MO DoR MO-60 2020 free printable template

Show details

Reset Footprint FormDepartment Use Only

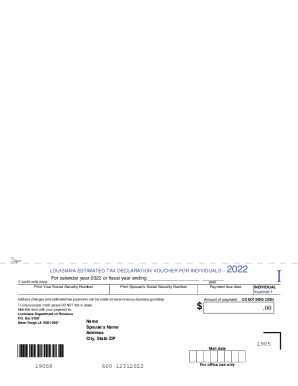

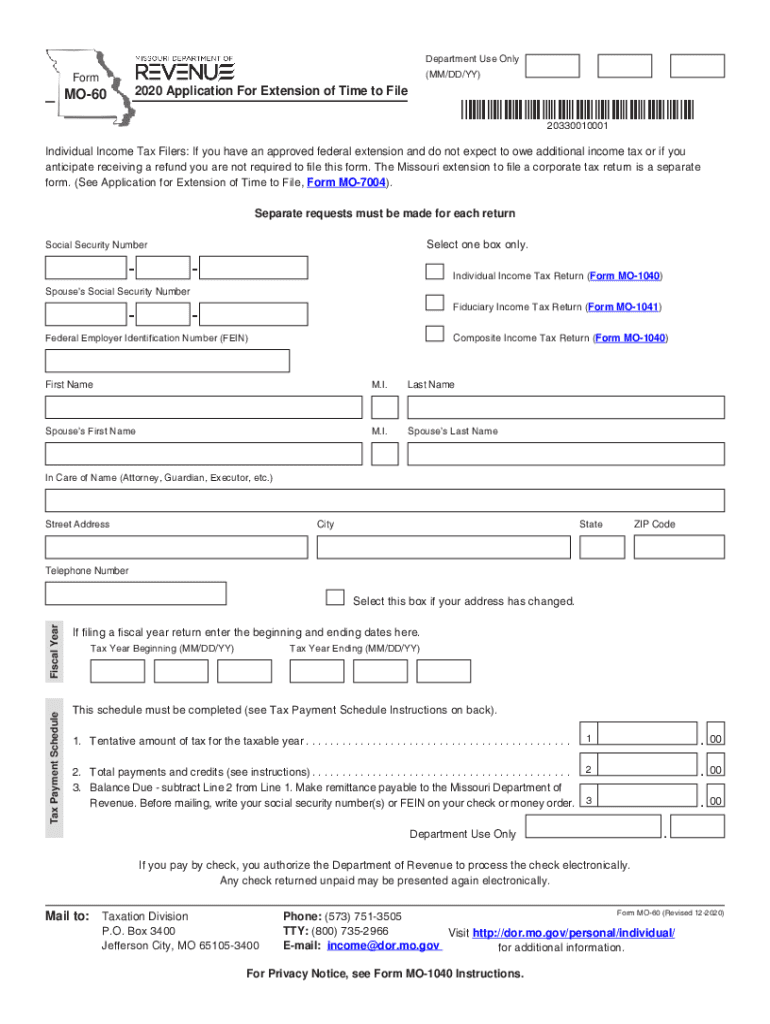

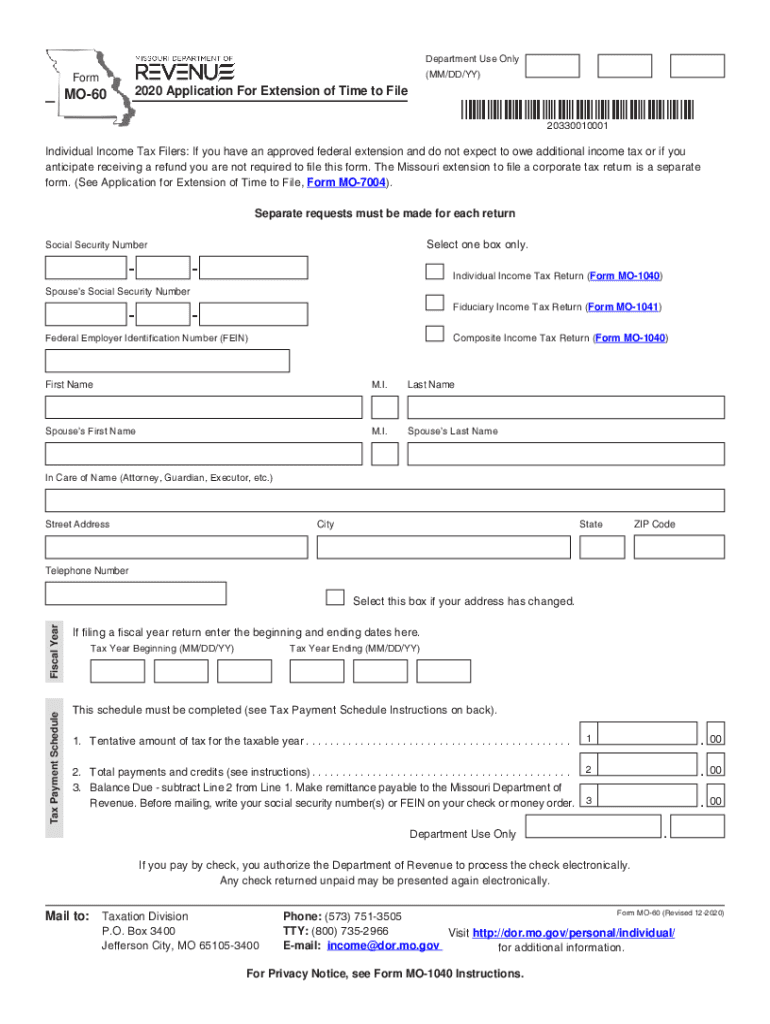

(MM/DD/BY)Form2020 Application For Extension of Time to FileMO60×20330010001*

20330010001Individual Income Tax Filers: If you have an approved federal extension

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MO DoR MO-60

Edit your MO DoR MO-60 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MO DoR MO-60 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MO DoR MO-60 online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit MO DoR MO-60. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO DoR MO-60 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MO DoR MO-60

How to fill out MO DoR MO-60

01

Obtain the MO DoR MO-60 form from the official website or a local office.

02

Enter your name, address, and contact information at the top of the form.

03

Provide your Social Security Number or Employer Identification Number.

04

Clearly indicate the type of report by checking the appropriate box.

05

Fill in the financial information as required, including income, deductions, and credits.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form at the designated section.

08

Submit the form by mail or electronically as instructed.

Who needs MO DoR MO-60?

01

Individuals filing a personal income tax return in Missouri.

02

Businesses reporting state income or franchise taxes.

03

Tax preparers working on behalf of clients.

04

Residents claiming specific tax credits or deductions.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to file a Missouri tax extension?

If you owe MO income taxes, you will either have to submit a MO tax return or extension by the April 18, 2023 tax deadline in order to avoid late filing penalties. The extension will only avoid late filing penalties until Oct. 16, 2023. Note: Unless you pay all your Taxes or eFile your tax return by Oct.

Does Missouri require tax extension?

If you owe MO income taxes, you will either have to submit a MO tax return or extension by the April 18, 2023 tax deadline in order to avoid late filing penalties. The extension will only avoid late filing penalties until Oct. 16, 2023. Note: Unless you pay all your Taxes or eFile your tax return by Oct.

Who needs a mo tax ID number?

Missouri businesses must obtain identification numbers to use in their compliance with Missouri tax responsibilities. These numbers and the certificates are used to prove eligibility to make sales tax-exempted purchases allowed under state law.

How do I file a Mo state tax extension?

File Form MO-60, Application for Extension of Time to File, for an automatic six-month extension if the taxpayer expects to have tax due or needs a Missouri extension but not a federal extension. Include payment by the original due date of the return. Form MO-60 is also used to request a longer extension for cause.

Can I file my own extension for taxes?

You can file an extension for your taxes by submitting Form 4868 with the IRS online or by mail. This must be done before the last day for filing taxes.

Can I file a Missouri tax extension online?

The 2022 Missouri State Income Tax Return forms for Tax Year 2022 (Jan. 1 - Dec. 31, 2022) can be e-Filed together with the IRS Income Tax Return by the April 18, 2023 due date. If you file a tax extension you can e-File your Taxes until October 16, 2023 without a late filing penalty.

Does Missouri have automatic extension?

Missouri grants an automatic extension of time to file to any individual, business filing a composite return, or fiduciary if you filed a federal extension. You do not need to file an Application for Extension of Time to File (Form MO-60) unless: • You expect to owe a tax liability for the period.

Does Missouri require a separate extension?

You aren't required to file an extension if you don't expect to owe additional income tax or if you anticipate receiving a refund. If you wish to file a Missouri extension, and don't expect to owe Missouri income tax, you may file an extension by filing Form MO-60 , Application for Extension of Time to File.

What is a Mo-60 form?

Form MO-60 (Revised 12-2015) Missouri grants an automatic extension of time to file to any individual, partnership, or fiduciary if you filed a federal extension. You do not need to file a Form MO-60 (Application for Extension of Time to File) unless: • You expect to owe a tax liability for the period.

Does Mo accept federal extension for individuals?

An automatic extension of time to file will be granted until October 15, 2023. If you receive an extension of time to file your federal income tax return, you will automatically be granted an extension of time to file your Missouri income tax return, provided you do not expect to owe any additional Missouri income tax.

Do I need to file a mo extension?

If you owe MO income taxes, you will either have to submit a MO tax return or extension by the April 18, 2023 tax deadline in order to avoid late filing penalties. The extension will only avoid late filing penalties until Oct. 16, 2023. Note: Unless you pay all your Taxes or eFile your tax return by Oct.

Who Must file MO tax return?

If you or your spouse earned Missouri source income of $600 or more (other than military pay), you must file a Missouri income tax return by completing Form MO-1040 and Form MO-NRI. Be sure to include a copy of your federal return.

Does Mo accept the federal extension?

If you have an approved Federal tax extension (IRS Form 4868), the State of Missouri will automatically grant you an extension as well. In this case, you do not need to file anything with Missouri unless you owe state income tax.

Do tax extensions need to be filed?

An extension of time to file your return does not grant you any extension of time to pay your taxes. You should estimate and pay any owed taxes by your regular deadline to help avoid possible penalties. You must file your extension request no later than the regular due date of your return.

Why do I need a mo-1040?

You must file Form MO-1040 if at least one of the following applies: You or your spouse claim or file: a. a pension or social security/social security disability or military exemption or property tax credit and you also have other special filing situations.

How do I file an extension in Mo?

Attach a copy of the federal extension to the Missouri return when filed. File Form MO-60, Application for Extension of Time to File, for an automatic six-month extension if the taxpayer expects to have tax due or needs a Missouri extension but not a federal extension.

What states accept federal extension for individuals?

16498: States That Accept Federal Extension StateReturn TypeNew Mexico1040, 1120, 1120S, 1065, 1041Ohio1040, 1120S, 1065, 1041Oklahoma1040, 1120, 1120S, 1065, 1041Oregon1040, 1120, 1120S, 1065, 1041, 70624 more rows

Does Mo accept federal extension 7004?

An approved Form MO-7004 extends the due date up to 180 days. D You seek a Missouri extension exceeding the federal automatic extension period. Form MO-7004 must be filed on or before the end of the federal automatic extension period.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out MO DoR MO-60 using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign MO DoR MO-60 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Can I edit MO DoR MO-60 on an iOS device?

Create, edit, and share MO DoR MO-60 from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I fill out MO DoR MO-60 on an Android device?

Complete your MO DoR MO-60 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is MO DoR MO-60?

MO DoR MO-60 is a form used by the Missouri Department of Revenue for reporting various tax information, particularly related to corporate income tax.

Who is required to file MO DoR MO-60?

Entities such as corporations and organizations doing business in Missouri that have an obligation to report their income and pay corporate income tax are required to file MO DoR MO-60.

How to fill out MO DoR MO-60?

To fill out MO DoR MO-60, you need to provide detailed financial information, including gross receipts, deductions, and other relevant income figures, as well as complete identifying information for the organization.

What is the purpose of MO DoR MO-60?

The purpose of MO DoR MO-60 is to collect accurate tax information from corporations to ensure compliance with state tax laws and facilitate the calculation of tax liabilities.

What information must be reported on MO DoR MO-60?

MO DoR MO-60 requires reporting of the corporation's total income, deductions, the amount of tax due, credits claimed, and any other pertinent financial information related to income earned in Missouri.

Fill out your MO DoR MO-60 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MO DoR MO-60 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.