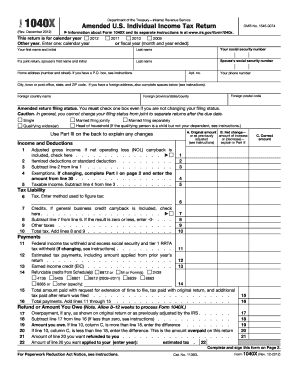

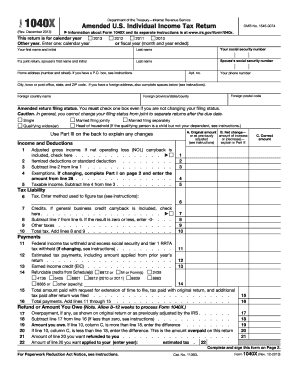

IRS Instructions 1040X 2011 free printable template

Instructions and Help about IRS Instructions 1040X

How to edit IRS Instructions 1040X

How to fill out IRS Instructions 1040X

About IRS Instructions 1040X 2011 previous version

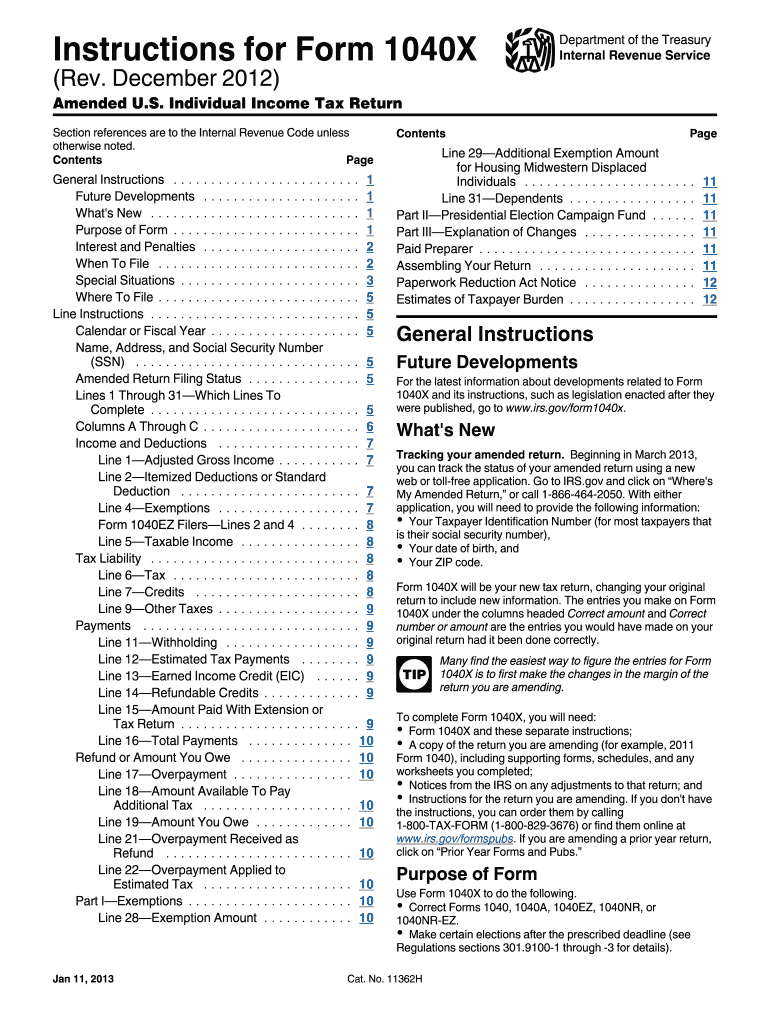

What is IRS Instructions 1040X?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS Instructions 1040X

What should I do if I realize I made a mistake after filing the online1040xform 2011?

If you find an error after filing your online1040xform 2011, you can correct it by submitting an amended return. To do this, ensure you use the correct form designated for amendments and follow any specific instructions provided. It's important to act promptly to avoid potential penalties.

How can I check the status of my online1040xform 2011 submission?

You can verify the status of your online1040xform 2011 by using the online portal provided by the IRS. You will typically need your Social Security number and other personal information to track your filing status and confirm its processing.

What are the common mistakes people make when filing online1040xform 2011?

Common errors when filing the online1040xform 2011 include incorrect Social Security numbers, mismatched names, and failing to check all calculations. To minimize these mistakes, double-check your entries and ensure you have reported all required information accurately.

Are e-signatures acceptable when submitting the online1040xform 2011?

Yes, e-signatures are generally acceptable for the online1040xform 2011 when file electronically. Make sure you follow the guidelines provided in the filing portal to ensure your submission is valid and complies with IRS requirements.

What should I do if my online1040xform 2011 is rejected?

If your online1040xform 2011 is rejected, review the rejection notice for specific error codes. Correct the errors indicated and resubmit your amended form as soon as possible to avoid delays in processing your tax return and any refunds.