MO Form E-6 2010 free printable template

Show details

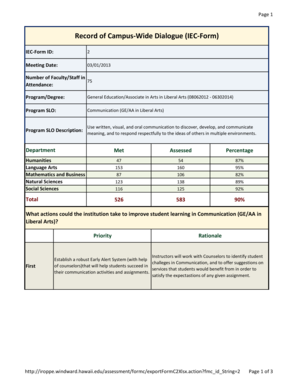

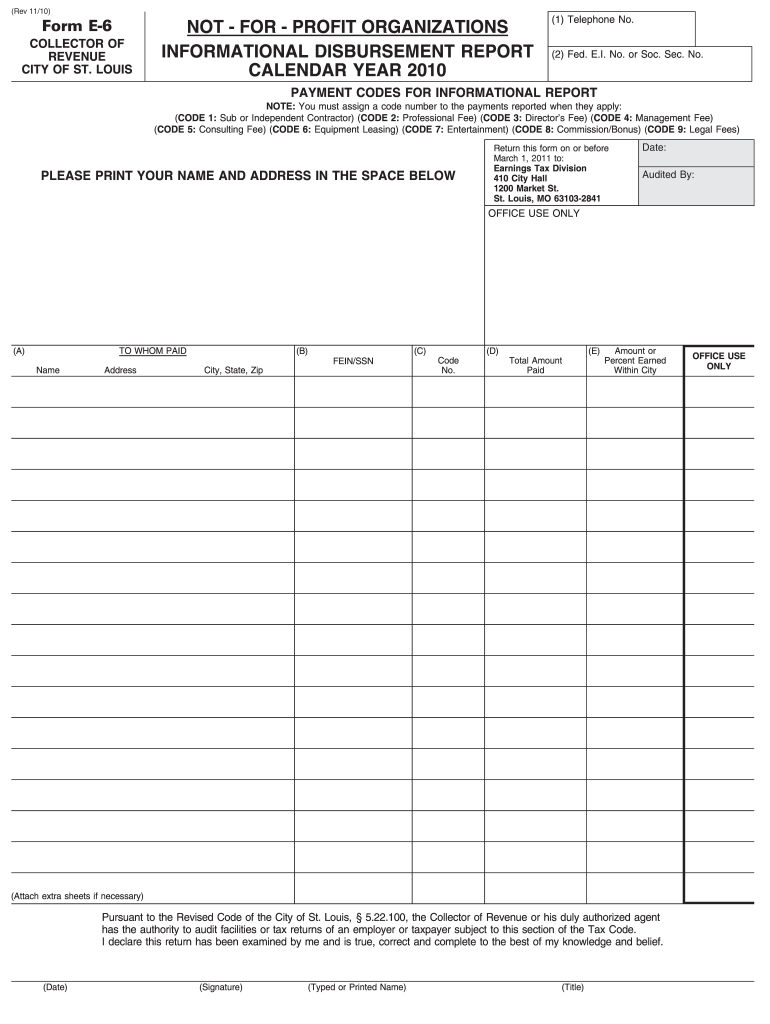

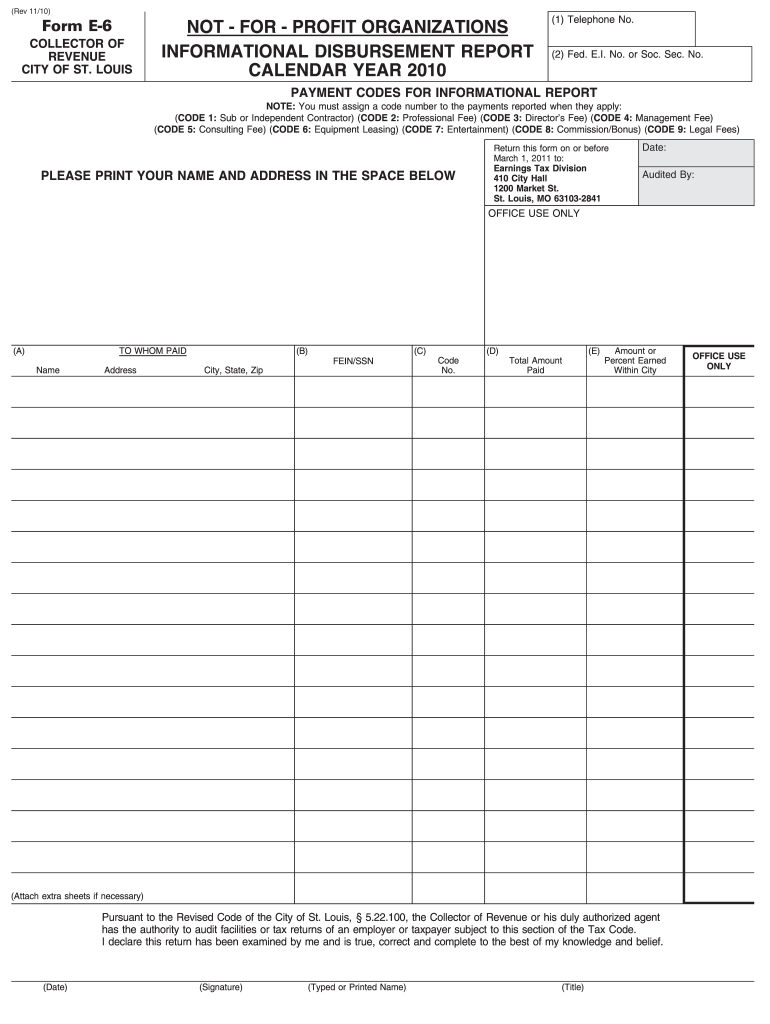

3/07 Rev 11/10 Form E-6 COLLECTOR OF REVENUE CITY OF ST. LOUIS NOT - FOR - PROFIT ORGANIZATIONS INFORMATIONAL DISBURSEMENT REPORT CALENDAR YEAR 2010 1 Telephone No. 2 Fed. E.I. No. or Soc. Sec. No. PAYMENT CODES FOR INFORMATIONAL REPORT NOTE You must assign a code number to the payments reported when they apply CODE 1 Sub or Independent Contractor CODE 2 Professional Fee CODE 3 Director s Fee CODE 4 Management Fee CODE 5 Consulting Fee CODE 6 Equipment Leasing CODE 7 Entertainment CODE 8...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MO Form E-6

Edit your MO Form E-6 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MO Form E-6 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MO Form E-6 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit MO Form E-6. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO Form E-6 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MO Form E-6

How to fill out MO Form E-6

01

Obtain the MO Form E-6 from the official website or local office.

02

Write your full name in the designated field.

03

Enter your Social Security number accurately.

04

Provide your mailing address including city, state, and ZIP code.

05

Indicate the tax year for which you are submitting the form.

06

Fill in the required financial information as prompted.

07

Review all entries for accuracy and completeness.

08

Sign and date the form.

09

Submit the form either online or by mailing it to the appropriate address.

Who needs MO Form E-6?

01

Individuals who have received a tax credit or incentive and need to report certain financial data.

02

Businesses applying for tax refunds or adjustments related to previous filings.

03

Tax professionals preparing documentation for client tax returns.

Fill

form

: Try Risk Free

People Also Ask about

Do I have to pay St Louis City tax?

Anyone with a permanent address in the City of St. Louis will be required to file on 100% of their earnings.

Who must file a City of St. Louis tax return?

Residents of the City of St. Louis, regardless of the location of their employer. Employees of businesses located or performing work/services within the City of St. Louis, regardless of where they live.

What is a St Louis P 10?

Form P-10 is a quarterly tax return to remit payroll expense tax of 1/2 of 1% (0.005) of gross compensation paid to employees who are performing work or services in the City of St. Louis.

Who has to file a St Louis City tax return?

Residents of the City of St. Louis, regardless of the location of their employer. Employees of businesses located or performing work/services within the City of St. Louis, regardless of where they live.

How much is City tax in St. Louis?

The Missouri sales tax rate is currently 4.23%. The County sales tax rate is 0%. The Saint Louis sales tax rate is 5.45%.

What is the St Louis City earnings tax lawsuit?

The lawsuit was filed in 2021, after the plaintiffs, Mark Boles, of St. Louis County, and Kos Semonski, of St. Charles County, were denied earnings tax refunds for 2020. In previous years, the city had issued them and thousands of others rebates for days they traveled and worked outside city limits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find MO Form E-6?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the MO Form E-6 in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I execute MO Form E-6 online?

Easy online MO Form E-6 completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit MO Form E-6 on an Android device?

You can edit, sign, and distribute MO Form E-6 on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is MO Form E-6?

MO Form E-6 is a tax form used in Missouri for reporting certain income and tax information.

Who is required to file MO Form E-6?

Individuals or entities that have received income that requires reporting to the state of Missouri must file MO Form E-6.

How to fill out MO Form E-6?

To fill out MO Form E-6, gather your income information, complete the form with accurate figures, and follow the instructions provided for submission.

What is the purpose of MO Form E-6?

The purpose of MO Form E-6 is to report income and tax details to the Missouri Department of Revenue for tax compliance.

What information must be reported on MO Form E-6?

MO Form E-6 requires reporting of income earned, tax withheld, and other relevant financial details as specified in the form guidelines.

Fill out your MO Form E-6 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MO Form E-6 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.