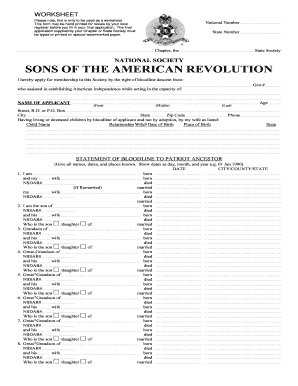

LA Suspicious Activity Report 2005-2025 free printable template

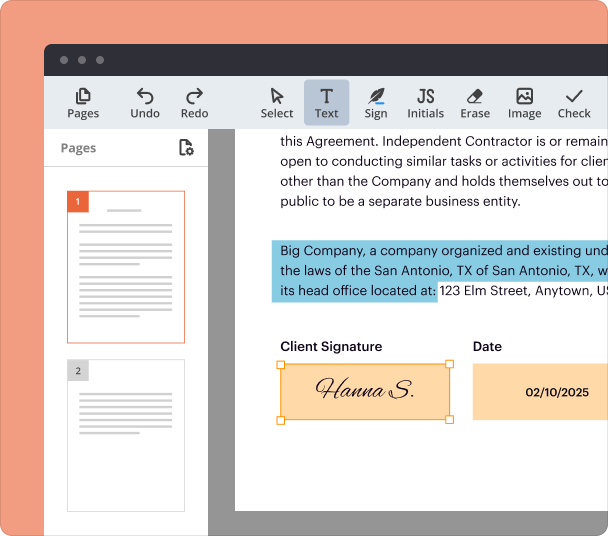

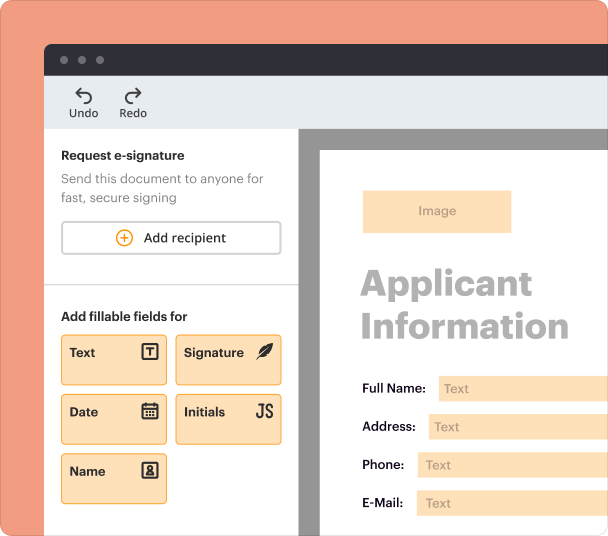

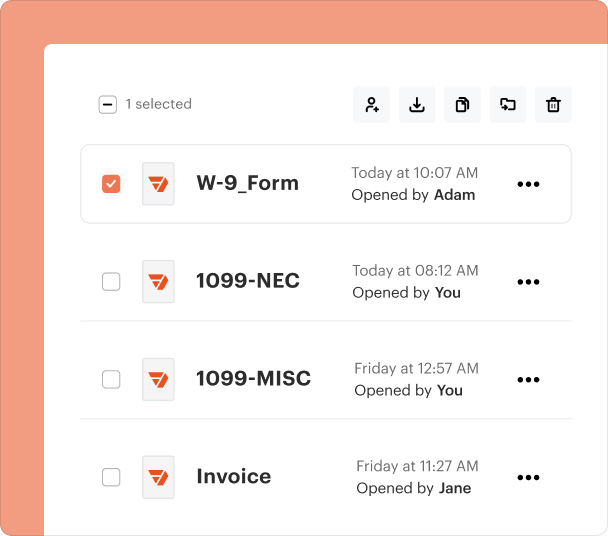

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

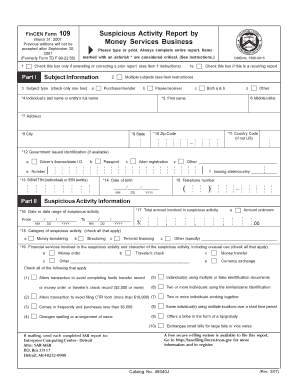

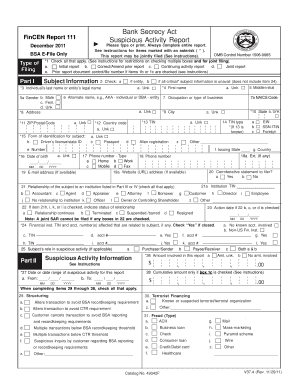

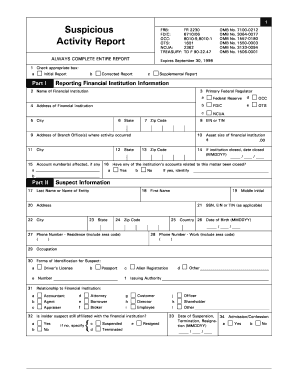

How to fill out a LA suspicious activity report form form

Filling out a LA suspicious activity report (SAR) form is crucial for financial institutions to communicate any irregularities or potential illegal activities. This guide provides a detailed overview on the important aspects of the SAR, helping institutions in Louisiana fulfill their legal obligations while ensuring financial oversight.

Understanding the Suspicious Activity Report (SAR)

A Suspicious Activity Report (SAR) is a document that financial institutions must file to report suspicious transactions that may involve money laundering or fraud. These reports are vital for financial oversight and customer protection, helping authorities identify and address illegal activities.

-

Financial institutions in Louisiana are legally required to report suspicious activities to comply with federal regulations, ensuring they contribute to the prevention of financial crimes.

-

The SAR plays a critical role in maintaining the integrity of the financial system by alerting law enforcement to potentially harmful activities.

What are the key components of the Suspicious Activity Report?

Filling a SAR involves several parts that collect essential information about the reporting institution, the suspected individual, and the suspicious activities observed.

-

This section requires the institution’s name, address, and contact details for accurate identification.

-

This section should include personal identifiers for the suspect, including names and their relationship to the institution.

-

This includes a description of the suspicious activities observed and evaluates their potential impact on the institution's financial integrity.

-

A designated contact person should be listed with full contact information to facilitate communication after submission.

How to fill out the SAR form: A step-by-step guide

-

Ensure you have all relevant details about the reporting institution and the suspicious activities before starting the form.

-

Clearly articulate the nature of suspicious activities and utilize defined terms and phrases for clarity.

-

Common mistakes include omitting key information or errors in contact details. A thorough review can prevent delays.

-

Follow the relevant submission process as described in the submission guidelines and ensure records are kept.

What are three key reasons to report suspicious activity promptly?

-

Prompt reporting helps institutions comply with legal obligations, thus avoiding potential penalties that can arise from delays.

-

Reporting suspicious activities promptly can mitigate the risk of financial losses, safeguarding the institution's assets.

-

Timely reporting contributes to the overall security of the financial ecosystem, enabling law enforcement to act swiftly.

How to navigate the submission process for your SAR

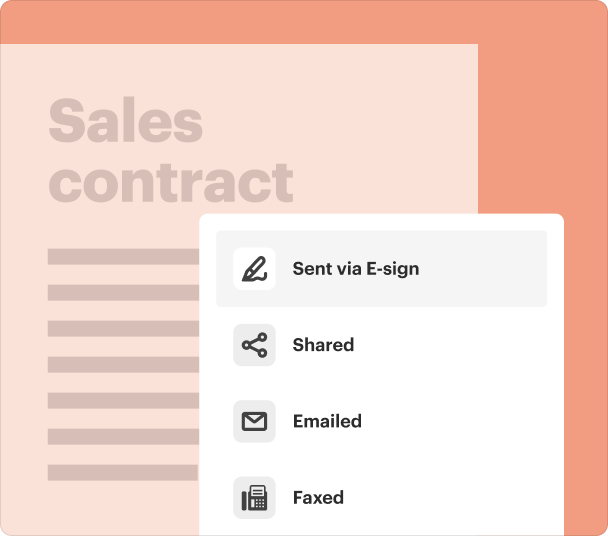

The submission process for a SAR can be streamlined with digital tools. By utilizing pdfFiller, you can create, eSign, and securely submit the form electronically, ensuring compliance with legal requirements.

-

Use the platform to fill out the SAR form and ensure all fields are accurately completed.

-

Utilize the secure submission feature of pdfFiller to send your completed SAR directly to the appropriate authorities.

-

Keep copies of submitted documents for your records, which aids in future compliance queries or follow-ups.

What are common questions about the SAR process?

As you navigate the SAR process, questions often arise regarding submission outcomes or institutional responsibilities.

-

Typically, once submitted, regulatory agencies assess the report. They may reach out for additional information or provide feedback.

-

Institutions should address any feedback promptly, ensuring that they adhere to any necessary adjustments or follow-up queries.

-

Resources for ongoing training regarding SAR filings are available on various financial regulatory websites and organizations.

How to adapt to changes in regulatory frameworks?

Staying updated on changes to financial regulations ensures compliance and protects institutions from potential penalties. Utilizing tools like pdfFiller can aid in managing compliance efficiently.

-

Regularly review updates from regulatory agencies in Louisiana to remain compliant with evolving financial laws.

-

Invest in training for staff to understand changes better and to avoid common compliance pitfalls.

-

Take advantage of pdfFiller to efficiently manage documents, ensuring that compliance protocols are easy to follow.

What popular links and resources are available?

Accessing reliable resources is essential for effective SAR management. Here are some recommended links and resources.

-

Visit government websites dedicated to financial crime to find reporting information and guidelines.

-

Access online platforms that provide anti-money laundering training, essential for compliance understanding.

-

Keep contact information for local law enforcement agencies for quick reference in reporting suspicious activity.

What are related topics in financial oversight?

Understanding financial oversight and compliance measures is crucial for any financial institution. It's helpful to explore related topics.

-

AML regulations establish a framework for financial institutions to prevent criminal organizations from using money obtained through illegal activities.

-

Effective risk management strategies help institutions identify and mitigate risks associated with suspicious activities.

-

Implementing best practices for SAR management ensures consistency and compliance throughout the institution.

Frequently Asked Questions about fincen sar form pdf

What makes a transaction suspicious?

A transaction may be regarded as suspicious if it involves an unusual amount of money, a change in behavior from the customer, or transactions lacking an apparent lawful purpose.

Who must file a SAR?

All financial institutions, including banks, credit unions, and money service businesses, must file a SAR when they detect suspicious activities.

Can individuals report suspicious activities?

Yes, individuals can report suspicious activities to financial institutions, who will assess and potentially escalate these reports for SAR filing.

What is the timeframe for SAR filing?

Financial institutions must file a SAR within 30 days of detecting suspicious activities to comply with federal regulations.

Are SARs confidential?

Yes, SARs are confidential documents; disclosing the existence of a SAR is prohibited and could lead to legal repercussions.

pdfFiller scores top ratings on review platforms