NM TRD PIT-ADJ 2024-2025 free printable template

Show details

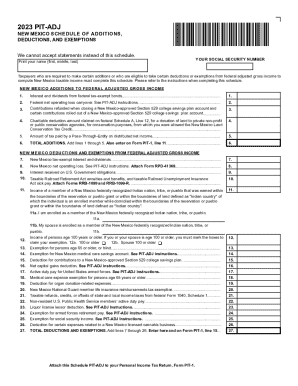

2024 PIT-ADJ NEW MEXICO SCHEDULE OF ADDITIONS, DEDUCTIONS, AND EXEMPTIONS We cannot accept statements instead of this schedule. Print your name (first, middle, last) *240280200* YOUR SOCIAL SECURITY

pdfFiller is not affiliated with any government organization

Instructions and Help about NM TRD PIT-ADJ

How to edit NM TRD PIT-ADJ

How to fill out NM TRD PIT-ADJ

Instructions and Help about NM TRD PIT-ADJ

How to edit NM TRD PIT-ADJ

To edit the NM TRD PIT-ADJ form, begin by downloading a blank version from the New Mexico Taxation and Revenue Department website. Once downloaded, you can use pdfFiller to upload, edit, and modify the form. Utilize the editing tools available on pdfFiller to ensure all fields are accurately filled. Finally, save your edited version for submission.

How to fill out NM TRD PIT-ADJ

Filling out the NM TRD PIT-ADJ form requires careful attention to details. Start by entering your personal information, including your name, address, and Social Security number. Next, report any adjustments needed for your personal income tax filing. Make sure to calculate any applicable deductions and tax credits accurately. After completing the form, review it for any errors before submission.

Latest updates to NM TRD PIT-ADJ

Latest updates to NM TRD PIT-ADJ

The New Mexico Taxation and Revenue Department periodically reviews and updates the NM TRD PIT-ADJ tax form to reflect changes in tax laws and policies. It's essential to check the official website for the most current version and any specific instructions that may apply for the current tax year.

All You Need to Know About NM TRD PIT-ADJ

What is NM TRD PIT-ADJ?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About NM TRD PIT-ADJ

What is NM TRD PIT-ADJ?

The NM TRD PIT-ADJ form is a tax adjustment form used by residents of New Mexico to report changes to their personal income tax returns. This form allows taxpayers to make corrections or adjustments that affect their tax liability. It plays a critical role in ensuring that taxpayers maintain compliance with state tax regulations.

What is the purpose of this form?

The primary purpose of the NM TRD PIT-ADJ form is to enable taxpayers to request adjustments to their previously filed personal income tax returns. This can include adjustments for additional deductions, corrections to income figures, or updates related to tax credits claimed on prior returns. Utilizing this form helps maintain accurate tax records and ensures taxpayers remain compliant with state tax laws.

Who needs the form?

The NM TRD PIT-ADJ form is needed by individuals who file a personal income tax return in New Mexico and discover that amendments are necessary after submission. This includes those who need to correct math errors, report omitted income, or claim additional tax credits or deductions not initially included on their tax return.

When am I exempt from filling out this form?

You are exempt from filling out the NM TRD PIT-ADJ form if you have not made any changes to your previously filed personal income tax return, and your filing status has not changed. Additionally, if your tax situation remains unchanged from the prior year, you do not need to submit this form.

Components of the form

The NM TRD PIT-ADJ form consists of several key components that seek information necessary for adjustments. Taxpayers must provide their identification details, a summary of adjustments being made, and the calculations associated with those changes. Clear instructions are included on the form to guide users in completing it accurately.

What are the penalties for not issuing the form?

Failure to issue the NM TRD PIT-ADJ form when adjustments are needed can lead to penalties imposed by the New Mexico Taxation and Revenue Department. This may include fines or interest on any additional taxes owed. Furthermore, failure to report adjustments can result in an inaccurate tax liability, potentially leading to future audit complications.

What information do you need when you file the form?

When filing the NM TRD PIT-ADJ form, you will need various pieces of information including your original return, records of payments, documentation supporting the adjustments, and any other relevant tax documents that correspond with the changes you are reporting. Ensure all information is accurate and complete to avoid delays in processing.

Is the form accompanied by other forms?

Often, the NM TRD PIT-ADJ form may need to be submitted alongside other forms, especially if the adjustments pertain to further documentation or supporting evidence. Review the instructions on the form carefully to determine if any additional forms are required based on your specific situation.

Where do I send the form?

The completed NM TRD PIT-ADJ form should be sent to the New Mexico Taxation and Revenue Department at the address specified in the form's instructions. It's advisable to keep a copy of the submitted form for your records, along with any accompanying documentation for your personal files.

See what our users say