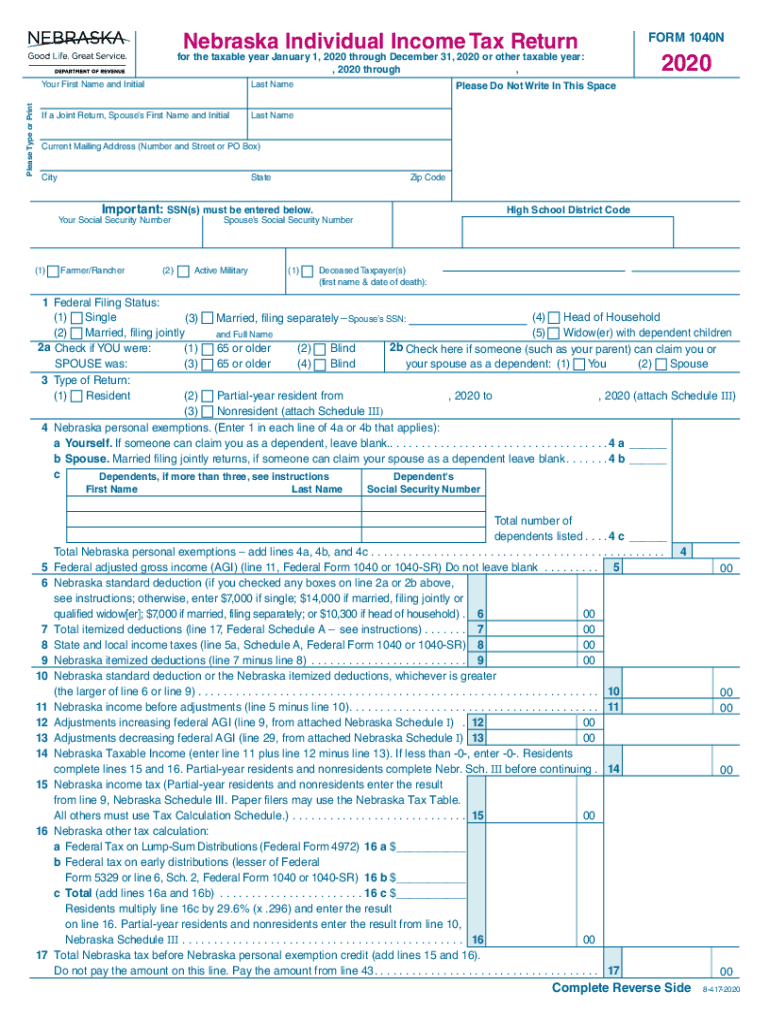

NE Individual Income Tax Booklet 2020 free printable template

Show details

2020

Nebraska

Individual Income Tax BookletEfile your return. More info... It is the fast, secure, and easy way to file!

Defile offers FREE filing of your state return.

All taxpayers can use the Fed/State

pdfFiller is not affiliated with any government organization

Instructions and Help about NE Individual Income Tax Booklet

How to edit NE Individual Income Tax Booklet

How to fill out NE Individual Income Tax Booklet

Instructions and Help about NE Individual Income Tax Booklet

How to edit NE Individual Income Tax Booklet

To edit the NE Individual Income Tax Booklet, you can use pdfFiller’s editing tools, which allow you to update your information directly on the PDF form. Begin by uploading the booklet to the platform, where you can then fill in personal details, adjust any incorrect entries, and make necessary changes to ensure accuracy before submission.

How to fill out NE Individual Income Tax Booklet

Filling out the NE Individual Income Tax Booklet involves understanding the various sections where you input personal and financial information. Follow these steps:

01

Obtain the latest version of the NE Individual Income Tax Booklet.

02

Gather all necessary documentation, including your W-2 forms, 1099 forms, and any other income records.

03

Begin with your personal identification information, including your Social Security number and filing status.

04

Report total income on the applicable lines provided.

05

Claim any deductions or credits and calculate your tax liability.

About NE Individual Income Tax Booklet 2020 previous version

What is NE Individual Income Tax Booklet?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About NE Individual Income Tax Booklet 2020 previous version

What is NE Individual Income Tax Booklet?

The NE Individual Income Tax Booklet is a tax form used by individuals in Nebraska to report their income and calculate their state income tax liability. This form is essential for ensuring compliance with state tax laws and includes detailed instructions on how to accurately report taxable income, claim deductions, and apply for credits.

What is the purpose of this form?

The primary purpose of the NE Individual Income Tax Booklet is to provide a structured format for taxpayers to report their financial information for the tax year. It enables the state government to assess the tax owed by each individual and ensures that taxpayers are adhering to Nebraska’s tax regulations, facilitating the proper collection of revenue.

Who needs the form?

All individuals who reside in Nebraska and earn income must use the NE Individual Income Tax Booklet to file their state taxes. This includes employees, self-employed individuals, and those who earn income through investments, rentals, or other sources. Exceptions may apply for very low-income filers, who may not be required to file.

When am I exempt from filling out this form?

You may be exempt from filling out the NE Individual Income Tax Booklet if your income falls below the state’s minimum tax filing threshold. In addition, taxpayers who are claimed as dependents on another's tax return and those who meet specific criteria related to age or disability may also qualify for exemptions.

Components of the form

The NE Individual Income Tax Booklet consists of several key components including:

01

Taxpayer identification information.

02

Income reporting section.

03

Deductions and credits section.

04

Tax calculations and payment details.

Each section must be filled out accurately to ensure correct tax assessment and compliance.

What are the penalties for not issuing the form?

Failure to file the NE Individual Income Tax Booklet by the due date can result in penalties imposed by the state. These penalties may include fines and interest on any unpaid tax balance. Additionally, prolonged non-compliance could lead to more severe actions, such as tax liens or garnishments on wages.

What information do you need when you file the form?

When filing the NE Individual Income Tax Booklet, you will need several pieces of information, including:

01

Your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

02

Total income information from W-2s and 1099s.

03

Details on any deductions or credits you are eligible to claim.

04

Bank account information if you choose direct deposit for any tax refund.

Is the form accompanied by other forms?

Yes, the NE Individual Income Tax Booklet may be accompanied by other forms, depending on your specific tax situation. For example, if you are claiming certain credits or reporting specific types of income, supplementary schedules or additional forms may be required.

Where do I send the form?

You must send the completed NE Individual Income Tax Booklet to the Nebraska Department of Revenue. The mailing address can be found in the instructions section of the booklet or on the Nebraska Department of Revenue's official website. Ensure it is sent to the correct address based on your jurisdiction to avoid processing delays.

See what our users say