Get the free Chapter 2 - Estates in Real Property and Forms of ...

Show details

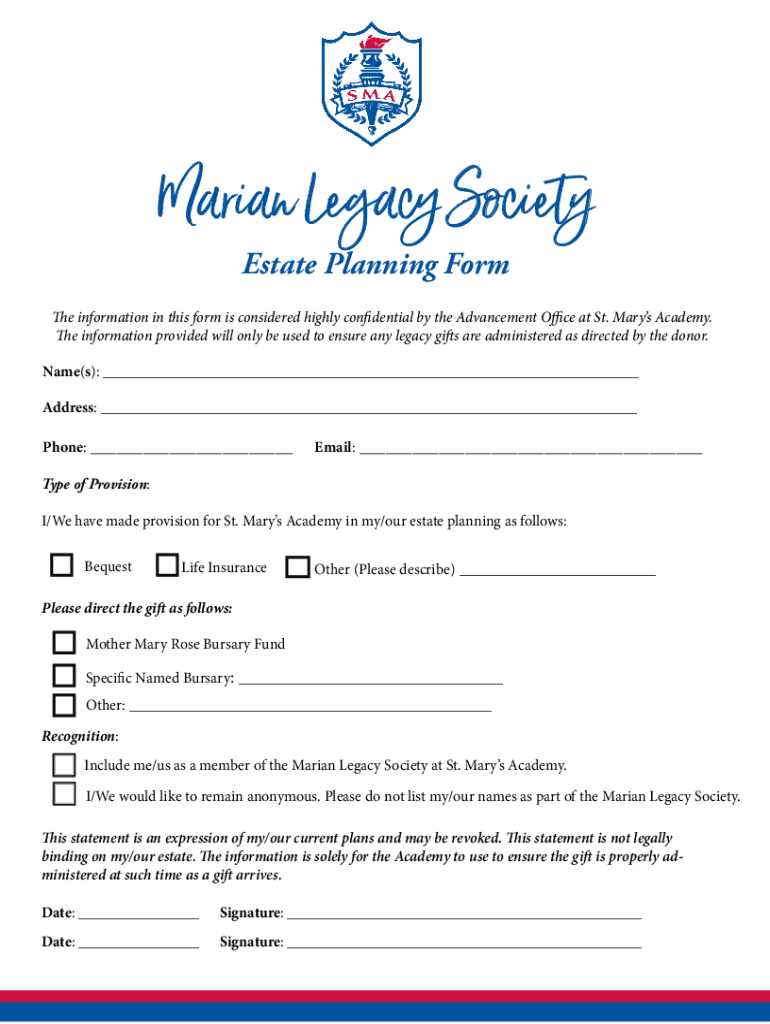

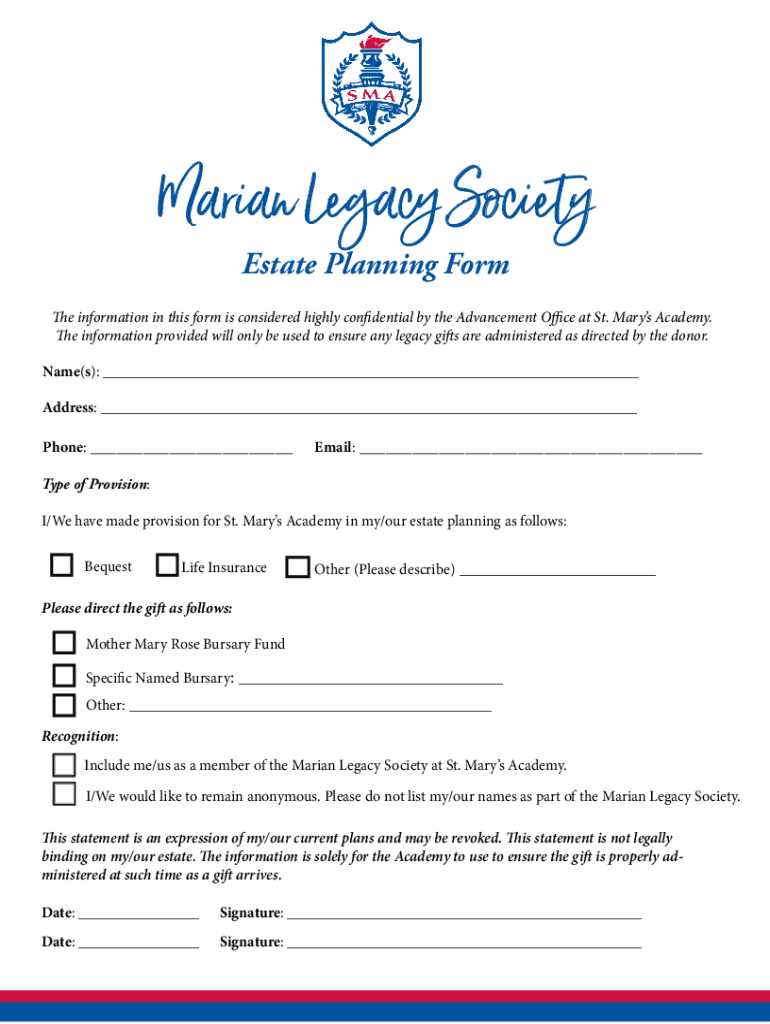

Marian Legacy Society Estate Planning Forth information in this form is considered highly confidential by the Advancement Office at St. Mary's Academy. The information provided will only be used to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign chapter 2 - estates

Edit your chapter 2 - estates form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your chapter 2 - estates form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit chapter 2 - estates online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit chapter 2 - estates. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out chapter 2 - estates

How to fill out chapter 2 - estates

01

To fill out chapter 2 - estates, follow these steps:

02

Begin by providing a title for the chapter, such as 'Estates: Overview'.

03

Introduce the topic of estates and provide a brief explanation of its relevance.

04

Include subsections within the chapter that cover different aspects of estates, such as 'Types of Estates', 'Rights and Responsibilities of Estate Owners', and 'Estate Planning'.

05

Provide a thorough description and analysis of each subsection, using appropriate examples and references.

06

Include relevant diagrams, charts, or tables to help illustrate key concepts.

07

Ensure that the chapter is structured logically and sequentially, giving the reader a clear understanding of the topic.

08

Proofread and edit the chapter for any grammatical or spelling errors before finalizing it.

09

Format the chapter appropriately, following any style guidelines provided.

Who needs chapter 2 - estates?

01

Chapter 2 - Estates is useful for individuals or organizations involved in real estate, property management, or estate planning.

02

This chapter can be beneficial for real estate agents, property developers, lawyers specializing in estate planning, and even individuals who want to gain a deeper understanding of estates and its various aspects.

03

By including this chapter, you provide valuable information and guidance to those who need to navigate the complexities of estates in their professional or personal lives.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I edit chapter 2 - estates on an iOS device?

Use the pdfFiller mobile app to create, edit, and share chapter 2 - estates from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How can I fill out chapter 2 - estates on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your chapter 2 - estates. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I complete chapter 2 - estates on an Android device?

Use the pdfFiller mobile app to complete your chapter 2 - estates on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is chapter 2 - estates?

Chapter 2 - estates refers to a section of tax law that outlines the rules and regulations governing the taxation of estates, including the filing of estate tax returns.

Who is required to file chapter 2 - estates?

Individuals or entities that manage the estate of a deceased person and whose estate exceeds the federal estate tax exemption threshold must file Chapter 2 - estates.

How to fill out chapter 2 - estates?

To fill out Chapter 2 - estates, one must gather required documentation regarding the deceased's assets, liabilities, and any previous tax returns, and then accurately complete the designated forms provided by the IRS.

What is the purpose of chapter 2 - estates?

The purpose of Chapter 2 - estates is to outline the reporting and taxation requirements for estates to ensure compliance with federal tax laws and to calculate and collect any estate taxes owed.

What information must be reported on chapter 2 - estates?

Chapter 2 - estates requires reporting of the decedent's assets, liabilities, property values, gross estate value, deductions, and any gifts made prior to death.

Fill out your chapter 2 - estates online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Chapter 2 - Estates is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.