SD Streamlined Sales and Use Tax Certificate of Exemption 2009 free printable template

Show details

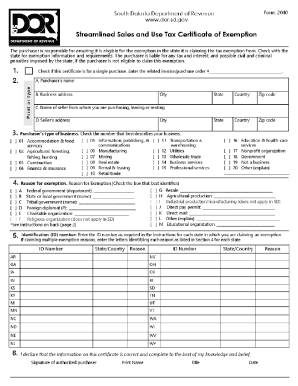

SD EForm - 1932 V6 HELP Complete and use the button at the end to print for mailing. South Dakota Streamlined Sales Tax Agreement Certificate of Exemption Warning to purchaser This is a multi-state form. Not all states allow all exemptions listed on this form. Purchasers are responsible for knowing if they qualify to claim exemption from tax in the state that is due tax on this sale.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SD Streamlined Sales and Use Tax

Edit your SD Streamlined Sales and Use Tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SD Streamlined Sales and Use Tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit SD Streamlined Sales and Use Tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit SD Streamlined Sales and Use Tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SD Streamlined Sales and Use Tax Certificate of Exemption Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SD Streamlined Sales and Use Tax

How to fill out SD Streamlined Sales and Use Tax Certificate

01

Obtain a copy of the SD Streamlined Sales and Use Tax Certificate from the appropriate state website or office.

02

Fill in the purchaser's name and address in the designated fields.

03

Enter the seller's name and address.

04

Indicate the type of property being purchased, whether taxable or exempt.

05

Provide the reason for the exemption by selecting the appropriate category.

06

Enter the date of the transaction.

07

Sign and date the certificate to certify its accuracy.

Who needs SD Streamlined Sales and Use Tax Certificate?

01

Businesses or individuals who purchase goods or services in South Dakota and are claiming an exemption from sales tax.

02

Soldiers or military personnel stationed in South Dakota.

03

Non-profit organizations that qualify for tax-exempt status under South Dakota laws.

Fill

form

: Try Risk Free

People Also Ask about

Do I need a sales tax license in South Dakota?

If you are conducting business in South Dakota you need a license even if you do not have a physical location. If you have nexus then all your sales in South Dakota are taxable (including online and catalog sales) and you must be licensed with the Department of Revenue.

Does 501c3 pay sales tax South Dakota?

S.D. Codified Laws § 10-45-14. Nonprofits that devote resources exclusively to the relief of the poor, distressed or underprivileged and is recognized under the Internal Revenue Code as tax-exempt is exempt from sales tax.

What is tax exempt in South Dakota?

Some goods are exempt from sales tax under South Dakota law. Examples include gasoline, purchases made with food stamps, and prescription drugs.

How long does a sales tax exemption certificate last in South Dakota?

Before a seller may exempt a sale from tax, he must receive a properly completed exemption certificate from the purchaser. Sellers must keep exemption certificates in their records for three years.

What is not taxed in South Dakota?

South Dakota does not have an individual income tax. South Dakota also does not have a corporate income tax. South Dakota has a 4.50 percent state sales tax rate, a max local sales tax rate of 4.50 percent, and an average combined state and local sales tax rate of 6.40 percent.

Is there tax on groceries in SD?

37 states do not levy a sales tax on food. Currently, South Dakota is one of only three states that tax groceries at the full sales tax rate without any offsetting tax credit.

Do South Dakota sales tax exemption certificates expire?

Before a seller may exempt a sale from tax, he must receive a properly completed exemption certificate from the purchaser. Sellers must keep exemption certificates in their records for three years.

What services are taxable in South Dakota?

Are services subject to sales tax in South Dakota? "Goods" refers to the sale of tangible personal property, which are generally taxable. "Services" refers to the sale of labor or a non-tangible benefit. In South Dakota, services are taxable unless specifically exempted.

Who is exempt from sales tax in South Dakota?

Several examples of items that exempt from South Dakota sales tax are prescription medications, farm machinery, advertising services, replacement parts, and livestock. These categories may have some further qualifications before the special rate applies, such as a price cap on clothing items.

What is SD excise tax?

A 2% contractor's excise tax is imposed on the gross receipts of all prime and subcontractors engaged in construction services or reality improvement projects. The work must be for the utility company and the prime contractor must receive payment directly from the utility company to be taxed under SDCL 10-46B.

What is subject to sales tax in South Dakota?

Most services in South Dakota are subject to sales tax with some exceptions in the construction industry. The state sales tax rate for South Dakota is 4.5%.

Are churches tax-exempt in South Dakota?

Sales and Use Tax A church is not exempt from paying sales tax on purchases even though it may have a 501(c)(3) or other exempt status with the IRS. A church is not required to have a sales tax license for most activities, but it may be required to obtain a license if it sells taxable products or services.

Does South Dakota require a resale certificate?

South Dakota does not require registration with the state for a resale certificate.

What is the difference between tax exemption certificate and seller permit?

Resale certificates are also sometimes called “reseller's permits” or sometimes just the blanket term “exemption certificates.” Your resale certificate is generally the same thing as your sales tax permit (sometimes called sales tax license.)

What taxes do you pay in South Dakota?

What is South Dakota's Sales Tax Rate? The South Dakota sales tax and use tax rates are 4.5%.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get SD Streamlined Sales and Use Tax?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the SD Streamlined Sales and Use Tax in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I sign the SD Streamlined Sales and Use Tax electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your SD Streamlined Sales and Use Tax in minutes.

How do I fill out SD Streamlined Sales and Use Tax on an Android device?

Use the pdfFiller mobile app and complete your SD Streamlined Sales and Use Tax and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is SD Streamlined Sales and Use Tax Certificate?

The SD Streamlined Sales and Use Tax Certificate is a form used to certify that a buyer is exempt from sales tax on certain purchases, in accordance with the Streamlined Sales and Use Tax Agreement.

Who is required to file SD Streamlined Sales and Use Tax Certificate?

Entities that qualify for tax exemption, such as certain non-profit organizations, government entities, or businesses purchasing goods for resale, are required to file the SD Streamlined Sales and Use Tax Certificate.

How to fill out SD Streamlined Sales and Use Tax Certificate?

To fill out the certificate, one must provide information such as the purchaser's name, address, the type of exemption claimed, and sign the document to confirm its accuracy.

What is the purpose of SD Streamlined Sales and Use Tax Certificate?

The purpose of the certificate is to document and validate claims for exemption from sales tax, ensuring compliance with tax regulations for exempt purchases.

What information must be reported on SD Streamlined Sales and Use Tax Certificate?

The information that must be reported includes the purchaser's details, the type of exemption being claimed, the purchaser's tax identification number (if applicable), and the signature of the purchaser or authorized agent.

Fill out your SD Streamlined Sales and Use Tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SD Streamlined Sales And Use Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.