Clear Permit Number Period Covered Date of Issuance PERMIT

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WI DoR BT-136

Edit your WI DoR BT-136 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WI DoR BT-136 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing WI DoR BT-136 online

To use our professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit WI DoR BT-136. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI DoR BT-136 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WI DoR BT-136

How to fill out WI DoR BT-136

01

Obtain the WI DoR BT-136 form from the official Wisconsin Department of Revenue website.

02

Fill in your name and contact information at the top of the form.

03

Provide your Social Security Number or Federal Employer Identification Number (EIN).

04

Complete the relevant sections pertaining to your business or personal situation.

05

Indicate the tax period for which you are filing or reporting.

06

Detail any deductions, credits, or payments you are claiming.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form before submitting it to the Wisconsin Department of Revenue.

Who needs WI DoR BT-136?

01

Individuals or businesses who need to report income taxes in Wisconsin.

02

Taxpayers claiming certain deductions or credits associated with their tax returns.

03

Those required to file state tax forms for specific tax periods.

Fill

form

: Try Risk Free

People Also Ask about

What time do Class B fermented malt beverage in Class B liquor license establishments need to close on New Year's Eve per Wisconsin law?

Between 12 midnight and 6 a.m., no person may sell fermented malt beverages on Class B licensed premises in an original unopened package, container or bottle or for consumption away from the premises.

Can you bartend without a license in Wisconsin?

Bartenders are subject to legal requirements that govern the alcohol industry. In Wisconsin, applying and obtaining a bartender license is required.

How hard is it to get a liquor license in Wisconsin?

You must meet several requirements to apply for liquor licenses. You must be over the age of 21, you must have lived in Wisconsin for at least 90 days at the time of application, must have a seller's permit from the Wisconsin Department of Revenue, and must complete a server's training course.

How much is a liquor license in Wisconsin for a bar?

Alcohol Beverage Licenses License TypeAnnual FeeRetail "Class A" Intoxicating Liquor License$350.00Retail "Class B" Intoxicating Liquor License$400.00Class "A" Beer License$75.00Class "B" Beer License$100.004 more rows

Can you get a bartending license in Wisconsin with a DUI?

Wisconsin's Fair Employment Law prohibits the denial of a license based on a pending arrest or conviction record unless the record substantially relates to the licensing activity. The applicant must have successfully completed an approved responsible beverage server training course.

How do I renew my Wisconsin bartending license?

How To Renew Bartending License. A Wisconsin alcohol seller server certificate is valid for 2 years. If you need to renew your Wisconsin bartender license, you do need to retake the course. If you used us previously, the next time through will be a breeze.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send WI DoR BT-136 for eSignature?

When you're ready to share your WI DoR BT-136, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I create an electronic signature for signing my WI DoR BT-136 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your WI DoR BT-136 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I fill out the WI DoR BT-136 form on my smartphone?

Use the pdfFiller mobile app to complete and sign WI DoR BT-136 on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is WI DoR BT-136?

WI DoR BT-136 is a tax form used by businesses in Wisconsin to report their income and calculate their tax liabilities.

Who is required to file WI DoR BT-136?

Businesses operating in Wisconsin that are subject to state income tax must file WI DoR BT-136.

How to fill out WI DoR BT-136?

To fill out WI DoR BT-136, businesses need to provide information about their income, deductions, and credits, ensuring all fields are accurately completed according to the instructions provided by the Wisconsin Department of Revenue.

What is the purpose of WI DoR BT-136?

The purpose of WI DoR BT-136 is to assist the Wisconsin Department of Revenue in assessing the tax obligations of businesses in the state.

What information must be reported on WI DoR BT-136?

WI DoR BT-136 requires reporting of total income, allowable deductions, tax credits, and other relevant financial data related to the business's operations.

Fill out your WI DoR BT-136 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WI DoR BT-136 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.