NC NCUI 685 2012 free printable template

Show details

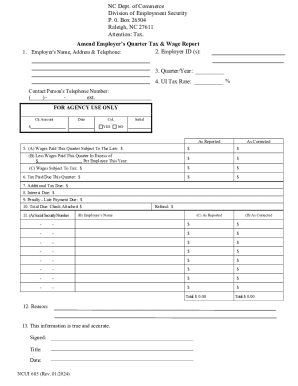

A Social Security Number Refund Total 12. Reason 13. This information is true and accurate. Signed Title NCUI 685 Rev. 01/2012 Instructions for Completing Form NCUI 685 1. 11. The remainder of Form NCUI 685 is to be used to correct individual employee s wages that were previously reported incorrectly. 3. Enter the quarter and year to be corrected in the format Q-YYYY. Example 1-2001 Note A separate Form NCUI 685 for each quarter to be corrected i...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NC NCUI 685

Edit your NC NCUI 685 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NC NCUI 685 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NC NCUI 685 online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit NC NCUI 685. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NC NCUI 685 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NC NCUI 685

How to fill out NC NCUI 685

01

Obtain the NC NCUI 685 form from the North Carolina Division of Employment Security website.

02

Fill in your personal identification information such as your name, address, and Social Security number.

03

Specify the type of separation from employment (e.g., laid off, fired, quit).

04

Provide details related to your employment, including the name of your employer and the dates of employment.

05

Answer the questions regarding your availability for work and your job search efforts.

06

Carefully review the form to ensure all information is accurate and complete.

07

Sign and date the form at the bottom.

08

Submit the completed form via mail, fax, or online submission according to the instructions provided.

Who needs NC NCUI 685?

01

Individuals who have lost their job and are seeking unemployment benefits in North Carolina need to fill out the NC NCUI 685 form.

02

Those who have had a separation from their last employer and need to provide information for unemployment insurance claims.

Fill

form

: Try Risk Free

People Also Ask about

What is the federal unemployment tax rate for 2023?

The 2023 FUTA tax rate is 6% of the first $7,000 from each employee's annual wages. Therefore, employers shouldn't pay more than $420 annually for each employee (6.0% x $7,000).

How long do you have to work to get unemployment in NC?

You must have worked in employment subject to UI tax (known as covered employment) and received wages in at least two (2) quarters of your base period. You must also have been paid wages totaling at least six (6) times the average weekly insured wage during your base period.

What is the penalty for filing Ncui 101 late?

The maximum late filing penalty is 25% (. 25).

What is the NC unemployment tax rate for 2023?

Important Information for Annual Experience Rating for 2023 Tax Rates Taxable Wage Base for 2023$29,600UI Tax Rate for Beginning Employers1%Minimum UI Tax Rate0.06%Maximum UI Tax Rate5.76%Mail Date for Unemployment Tax Rate Assignments For 2022November 14, 20224 more rows

What is the penalty for filing NC franchise tax late?

A penalty for failure to timely file a return (5% of the net tax due per month, maximum 25%) will be assessed for failure to file a withholding return by the due date of the return. In addition, criminal penalties are provided for willful failure to comply with the withholding statutes.

What is the penalty for failure to file NCDOR?

Penalties. A taxpayer will be assessed a penalty of $50 per day, up to a maximum of $1,000, for failure to file the informational return by the date the return is due.

What is the employer tax rate in NC?

Based on economic conditions, an employer's tax rate could be as low as 0.060% or as high as 5.760%.

What is a Ncui 685 form?

Instructions for Completing the Adjustment to Employer's Quarterly Tax and Wage Report. (Form NCUI 685)

How to file for unemployment in Charlotte NC?

You can apply for benefits online 24 hours a day, seven days a week. If you need help, contact our Customer Call Center at 888-737-0259.Create an Online Account to: Apply for unemployment benefits. Complete your weekly certifications. Check your claim status.

What is the SUTA rate for 2023 in NC?

For Tax Year 2023, the North Carolina individual income tax rate is 4.75% (0.0475). For Tax Year 2022, the North Carolina individual income tax rate is 4.99% (0.0499).

What is the employer's quarterly tax and wage report NC?

The Employer's Quarterly Tax and Wage Report (Form NCUI 101) is used to report wage and tax information. You may download a blank Employer's Quarterly Tax and Wage Report (Form NCUI 101) from our website, or contact the Employer Call Center at 919-707-1150 to request that a blank form be mailed to you.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my NC NCUI 685 directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign NC NCUI 685 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I edit NC NCUI 685 straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing NC NCUI 685.

How do I complete NC NCUI 685 on an Android device?

Use the pdfFiller Android app to finish your NC NCUI 685 and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is NC NCUI 685?

NC NCUI 685 is a form used in North Carolina for reporting wage information for unemployment insurance purposes.

Who is required to file NC NCUI 685?

Employers in North Carolina who have employees and are liable for unemployment insurance must file NC NCUI 685.

How to fill out NC NCUI 685?

To fill out NC NCUI 685, employers must provide information about their employees' wages, including total wages paid, number of employees, and the reporting period.

What is the purpose of NC NCUI 685?

The purpose of NC NCUI 685 is to collect and report employment information for the determination of unemployment insurance benefits.

What information must be reported on NC NCUI 685?

NC NCUI 685 must report total wages paid to employees, the number of employees, the quarters of the reporting period, and the employer's identification information.

Fill out your NC NCUI 685 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NC NCUI 685 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.