NE Individual Income Tax Booklet 2024-2025 free printable template

Show details

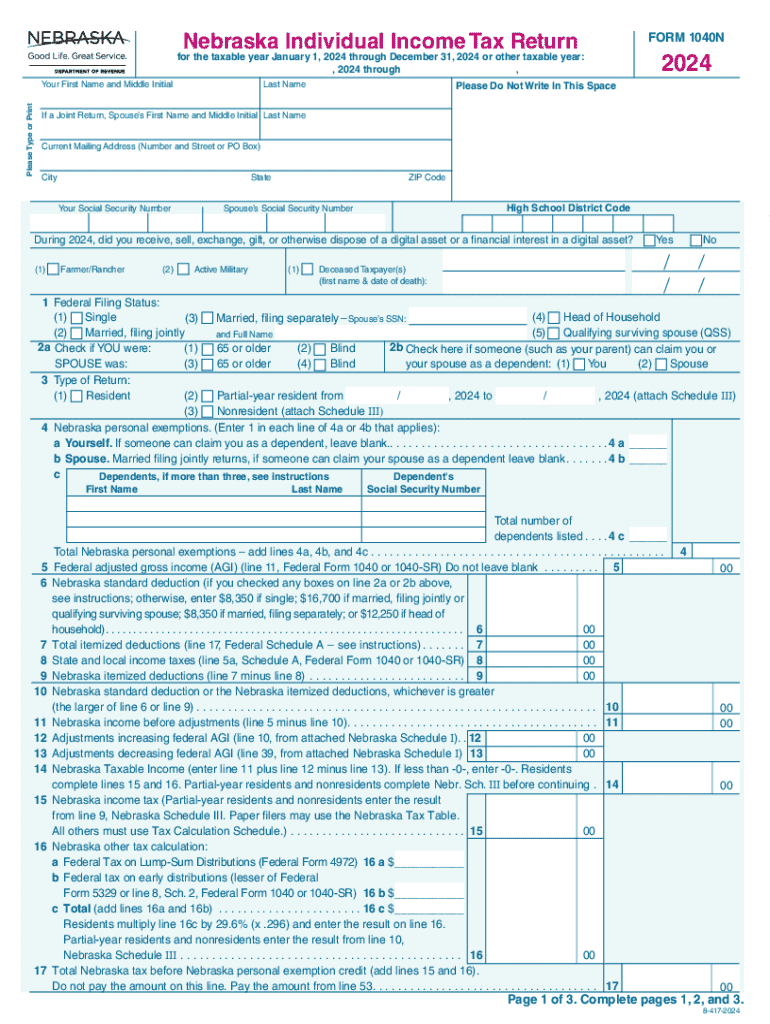

Enter the Part B information for each parcel from the Look-up Tool. Name on Tax Return Type of Nebraska Tax Return this Form is being Filed with 1040N 1041N 1065N 1120N Part A Computation of the Credit Enter the line 2a amount here and on Form 1040N Form 1041N Form 1120N Form 1120-SN Form 1065N or Form 1120NF as appropriate. Nebraska Individual Income Tax Booklet This booklet is no longer mailed and may be obtained from DOR s website. E-file your return* NebFile offers FREE e-filing of your...state return* All taxpayers can use the Fed/State program to e-file federal and Nebraska tax returns. File online by purchasing software from a retailer or with an authorized tax return preparer. When electronically submitting the return use the electronic payment option to schedule a payment to pay the balance due or make estimated income tax payments. Or use the DOR e-pay system to schedule payments after e-filing the return* For more information or to use any of DOR electronic services go to...revenue. nebraska*gov 8-307-2024 What s New the Nebraska individual income tax is reduced to 5. 84. School Readiness Tax Credit LB 754 2023. Beginning with tax year 2024 the School Readiness tax Credit Act restored both a nonrefundable and refundable income tax credit with updated tax credit amounts. Eligible childcare and education providers and staff members or self-employed individuals of an eligible program must first apply to the Nebraska Department of Revenue DOR for the taxpayer to...receive certification of the tax credit. Applications will be processed in the order received* The total amount of credits available under the Act is limited to 7. 5 million for each tax year. A nonrefundable tax credit is available to persons who own or operate an eligible childcare and education program that serves children who participate in the childcare subsidy program established in Neb. Rev* Stat. 68-1202. The credit to the childcare and education provider is equal to the average monthly...number of subsidy children who attend the provider s program multiplied by a dollar amount based on the quality scale rating of the eligible program A 1 200 for a Step Five program B 1 000 for a Step Four program C 800 for a Step Three program D 600 for a Step Two program and E 400 for a Step One program* This nonrefundable tax credit is available to individuals corporate taxpayers and fiduciaries. The providers must first apply to DOR to receive the credits. The nonrefundable credit can be...claimed by an S corporation or partnership electing to pay the Nebraska income tax. A refundable tax credit is available to to an individual who was employed with or who is a self-employed individual providing child care and early childhood education for an eligible program for at least six months during the taxable year and are classified in the Nebraska Early Childhood Professional Record System* Eligible staff members receive a credit equal to Level Five Level Four Level Three Level Two Level...One Opportunity Scholarships Act LB 753 2023 and LB 1402 2024.

pdfFiller is not affiliated with any government organization

Instructions and Help about NE Individual Income Tax Booklet

How to edit NE Individual Income Tax Booklet

How to fill out NE Individual Income Tax Booklet

Instructions and Help about NE Individual Income Tax Booklet

How to edit NE Individual Income Tax Booklet

pdfFiller provides tools to edit the NE Individual Income Tax Booklet easily. Users can upload the form and use the editing feature to modify information as needed. Ensure that changes are accurate to avoid issues with the Nebraska Department of Revenue.

How to fill out NE Individual Income Tax Booklet

To fill out the NE Individual Income Tax Booklet, begin by gathering all relevant financial documents, including W-2 forms and other income statements. Clearly follow the instructions in the booklet, providing accurate figures in each applicable field. Review the completed form for accuracy before submission.

Latest updates to NE Individual Income Tax Booklet

Latest updates to NE Individual Income Tax Booklet

Check with the Nebraska Department of Revenue for any recent changes to the NE Individual Income Tax Booklet. Updates may affect income tax rates, deductions, or credits that could impact your tax return.

All You Need to Know About NE Individual Income Tax Booklet

What is NE Individual Income Tax Booklet?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About NE Individual Income Tax Booklet

What is NE Individual Income Tax Booklet?

The NE Individual Income Tax Booklet is a document required for individuals to report their income and calculate the amount of state tax owed to Nebraska. It is essential for compliance with Nebraska tax laws and must be completed annually.

What is the purpose of this form?

The primary purpose of the NE Individual Income Tax Booklet is to serve as a reporting mechanism for individuals to declare their income to the state. It also facilitates the calculation of taxes owed and any potential refunds due to overpayment.

Who needs the form?

Any individual who earns income within the state of Nebraska is required to complete the NE Individual Income Tax Booklet. This includes residents and part-time residents who have income sourced from Nebraska.

When am I exempt from filling out this form?

Exemptions from filing the NE Individual Income Tax Booklet may apply to certain individuals, such as those whose income falls below a specified threshold or individuals who are not residents of Nebraska. However, always confirm current exemption criteria with the Nebraska Department of Revenue.

Components of the form

The NE Individual Income Tax Booklet includes various sections such as income reporting, deductions, credits, and calculation of tax liability. It also features instructions for each section to guide filers through the process.

What are the penalties for not issuing the form?

Failing to file the NE Individual Income Tax Booklet can result in penalties, including fines and interest on unpaid taxes. Timely and accurate submission is crucial to avoid such consequences.

What information do you need when you file the form?

Before filing the NE Individual Income Tax Booklet, gather necessary information such as Social Security numbers, income statements (W-2s, 1099 forms), and details on deductions and credits available to you. Accurate data is essential for a correct tax return.

Is the form accompanied by other forms?

Depending on individual circumstances, the NE Individual Income Tax Booklet may need to be submitted alongside other forms, such as schedules for specific deductions or additional income disclosures. Be sure to reference the instructions provided in the booklet.

Where do I send the form?

After completing the NE Individual Income Tax Booklet, it should be mailed to the designated address provided in the booklet. Ensure that it is sent to the appropriate department to avoid delays in processing.

See what our users say