Fbar Vs 8938

What is fbar vs 8938?

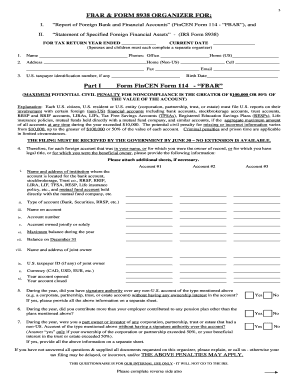

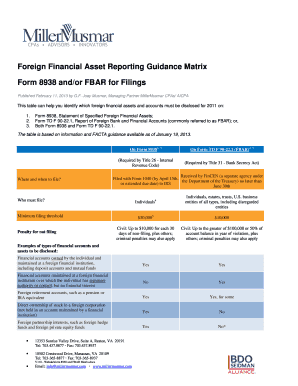

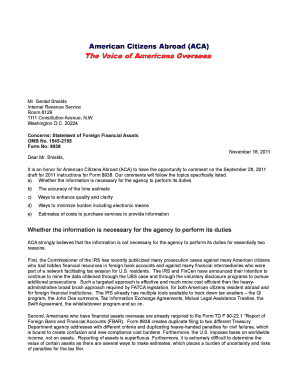

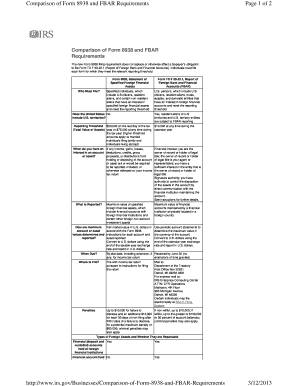

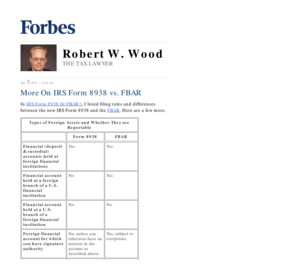

The FBAR (Foreign Bank and Financial Accounts) and Form 8938 are two important documents that individuals may need to file when they have financial accounts or assets located outside of the United States. The FBAR is required to be filed annually by U.S. taxpayers who have a financial interest in or signature authority over foreign financial accounts, while Form 8938 is used to report specified foreign financial assets that exceed certain thresholds.

What are the types of fbar vs 8938?

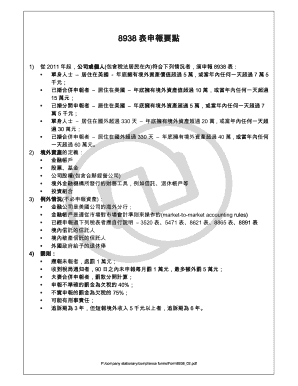

There are different types of FBAR and Form 8938 depending on the individual's financial situation. The FBAR is categorized into the following types: 1. Individual Filer FBAR: This is used by individuals who need to report their own foreign financial accounts. 2. Joint Filer FBAR: Married individuals who jointly own foreign financial accounts can use this type of FBAR. 3. Group FBAR: Certain individuals who are part of a consolidated FBAR filing can use this type. Form 8938, on the other hand, has different reporting thresholds based on the taxpayer's filing status and location of their foreign financial assets. The three main types of Form 8938 are: 1. Form 8938 for Single Individuals 2. Form 8938 for Married Individuals Filing Jointly 3. Form 8938 for Married Individuals Filing Separately

How to complete fbar vs 8938

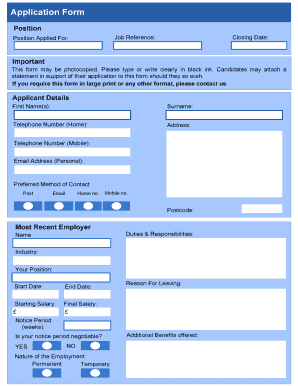

Completing the FBAR and Form 8938 may seem daunting, but with the right guidance, it can be done smoothly. Here are the steps to complete these forms: 1. Gather all necessary information: Collect details about your foreign financial accounts, such as bank statements, investment reports, and other relevant documents. 2. Determine the correct form and type: Understand whether you need to file an individual, joint, or group FBAR, as well as the appropriate Form 8938 based on your filing status. 3. Fill in the required fields: Provide accurate and up-to-date information about your foreign financial accounts, including their balances, income, and any relevant transactions. 4. Review and double-check: Carefully review the completed forms for any errors or omissions. 5. File the forms: Submit the completed FBAR and Form 8938 according to the designated filing deadline. It's important to note that pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

In conclusion, understanding the difference between FBAR and Form 8938 is crucial for individuals who have foreign financial accounts or assets. By following the steps provided and utilizing the services of pdfFiller, users can seamlessly complete these forms and ensure compliance with the necessary reporting requirements.