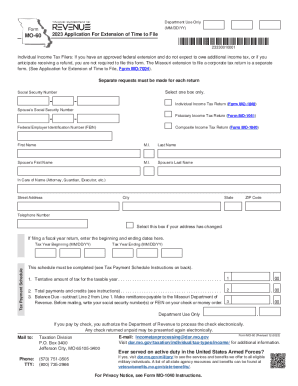

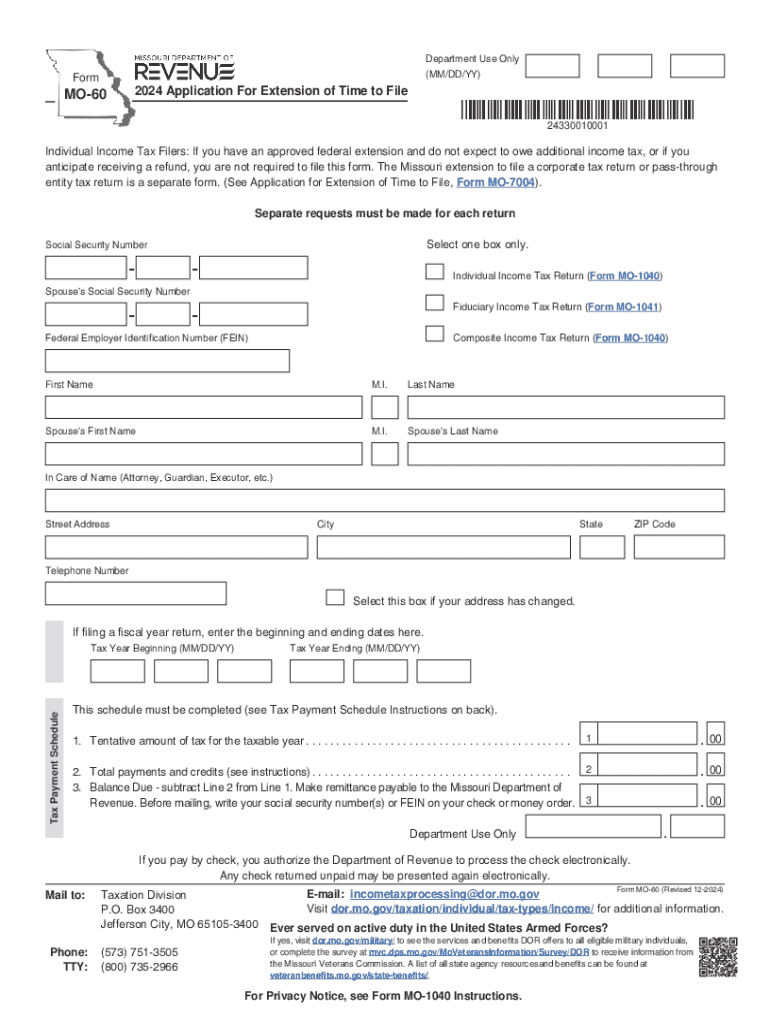

MO DoR MO-60 2024-2025 free printable template

Show details

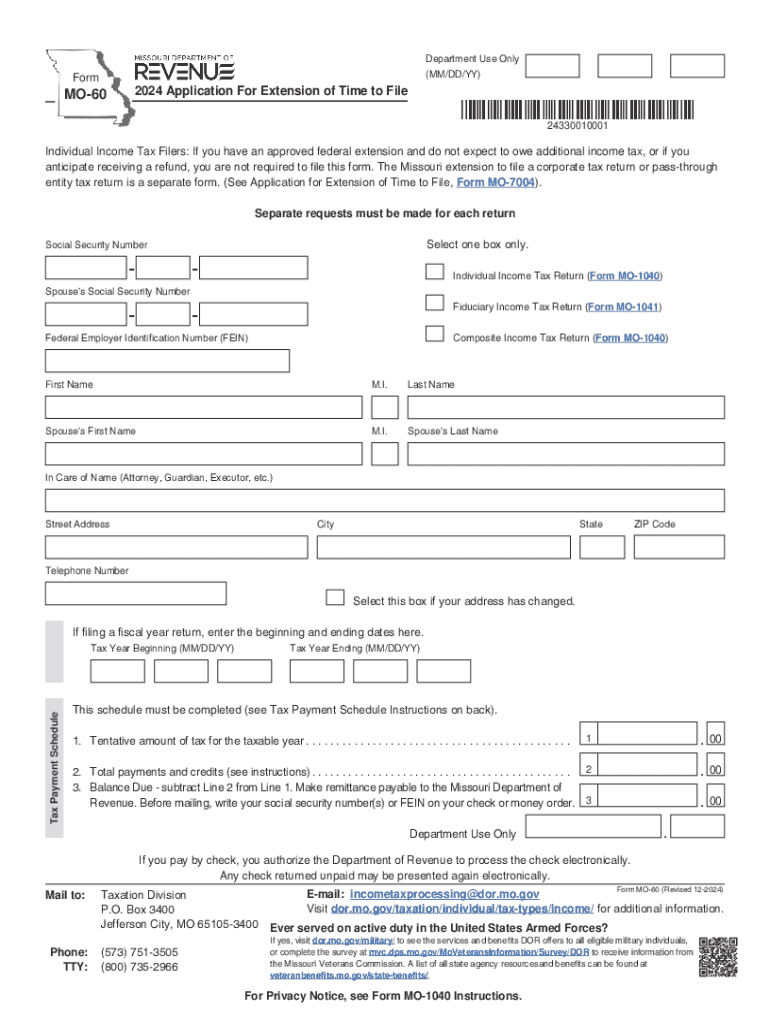

This form is used by individual and composite income tax filers in Missouri to apply for an extension of time to file their income tax returns. It outlines the conditions under which an extension can be granted, including scenarios where a federal extension is also filed. The form includes sections for providing taxpayer identification information and details regarding the expected tax liability, payments, and credits.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign mo 60 form

Edit your mo 60 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2024 missouri extension form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit missouri extension file online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 2024 mo 60 form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO DoR MO-60 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out mo 60 online 2024-2025

How to fill out MO DoR MO-60

01

Gather necessary information, including your name, address, and relevant tax identification numbers.

02

Review the instructions provided with the MO-60 form to understand the required fields.

03

Fill in your personal information accurately in the designated sections of the form.

04

Provide details regarding your income and deductions as required.

05

Double-check all entries for accuracy and completeness.

06

Sign and date the form where indicated.

07

Submit the completed MO-60 form to the Missouri Department of Revenue by the deadline.

Who needs MO DoR MO-60?

01

Individuals or businesses that are required to report and pay taxes in Missouri need to fill out MO DoR MO-60.

Fill

form

: Try Risk Free

People Also Ask about

Does Missouri recognize federal extension?

If you have an approved Federal tax extension (IRS Form 4868), the State of Missouri will automatically grant you an extension as well. In this case, you do not need to file anything with Missouri unless you owe state income tax.

Does Mo accept federal extension?

If you have an approved Federal tax extension (IRS Form 4868), the State of Missouri will automatically grant you an extension as well. In this case, you do not need to file anything with Missouri unless you owe state income tax.

Does Missouri have automatic extension?

Missouri grants an automatic extension of time to file to any individual, business filing a composite return, or fiduciary if you filed a federal extension. You do not need to file an Application for Extension of Time to File (Form MO-60) unless: • You expect to owe a tax liability for the period.

How do I file a tax extension on my 2022?

To request an extension to file your federal taxes after April 18, 2022, print and mail Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. We can't process extension requests filed electronically after April 18, 2022. Find out where to mail your form.

Is there an automatic tax extension?

We give you an automatic 6-month extension to file your return. You must file by the deadline to avoid a late filing penalty. The deadline is October 17, 2022.

Does Missouri grant automatic extension?

Missouri grants an automatic extension of time to file to any individual, business filing a composite return, or fiduciary if you filed a federal extension. You do not need to file an Application for Extension of Time to File (Form MO-60) unless: • You expect to owe a tax liability for the period.

Can I file a Missouri tax extension online?

The 2022 Missouri State Income Tax Return forms for Tax Year 2022 (Jan. 1 - Dec. 31, 2022) can be e-Filed together with the IRS Income Tax Return by the April 18, 2023 due date. If you file a tax extension you can e-File your Taxes until October 16, 2023 without a late filing penalty.

How do I file an extension in Mo?

Attach a copy of the federal extension to the Missouri return when filed. File Form MO-60, Application for Extension of Time to File, for an automatic six-month extension if the taxpayer expects to have tax due or needs a Missouri extension but not a federal extension.

Do I need to file for an extension for 2022 taxes?

If you find yourself unable to complete your 2022 federal tax return by the tax deadline, you'll first need to file an extension with the IRS to avoid potential late-filing penalties. Filing an extension will allow you to push your deadline to October 16, 2023.

Which states automatically extend with federal extension?

16498: States That Accept Federal Extension StateReturn TypeAlaska1120, 1120S, 1065Arizona1040, 1120, 1120S, 1065, 1041, 990Arkansas1040, 1120, 1120S, 1065, 1041Delaware1120, 1120S, 106524 more rows

Does Missouri require an extension?

You will automatically receive a Missouri extension if you have no state tax liability or if you're owed a state refund. On the other hand, if you do owe Missouri tax, you can request a Missouri tax extension with Form MO-60. Make sure to file Form MO-60 by the original due date of your return.

Does Missouri require an extension?

If you do not owe Missouri income taxes by the tax deadline of April 18, 2023, you do not have to prepare and file a MO tax extension. In case you expect a MO tax refund, you will need to file or e-File your MO tax return in order to receive your tax refund money.

How do I file an extension in Missouri?

Attach a copy of your federal extension (Federal Form 4868) with your Missouri income tax return when you file. If you expect to owe Missouri income tax, file Form MO-60 with your payment by the original due date of the return. Remember: An extension of time to file does not extend the time to pay.

How do I file a Missouri state tax extension?

Form MO-60 is due on or before the due date of the return. A copy of Form MO-60 must be enclosed with the Missouri return when filed. An approved Form MO-60 extends the due date up to six months for the individual income tax returns, and five months for fiduciary, and partnership income tax returns.

Does Missouri follow federal extension?

If you have an approved Federal tax extension (IRS Form 4868), the State of Missouri will automatically grant you an extension as well. In this case, you do not need to file anything with Missouri unless you owe state income tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete mo 60 online 2024-2025 online?

pdfFiller makes it easy to finish and sign mo 60 online 2024-2025 online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I make edits in mo 60 online 2024-2025 without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your mo 60 online 2024-2025, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How can I fill out mo 60 online 2024-2025 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your mo 60 online 2024-2025 by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is MO DoR MO-60?

MO DoR MO-60 is a tax form used in the state of Missouri for reporting certain income and deductions.

Who is required to file MO DoR MO-60?

Individuals and entities in Missouri who have specific types of income or deductions that need to be reported to the Missouri Department of Revenue are required to file MO DoR MO-60.

How to fill out MO DoR MO-60?

To fill out MO DoR MO-60, gather all necessary tax documents, complete the form accurately with your personal information, income details, and any deductions, then submit it according to the instructions provided on the form.

What is the purpose of MO DoR MO-60?

The purpose of MO DoR MO-60 is to provide the Missouri Department of Revenue with information on certain income, helping to ensure compliance with state tax laws.

What information must be reported on MO DoR MO-60?

The information that must be reported on MO DoR MO-60 includes the taxpayer's identification information, details of income earned, and any applicable deductions or credits.

Fill out your mo 60 online 2024-2025 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mo 60 Online 2024-2025 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.