NE Individual Income Tax Booklet 2023 free printable template

Show details

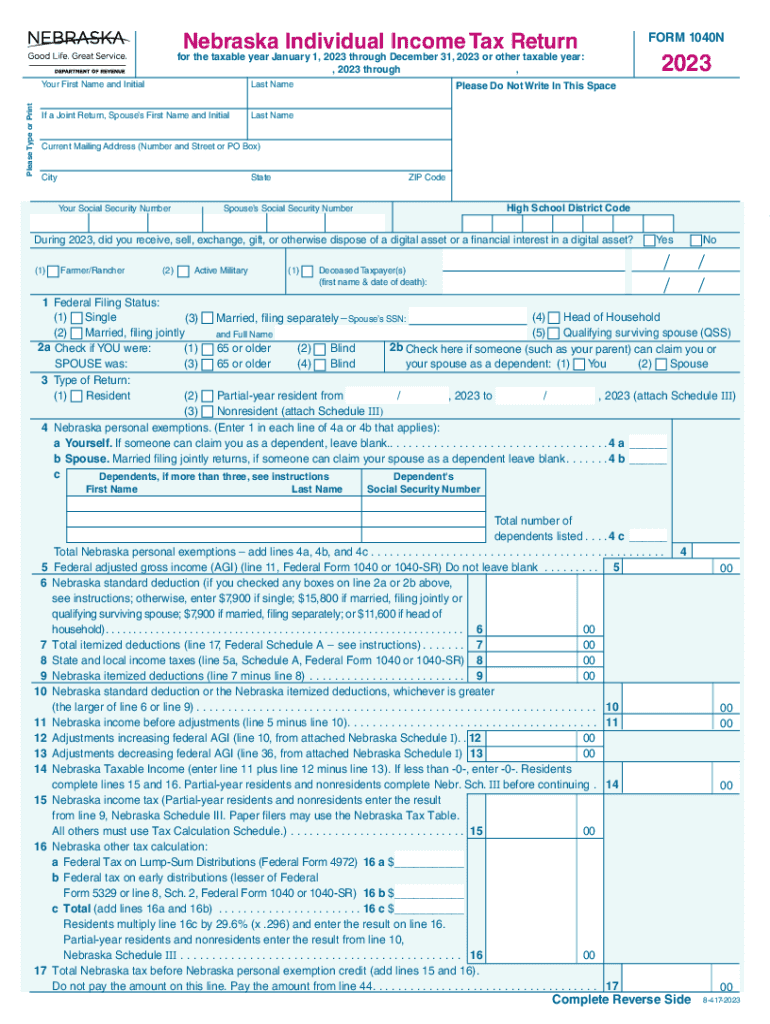

2023 Nebraska Individual Income Tax Booklet For tax years 2023 and after, the income tax forms and instructions will not be mailed and may be obtained from FOR\'s website. Efile your return. Defile

pdfFiller is not affiliated with any government organization

Instructions and Help about NE Individual Income Tax Booklet

How to edit NE Individual Income Tax Booklet

How to fill out NE Individual Income Tax Booklet

Instructions and Help about NE Individual Income Tax Booklet

How to edit NE Individual Income Tax Booklet

Editing the NE Individual Income Tax Booklet can be accomplished using pdfFiller's tools, allowing you to make adjustments to your tax information before submission. You can upload a scanned copy of the form, edit the fields directly on the platform, and ensure all data is accurate and formatted correctly. To enhance clarity, make sure to use consistent terminology throughout.

How to fill out NE Individual Income Tax Booklet

Filling out the NE Individual Income Tax Booklet requires careful attention to the provided instructions. Start by gathering essential documents such as your W-2 forms, 1099 forms, and any other income statements. The form typically includes various sections where personal information, income details, and deductions must be entered. Carefully follow the prompts and fill in each section to ensure accuracy.

About NE Individual Income Tax Booklet 2023 previous version

What is NE Individual Income Tax Booklet?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About NE Individual Income Tax Booklet 2023 previous version

What is NE Individual Income Tax Booklet?

NE Individual Income Tax Booklet is the official tax form used by Nebraska residents to report personal income, calculate tax liabilities, and determine eligibility for various deductions and credits. This form is crucial for ensuring compliance with state income tax laws and is typically filed annually.

What is the purpose of this form?

The purpose of the NE Individual Income Tax Booklet is to provide a structured format for taxpayers to report their income and calculate the taxes owed. By completing this form, individuals fulfill their legal obligation to report income to the Nebraska Department of Revenue and pay any resultant taxes. The form also facilitates the application of state-specific tax credits and deductions.

Who needs the form?

Residents of Nebraska who earn income and are required to file a state income tax return must complete the NE Individual Income Tax Booklet. This includes individuals with employment income, self-employed persons, and those receiving income from other sources, such as rental or investment income. Additionally, those who wish to claim credits and deductions related to their income must also utilize this form.

When am I exempt from filling out this form?

Exemptions from filing the NE Individual Income Tax Booklet may apply to certain individuals, including low-income earners, dependents, or individuals whose income falls below a specified threshold set by the Nebraska Department of Revenue. If you do not have taxable income for the year, or if you meet specific exemption criteria, you may not need to file.

Components of the form

The NE Individual Income Tax Booklet contains several components, including personal identification information, income details, deductions, credits, and tax calculations. Each component must be accurately completed to ensure a valid submission, allowing for any applicable credits or deductions to be claimed. It’s important to understand each section and gather the necessary documentation before filling out the form.

What are the penalties for not issuing the form?

Failure to submit the NE Individual Income Tax Booklet can result in penalties imposed by the Nebraska Department of Revenue. These penalties can include financial fines and interest on the amount owed. Individuals may also face legal actions or complications during any future tax filings if they do not comply with the submission requirements.

What information do you need when you file the form?

When filing the NE Individual Income Tax Booklet, you will need several key pieces of information. This includes your Social Security number, W-2 forms, any 1099 forms detailing other income, and documentation for any deductions or credits you plan to claim. Ensuring you have all necessary information will facilitate a smoother filing process and help mitigate any errors.

Is the form accompanied by other forms?

The NE Individual Income Tax Booklet may require additional supporting forms depending on your specific income sources or deductions. For instance, you might need to include schedules for self-employment income, property tax credits, or education tax credits. Review the instructions that accompany the tax booklet to determine the necessary accompanying forms.

Where do I send the form?

The completed NE Individual Income Tax Booklet should be mailed to the Nebraska Department of Revenue at the designated address provided in the booklet. This address may vary based on whether you are submitting a payment or requesting a refund, so check the instructions carefully to ensure accurate submission. Additionally, consider using certified mail for tracking purposes, enhancing security for your sensitive information.

See what our users say