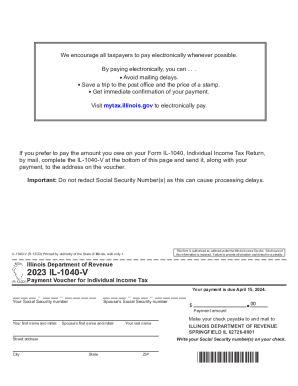

IL DoR IL-1040-V 2020 free printable template

Show details

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes. We encourage all taxpayers to pay electronically whenever possible.

By paying electronically,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL DoR IL-1040-V

Edit your IL DoR IL-1040-V form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL DoR IL-1040-V form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IL DoR IL-1040-V online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IL DoR IL-1040-V. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL DoR IL-1040-V Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL DoR IL-1040-V

How to fill out IL DoR IL-1040-V

01

Obtain the IL DoR IL-1040-V form from the Illinois Department of Revenue website or your tax preparer.

02

Fill in your name, address, and Social Security number at the top of the form.

03

Enter the tax year for which you are making the payment.

04

Indicate the amount you are submitting with the payment on the designated line.

05

Check the box indicating if this is a payment for a joint return if applicable.

06

If you're making an electronic payment, ensure you follow the online instructions provided on the site.

07

Sign and date the form at the bottom.

08

Include the completed IL-1040-V with your payment if mailing it or follow online submission guidelines.

Who needs IL DoR IL-1040-V?

01

Individuals who owe tax to the state of Illinois and are making a payment towards their income tax liability.

02

Taxpayers who file their Illinois income tax returns and have an amount due that needs to be remitted.

03

Residents and non-residents of Illinois who need to pay taxes that they owe to the state.

Fill

form

: Try Risk Free

People Also Ask about

Why do I have a 1040-ES payment voucher?

We'll automatically include four quarterly 1040-ES vouchers with your printout if you didn't withhold or pay enough tax this year. We do this to head off a possible underpayment penalty on next year's taxes. You may get these vouchers if you're self-employed or had an uncharacteristic spike in your income this year.

Is there a payment voucher for Form 1040?

Form 1040-V is a statement you send with your check or money order for any balance due on the “Amount you owe” line of your Form 1040 or 1040-NR.

Can you pay for 1120 with a check?

In addition, the foreign corporation has the option to pay the estimated tax due by check or money order, payable to the “United States Treasury.” To ensure proper crediting, enter the foreign corporation's EIN, “Form 1120-F (or 1120-FSC, if applicable) estimated tax payment,” and the tax period to which the payment

Is there a payment voucher for form 1120?

To pay estimated taxes, file a deposit via EFTPS. The 1120 does not have a federal estimated tax voucher.

Can I pay 2022 1040-ES Online?

You may send estimated tax payments with Form 1040-ES by mail, or you can pay online, by phone or from your mobile device using the IRS2Go app. You can also make your estimated tax payments through your online account, where you can see your payment history and other tax records.

What is a federal payment voucher?

Form 1040-V is a statement you send with your check or money order for any balance due on the “Amount you owe” line of your Form 1040 or 1040-NR.

Do I need to send my 1040 in with payment?

Bottom line: When paying your personal income tax bill, you'll have the option to pay online, with cash, or by check or money order. When paying with check or money order via the mail, you will need to complete and submit a Form 1040-V along with your payment.

How do I send a 1040-V payment voucher?

Don't staple or otherwise attach your payment or Form 1040-V to your return or to each other. Instead, just put them loose in the envelope. • Mail your 2021 tax return, payment, and Form 1040-V to the address shown on the back that applies to you. The IRS doesn't charge a fee for this service; the card processors do.

How do I pay my C Corp taxes?

Corporations must generally deposit income taxes electronically through the Electronic Federal Tax Payment System (EFTPS). The IRS can extend the time for paying the tax due for a period of up to six months if a payment by the due date will result in an undue hardship to the corporation.

How does IRS payment voucher work?

Form 1040-V: Payment Voucher is a statement that taxpayers send to the Internal Revenue Service (IRS) along with their tax return if they choose to make a payment with a check or money order. Taxpayers who must remit payment to the IRS and choose to do so with a check or money order must file Form 1040-V.

What is the 2022 Form 1040-ES payment voucher?

Use Form 1040-ES to figure and pay your estimated tax. Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.).

What is the 2022 Form 1040 ES payment voucher?

Use Form 1040-ES to figure and pay your estimated tax. Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.).

Can I make estimated tax payments without a voucher?

To avoid penalties, the payment—by check or money order accompanied by the correct IRS voucher—must be postmarked by the due date. Or, online payments can be made without a voucher.

How do I get an IRS payment voucher?

Where do I get a payment voucher? You can get the form by calling the tax forms number, 800-829-3676. You can also pick one up at your local IRS office. Call them first, 800-829-1040, to make sure that the form is available and to check on hours of service.

How do I get a payment voucher from the IRS?

Where do I get a payment voucher? You can get the form by calling the tax forms number, 800-829-3676. You can also pick one up at your local IRS office. Call them first, 800-829-1040, to make sure that the form is available and to check on hours of service.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete IL DoR IL-1040-V online?

pdfFiller has made filling out and eSigning IL DoR IL-1040-V easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I make changes in IL DoR IL-1040-V?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your IL DoR IL-1040-V to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I complete IL DoR IL-1040-V on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your IL DoR IL-1040-V. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is IL DoR IL-1040-V?

IL DoR IL-1040-V is a payment voucher used by individuals in Illinois to submit their state income tax payments when filing their income tax returns.

Who is required to file IL DoR IL-1040-V?

Individuals who owe state income tax and are filing an IL-1040 tax return are required to file IL DoR IL-1040-V to ensure their payment is applied correctly.

How to fill out IL DoR IL-1040-V?

To fill out IL DoR IL-1040-V, you need to provide your name, address, Social Security number, the tax year, and the amount of payment you are remitting, along with ensuring to follow the instructions provided on the form.

What is the purpose of IL DoR IL-1040-V?

The purpose of IL DoR IL-1040-V is to facilitate the payment process for taxpayers by providing a structured form to ensure that payments are properly allocated to their tax accounts.

What information must be reported on IL DoR IL-1040-V?

The information that must be reported on IL DoR IL-1040-V includes your name, address, Social Security number, the amount of payment being submitted, and the tax year for which the payment is applicable.

Fill out your IL DoR IL-1040-V online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL DoR IL-1040-V is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.