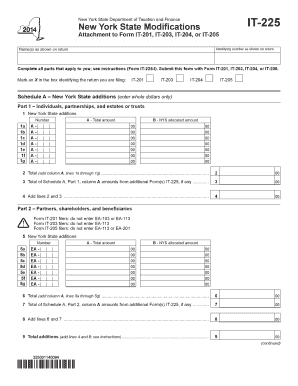

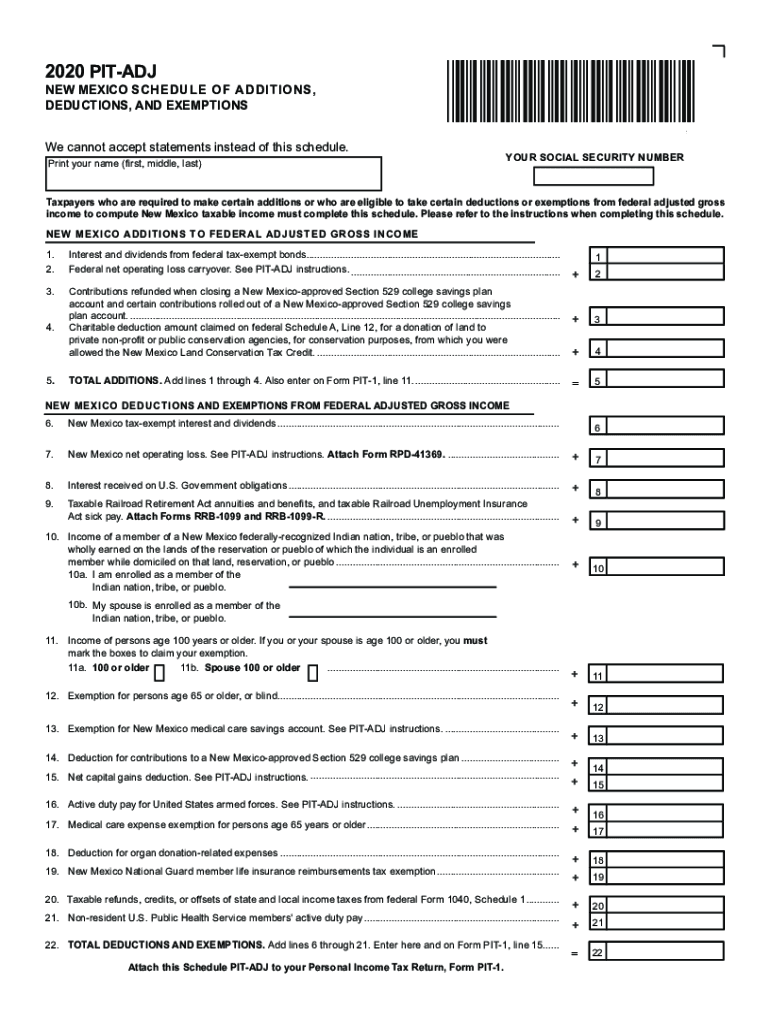

NM TRD PIT-ADJ 2020 free printable template

Instructions and Help about NM TRD PIT-ADJ

How to edit NM TRD PIT-ADJ

How to fill out NM TRD PIT-ADJ

About NM TRD PIT-ADJ 2020 previous version

What is NM TRD PIT-ADJ?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about NM TRD PIT-ADJ

What should I do if I discover an error after submitting the nm pit adj?

If you find an error in your submitted nm pit adj, you should file an amended form as soon as possible. The amended submission should clearly indicate the corrections made. Ensure you keep records of the original submission and the amendments for your personal records.

How can I verify the status of my nm pit adj submission?

You can verify the status of your nm pit adj submission by checking the online portal provided by the relevant tax authority. If you encounter any issues, look for common e-file rejection codes and their solutions to resolve any complications.

Are e-signatures accepted for the nm pit adj?

Yes, many jurisdictions accept e-signatures for the nm pit adj, but it is essential to confirm the specific requirements of your local tax authority. Ensure that the method used for e-signature meets their criteria for validity.

What steps should I take if I receive an audit notice regarding my nm pit adj?

In the event of receiving an audit notice related to your nm pit adj, carefully read the notice and prepare the documentation requested. It's advisable to consult with a tax professional to navigate the audit process effectively.

What are the common pitfalls to avoid when filing the nm pit adj?

Common errors when filing the nm pit adj include incorrect reporting of income or deductions and failure to include all required documentation. Double-check all entries for accuracy to prevent rejections or processing delays.