Fbar Form Pdf

What is fbar form pdf?

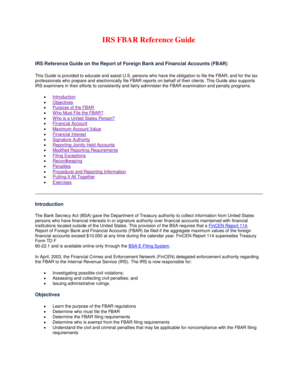

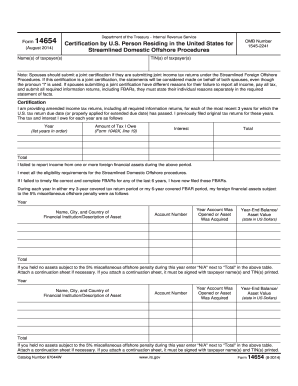

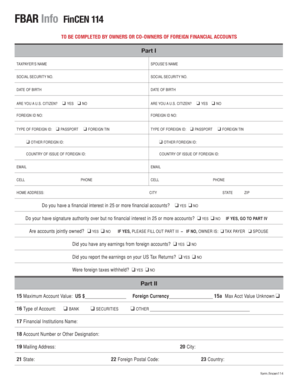

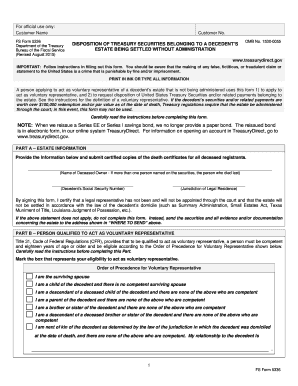

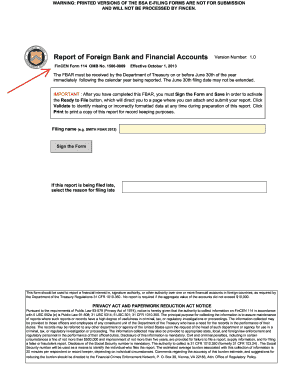

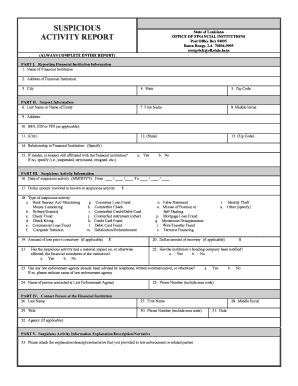

The fbar form pdf, also known as the Report of Foreign Bank and Financial Accounts, is a document used by the United States Department of Treasury to collect information regarding foreign financial accounts held by US taxpayers. This form is required to be filed by individuals, including US citizens, residents, and entities, who have an interest in or signature authority over one or more foreign financial accounts, if the aggregate value of these accounts exceeds $10,000 at any time during the calendar year.

What are the types of fbar form pdf?

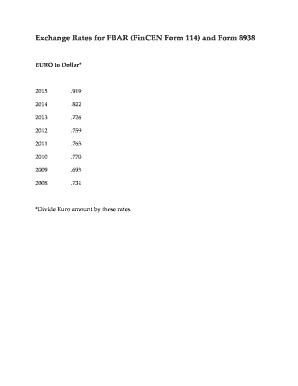

There are two types of fbar form pdf that individuals may come across. These include: 1. FinCEN Form 114: This is the main form used for reporting foreign financial accounts. 2. FinCEN Form 114a: This form is used by individuals who have signature authority over but no financial interest in one or more foreign financial accounts.

How to complete fbar form pdf

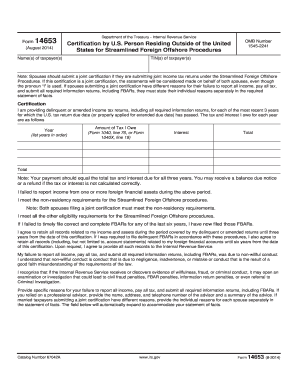

Completing the fbar form pdf is a straightforward process. Here are the steps to follow: 1. Download the fbar form pdf from the official website of the United States Department of Treasury. 2. Fill in the required personal information, such as your name, address, and taxpayer identification number. 3. Provide information about the foreign financial accounts you hold, including their names, account numbers, and maximum values during the calendar year. 4. Calculate the aggregate value of all your foreign financial accounts and enter it in the appropriate section. 5. Review the completed form to ensure accuracy. 6. Sign and date the form. 7. Keep a copy of the form for your records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.