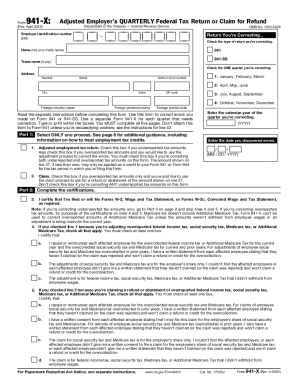

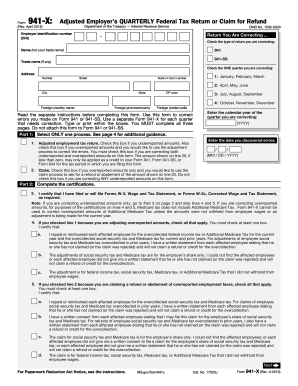

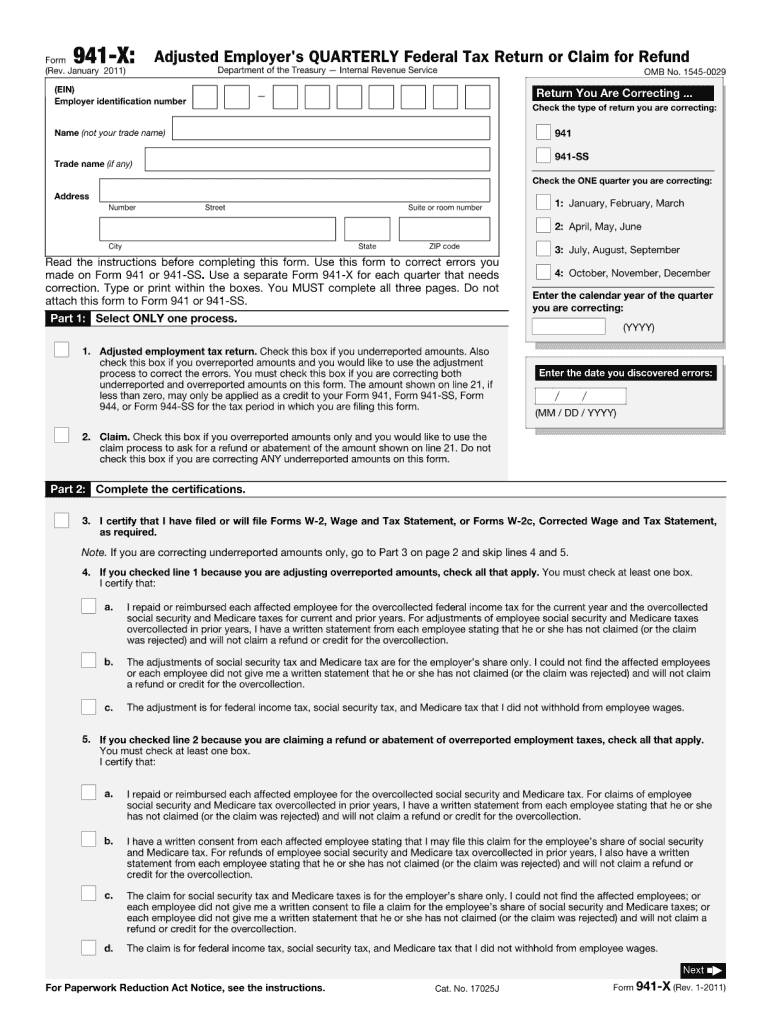

IRS 941-X 2011 free printable template

Instructions and Help about IRS 941-X

How to edit IRS 941-X

How to fill out IRS 941-X

About IRS 941-X 2011 previous version

What is IRS 941-X?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 941-X

What should I do if I realize I've made a mistake after filing the 2011 941 x form?

If you discover an error after filing the 2011 941 x form, you can submit a corrected form to amend your previous submission. Ensure you clearly indicate the corrections and provide accurate information, as this will help avoid complications with the IRS and ensure timely updates to your tax records. Remember to retain copies of both your original and amended submissions for your personal records.

How can I check the status of my filed 2011 941 x form?

To verify the status of your filed 2011 941 x form, you can contact the IRS directly or visit their official website for online tracking options. Keep in mind that processing times may vary, and you should have your filing details handy to facilitate inquiries. If you e-filed, you may also receive notifications regarding acceptance or rejections through your chosen e-filing platform.

What are some common errors to avoid when submitting the 2011 941 x form?

Common errors that filers make when submitting the 2011 941 x form include incorrect taxpayer identification numbers, misreported income or tax amounts, and missing signatures. To ensure accuracy, double-check all entries, adhere to the instructions provided, and consider consulting a tax professional if needed to avoid these pitfalls. Keeping good records will also assist in correcting potential issues in the future.

Can I e-file the 2011 941 x form, and what should I be aware of regarding technical requirements?

Yes, you can e-file the 2011 941 x form through certified software that meets IRS standards. Ensure your software is up to date and compatible with your operating system to reduce the likelihood of technical issues. It's also important to have a stable internet connection during submission and to follow any specific instructions provided by the software for successful filing.

See what our users say