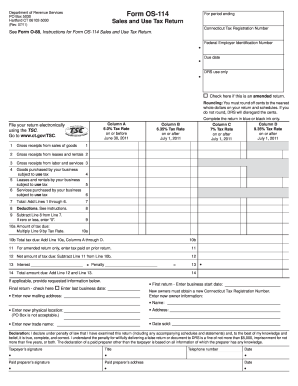

Blank Form 114

What is blank form 114?

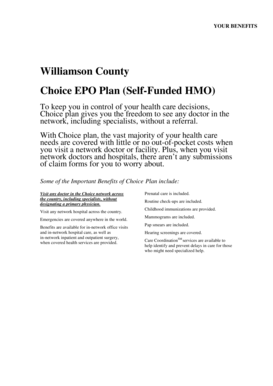

Blank form 114 is a standardized document used for various purposes, such as tax reporting, financial statements, and other legal requirements. It is a blank template that allows users to input information and fill in the necessary details to meet specific needs. This form helps streamline processes and ensures accurate recording of important data.

What are the types of blank form 114?

There are several types of blank form 114, each catering to different needs and requirements. Some common types include: 1. Form 114A - Used for individual tax reporting. 2. Form 114B - Used for business tax reporting. 3. Form 114C - Used for financial statements. 4. Form 114D - Used for legal documentation. These are just a few examples, and there may be other variants depending on the specific purpose.

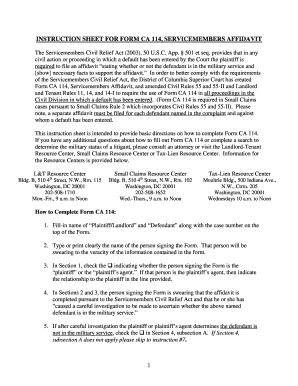

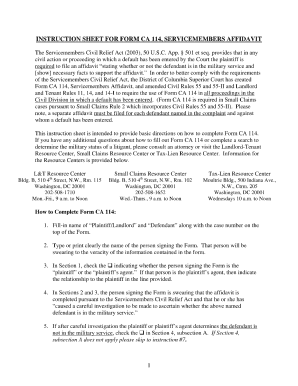

How to complete blank form 114

Completing blank form 114 is a straightforward process that can be done by following these steps: 1. Gather all necessary information and documents relevant to the purpose of the form. 2. Carefully read the instructions provided with the form to ensure all requirements are met. 3. Fill in the blanks and provide accurate information in the designated fields. 4. Double-check all entries for accuracy and completeness. 5. Sign and date the form as required. 6. Review the completed form to ensure it is error-free and meets all necessary criteria. By following these steps, you can confidently complete blank form 114 with ease and accuracy.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done. Stay organized and efficient with pdfFiller's intuitive platform.