NM TRD PIT-ADJ 2022 free printable template

Show details

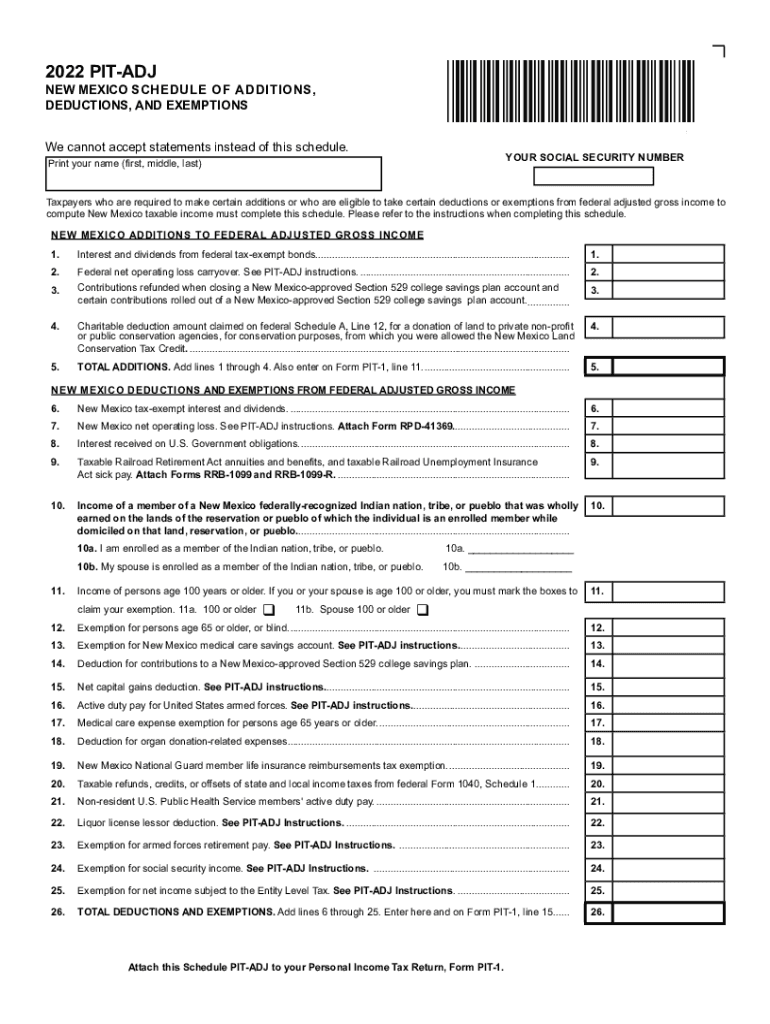

2022 PIT ADJ×220280200×NEW MEXICO SCHEDULE OF ADDITIONS, DEDUCTIONS, AND EXEMPTIONS We cannot accept statements instead of this schedule. YOUR SOCIAL SECURITY Numbering your name (first, middle,

pdfFiller is not affiliated with any government organization

Instructions and Help about NM TRD PIT-ADJ

How to edit NM TRD PIT-ADJ

How to fill out NM TRD PIT-ADJ

Instructions and Help about NM TRD PIT-ADJ

How to edit NM TRD PIT-ADJ

Editing the NM TRD PIT-ADJ form requires accessing a digital version of the form. You can utilize tools like pdfFiller to edit necessary fields seamlessly. Simply upload the form, make your edits, and save the updated version. Ensure accuracy to avoid delays in processing.

How to fill out NM TRD PIT-ADJ

Filling out the NM TRD PIT-ADJ involves several key steps:

01

Download the form from the New Mexico Taxation and Revenue Department's website or access it through pdfFiller.

02

Identify the qualifying factors for your adjustment, such as residency status and income adjustments.

03

Complete all required fields accurately and attach any necessary documentation if prompted.

04

Review the filled form for any errors or omissions before submission.

About NM TRD PIT-ADJ 2022 previous version

What is NM TRD PIT-ADJ?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About NM TRD PIT-ADJ 2022 previous version

What is NM TRD PIT-ADJ?

NM TRD PIT-ADJ is the New Mexico Personal Income Tax Adjustment form used by residents to amend their state income tax returns. This form allows taxpayers to report any changes or corrections to their income tax filings from previous years.

What is the purpose of this form?

The primary purpose of the NM TRD PIT-ADJ is to enable taxpayers to correct discrepancies in their personal income tax filings. Filing this form ensures that any updates or adjustments to tax liability are accurately reported to the New Mexico Taxation and Revenue Department, which may affect tax refunds or outstanding balances.

Who needs the form?

Individuals who have previously filed a personal income tax return in New Mexico and wish to amend that return are required to use the NM TRD PIT-ADJ. This includes those who have changes in income, deductions, credits, or filing status.

When am I exempt from filling out this form?

You may be exempt from filling out the NM TRD PIT-ADJ if your initial return was correctly filed and there are no changes to report. Additionally, if the adjustments made do not affect the amount of tax owed, you may not need to file this form.

Components of the form

The NM TRD PIT-ADJ includes various sections such as taxpayer identification information, the specific adjustments being made, and a summary of previous filings. Each section must be filled out accurately to ensure proper processing of the amendment.

What are the penalties for not issuing the form?

Failure to file the NM TRD PIT-ADJ when required may result in penalties or interest on any taxes owed. The New Mexico Taxation and Revenue Department may impose fines for non-compliance, which could increase the total tax liability.

What information do you need when you file the form?

When filing the NM TRD PIT-ADJ, you need to provide your Social Security number, details of the original return, and the specific changes being made. Gather supporting documents, including W-2s and 1099 forms, to substantiate your adjustments.

Is the form accompanied by other forms?

The NM TRD PIT-ADJ may need to be filed alongside other supporting documentation but typically does not require additional forms unless specified by the New Mexico Taxation and Revenue Department. Always check the most recent instructions for any updated requirements.

Where do I send the form?

Completed NM TRD PIT-ADJ forms should be mailed to the appropriate address listed in the form's instructions or submitted electronically through the New Mexico Taxation and Revenue Department website if available. Ensure that you send the form to the correct location to avoid processing delays.

See what our users say