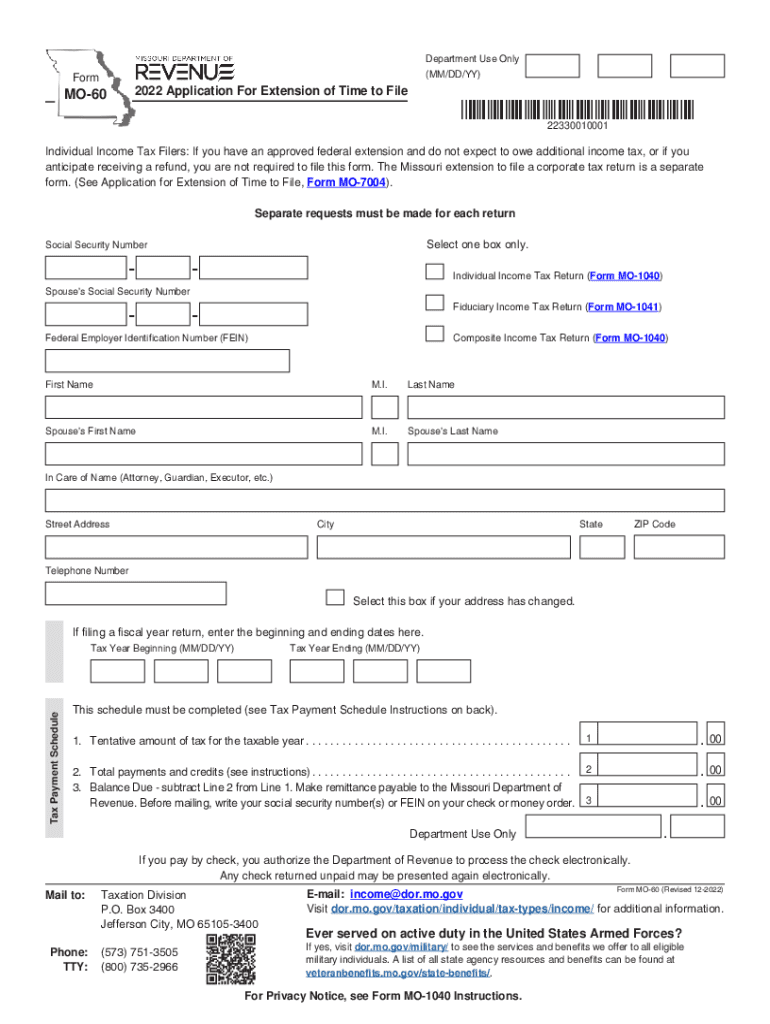

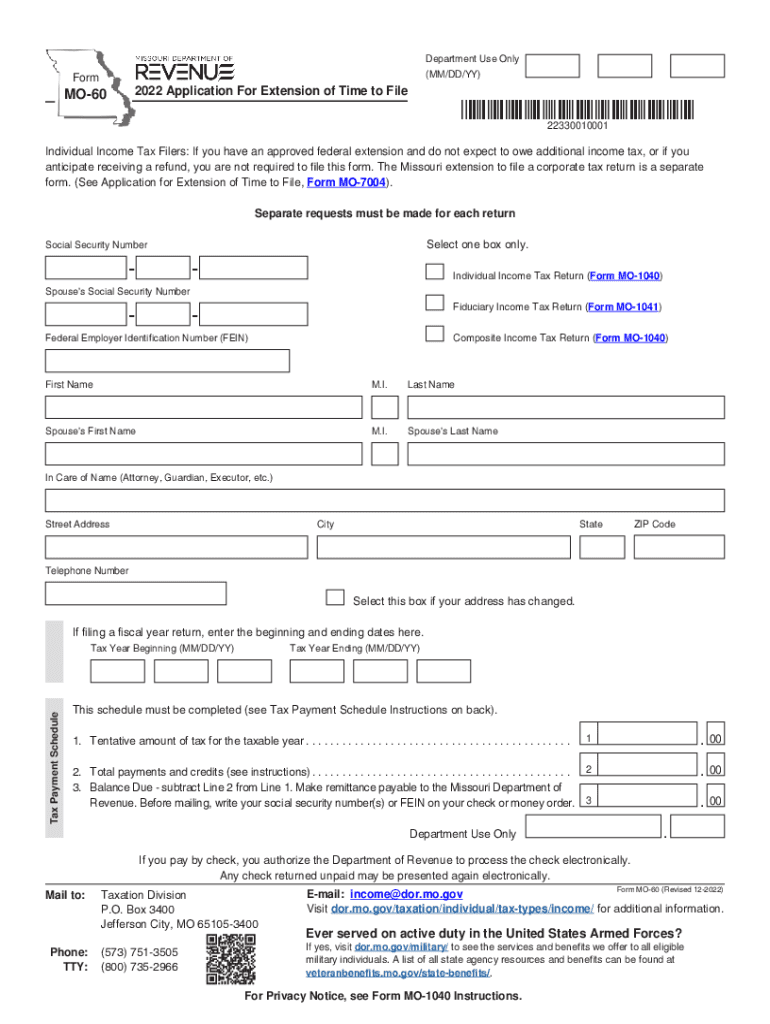

MO DoR MO-60 2022 free printable template

Show details

Reset Footprint FormDepartment Use Only (MM/DD/BY)Form2022 Application For Extension of Time to FileMO60×22330010001* 22330010001Individual Income Tax Filers: If you have an approved federal extension

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MO DoR MO-60

Edit your MO DoR MO-60 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MO DoR MO-60 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MO DoR MO-60 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit MO DoR MO-60. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO DoR MO-60 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MO DoR MO-60

How to fill out MO DoR MO-60

01

Gather all necessary financial documents related to income, deductions, and credits.

02

Start filling out the personal information section with your name, address, and Social Security number.

03

Report your income in the income section, categorizing it as wages, interest, dividends, etc.

04

Fill in the deductions section, including any personal exemptions or itemized deductions you qualify for.

05

Complete the tax credit section, ensuring you include all applicable credits.

06

Calculate your total tax liability based on the figures provided.

07

Review all entries for accuracy before submitting.

08

Sign and date the form before sending it to the appropriate department.

Who needs MO DoR MO-60?

01

Individuals who are residents of Missouri and need to report their individual income tax for the year.

02

Taxpayers looking to claim deductions or credits based on their financial situation.

03

Anyone required to submit a state income tax return in Missouri.

Fill

form

: Try Risk Free

People Also Ask about

Does Missouri recognize federal extension?

If you have an approved Federal tax extension (IRS Form 4868), the State of Missouri will automatically grant you an extension as well. In this case, you do not need to file anything with Missouri unless you owe state income tax.

Does Mo accept federal extension?

If you have an approved Federal tax extension (IRS Form 4868), the State of Missouri will automatically grant you an extension as well. In this case, you do not need to file anything with Missouri unless you owe state income tax.

Does Missouri have automatic extension?

Missouri grants an automatic extension of time to file to any individual, business filing a composite return, or fiduciary if you filed a federal extension. You do not need to file an Application for Extension of Time to File (Form MO-60) unless: • You expect to owe a tax liability for the period.

How do I file a tax extension on my 2022?

To request an extension to file your federal taxes after April 18, 2022, print and mail Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. We can't process extension requests filed electronically after April 18, 2022. Find out where to mail your form.

Is there an automatic tax extension?

We give you an automatic 6-month extension to file your return. You must file by the deadline to avoid a late filing penalty. The deadline is October 17, 2022.

Does Missouri grant automatic extension?

Missouri grants an automatic extension of time to file to any individual, business filing a composite return, or fiduciary if you filed a federal extension. You do not need to file an Application for Extension of Time to File (Form MO-60) unless: • You expect to owe a tax liability for the period.

Can I file a Missouri tax extension online?

The 2022 Missouri State Income Tax Return forms for Tax Year 2022 (Jan. 1 - Dec. 31, 2022) can be e-Filed together with the IRS Income Tax Return by the April 18, 2023 due date. If you file a tax extension you can e-File your Taxes until October 16, 2023 without a late filing penalty.

How do I file an extension in Mo?

Attach a copy of the federal extension to the Missouri return when filed. File Form MO-60, Application for Extension of Time to File, for an automatic six-month extension if the taxpayer expects to have tax due or needs a Missouri extension but not a federal extension.

Do I need to file for an extension for 2022 taxes?

If you find yourself unable to complete your 2022 federal tax return by the tax deadline, you'll first need to file an extension with the IRS to avoid potential late-filing penalties. Filing an extension will allow you to push your deadline to October 16, 2023.

Which states automatically extend with federal extension?

16498: States That Accept Federal Extension StateReturn TypeAlaska1120, 1120S, 1065Arizona1040, 1120, 1120S, 1065, 1041, 990Arkansas1040, 1120, 1120S, 1065, 1041Delaware1120, 1120S, 106524 more rows

Does Missouri require an extension?

You will automatically receive a Missouri extension if you have no state tax liability or if you're owed a state refund. On the other hand, if you do owe Missouri tax, you can request a Missouri tax extension with Form MO-60. Make sure to file Form MO-60 by the original due date of your return.

Does Missouri require an extension?

If you do not owe Missouri income taxes by the tax deadline of April 18, 2023, you do not have to prepare and file a MO tax extension. In case you expect a MO tax refund, you will need to file or e-File your MO tax return in order to receive your tax refund money.

How do I file an extension in Missouri?

Attach a copy of your federal extension (Federal Form 4868) with your Missouri income tax return when you file. If you expect to owe Missouri income tax, file Form MO-60 with your payment by the original due date of the return. Remember: An extension of time to file does not extend the time to pay.

How do I file a Missouri state tax extension?

Form MO-60 is due on or before the due date of the return. A copy of Form MO-60 must be enclosed with the Missouri return when filed. An approved Form MO-60 extends the due date up to six months for the individual income tax returns, and five months for fiduciary, and partnership income tax returns.

Does Missouri follow federal extension?

If you have an approved Federal tax extension (IRS Form 4868), the State of Missouri will automatically grant you an extension as well. In this case, you do not need to file anything with Missouri unless you owe state income tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my MO DoR MO-60 directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign MO DoR MO-60 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Where do I find MO DoR MO-60?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the MO DoR MO-60 in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I fill out MO DoR MO-60 using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign MO DoR MO-60 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is MO DoR MO-60?

MO DoR MO-60 is a document used for reporting Missouri tax information, specifically for certain types of businesses or organizations operating within the state.

Who is required to file MO DoR MO-60?

Businesses or organizations that have specific tax obligations in Missouri, such as partnerships, corporations, or certain nonprofit entities, are required to file MO DoR MO-60.

How to fill out MO DoR MO-60?

To fill out MO DoR MO-60, taxpayers need to provide accurate business information, declare income, deductions, and credits, and ensure that all required fields are completed in compliance with Missouri tax regulations.

What is the purpose of MO DoR MO-60?

The purpose of MO DoR MO-60 is to facilitate the reporting of taxable income and ensure that businesses meet their tax obligations under Missouri law.

What information must be reported on MO DoR MO-60?

Required information on MO DoR MO-60 includes business name, federal employer identification number (FEIN), total income, deductions, credits, and other pertinent financial details needed for tax assessment.

Fill out your MO DoR MO-60 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MO DoR MO-60 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.