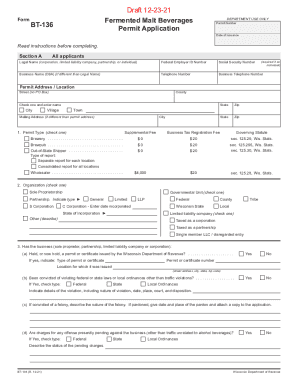

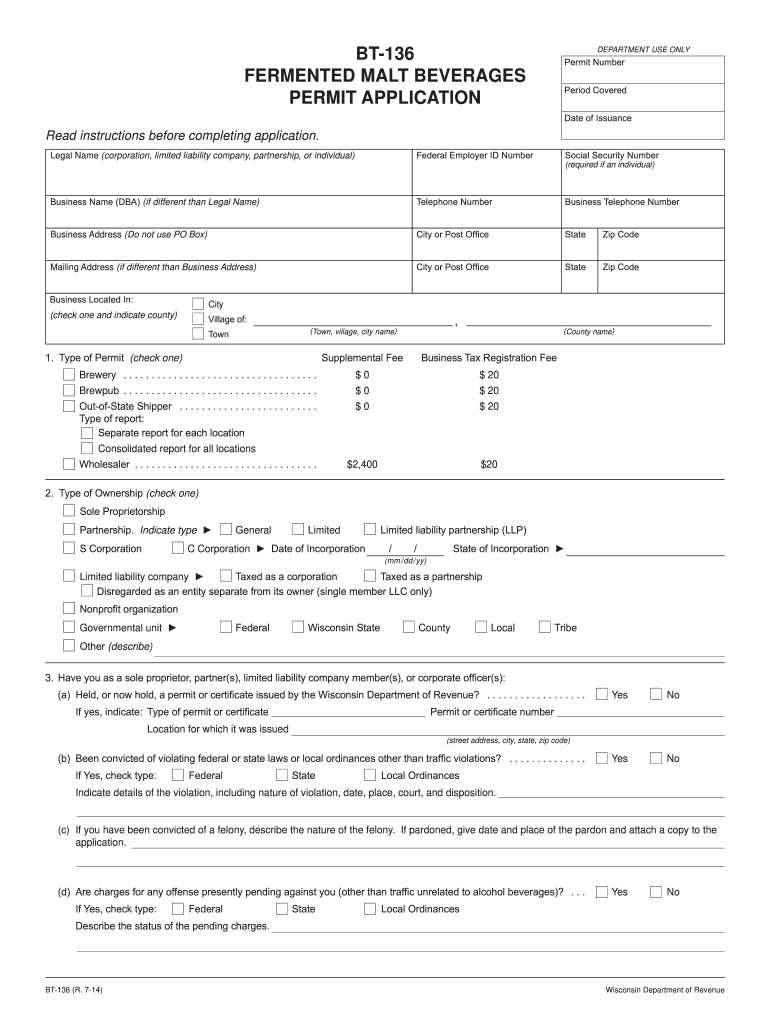

WI DoR BT-136 2014 free printable template

Show details

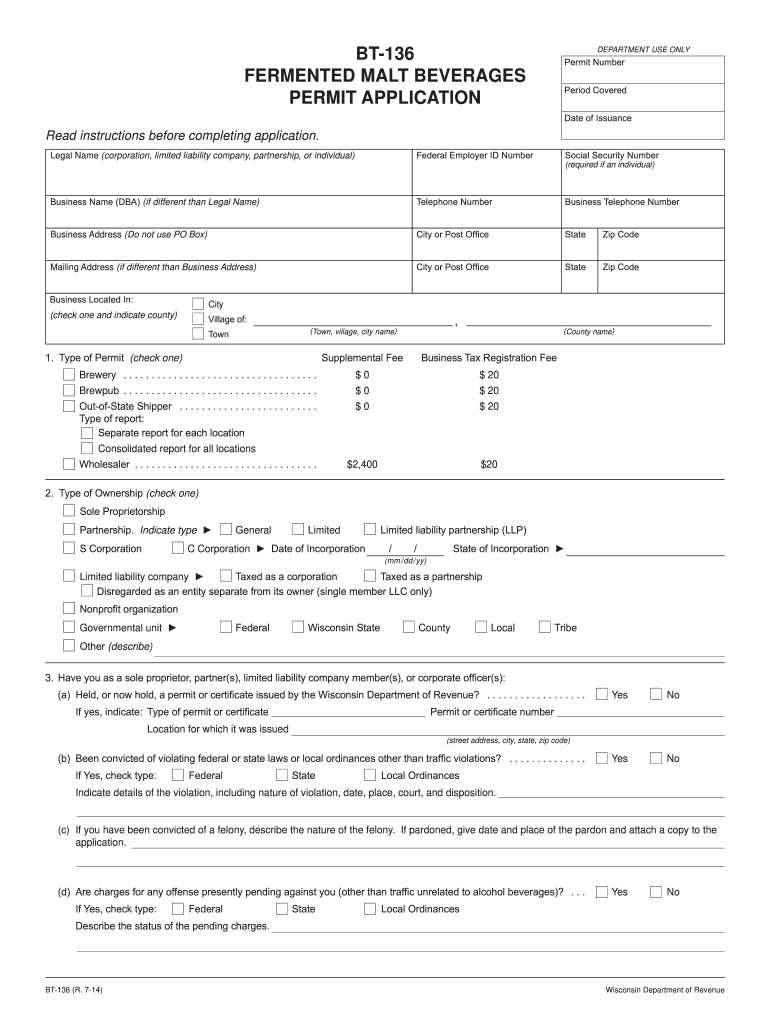

BT-136 (R. 8-16). Wisconsin Department ... BT-136. FERMENTED MALT BEVERAGES. PERMIT APPLICATION. DEPARTMENT ..... Form available at: revenue.wi.gov/forms/misc/a-222.pdf. Responsibilities of a ....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WI DoR BT-136

Edit your WI DoR BT-136 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WI DoR BT-136 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit WI DoR BT-136 online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit WI DoR BT-136. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI DoR BT-136 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WI DoR BT-136

How to fill out WI DoR BT-136

01

Obtain the WI DoR BT-136 form from the Wisconsin Department of Revenue website.

02

Fill in the identification section with your name, address, and social security number.

03

Specify the tax period for which you are filing the form.

04

Provide details of your income, including wages, business income, and any other sources of income.

05

List any deductions you may qualify for, such as educator expenses or student loan interest.

06

Complete the sections for credits and payments made.

07

Calculate your total tax due or refund amount based on the information provided.

08

Review the form for accuracy and completeness.

09

Sign and date the form at the bottom.

10

Submit the completed form according to the instructions provided (either by mail or electronically).

Who needs WI DoR BT-136?

01

Individuals or businesses residing in or doing business in Wisconsin who need to report their income for tax purposes.

02

Taxpayers who are eligible for tax deductions or credits in Wisconsin.

03

Those who are required by law to file a state tax return.

Fill

form

: Try Risk Free

People Also Ask about

How to open a bar in Wisconsin?

The basic qualifications are: You must be of legal drinking age (21) You must have resided continuously in Wisconsin for at least 90 days prior to the application date. You must have a seller's permit issued by the Department of Revenue. Call (608) 266‑2776 or use the department's Business Tax Online Registration.

What time do Class B fermented malt beverage and Class B liquor licensed establishments need to close on New Year's Eve per Wisconsin law?

Between 12 midnight and 6 a.m., no person may sell fermented malt beverages on Class B licensed premises in an original unopened package, container or bottle or for consumption away from the premises.

What time can I buy alcohol in Wisconsin?

Retail sale of alcohol State law prohibits retail sale of liquor and wine between 9:00 p.m. and 6:00 a.m., and beer between midnight and 6:00 a.m. State law allows local municipalities to further restrict retail sales of alcohol, or ban the issuance of retail liquor licenses altogether.

Who should be on premises at all times during business hours in Wisconsin?

The licensee, the agent named on the license (if a corporation), or a person with an operator's license must be on the premises unless all alcohol beverages are in locked storage. The licensee must notify the local law enforcement agency, in advance, of when underage persons will be on the premises (sec.

What does fermented malt beverage mean?

NOTE: In order for a brewery product to fall within the definition of a “malt beverage” under the FAA Act, it must be a fermented beverage made from both malted barley and hops, or their parts, or their products.

What time do Class B liquor licensed establishments need to close on New Years Eve per Wisconsin law?

How late can I sell packaged beer, wine, and liquor for carryout from my tavern or restaurant? Class "B" (beer) or "Class B" (intoxicating liquor, including wine) licensees must stop selling packaged beer, wine, and liquor at midnight.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit WI DoR BT-136 online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your WI DoR BT-136 and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I edit WI DoR BT-136 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign WI DoR BT-136 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I fill out WI DoR BT-136 on an Android device?

Use the pdfFiller app for Android to finish your WI DoR BT-136. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is WI DoR BT-136?

WI DoR BT-136 is a tax form used in Wisconsin for reporting certain business tax information.

Who is required to file WI DoR BT-136?

Businesses operating in Wisconsin that meet specific criteria related to tax obligations are required to file WI DoR BT-136.

How to fill out WI DoR BT-136?

To fill out WI DoR BT-136, businesses should gather necessary financial information, complete the form by following the provided instructions, and ensure all required data is accurately reported.

What is the purpose of WI DoR BT-136?

The purpose of WI DoR BT-136 is to collect information for tax assessment purposes and to ensure compliance with state tax laws.

What information must be reported on WI DoR BT-136?

WI DoR BT-136 requires reporting on income, deductions, credits, and other relevant financial data pertaining to the business's operations.

Fill out your WI DoR BT-136 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WI DoR BT-136 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.